U.S.-Japan Summit Concludes; President Trump to Announce Reciprocal Tariff Plan This Week【February 10, 2025】

Fundamental Analysis

- The U.S.-Japan summit has concluded, receiving positive evaluations, but trade concerns remain unresolved.

- President Trump mentioned reciprocal tariffs, stating that details would be announced later this week.

USDJPY Technical Analysis

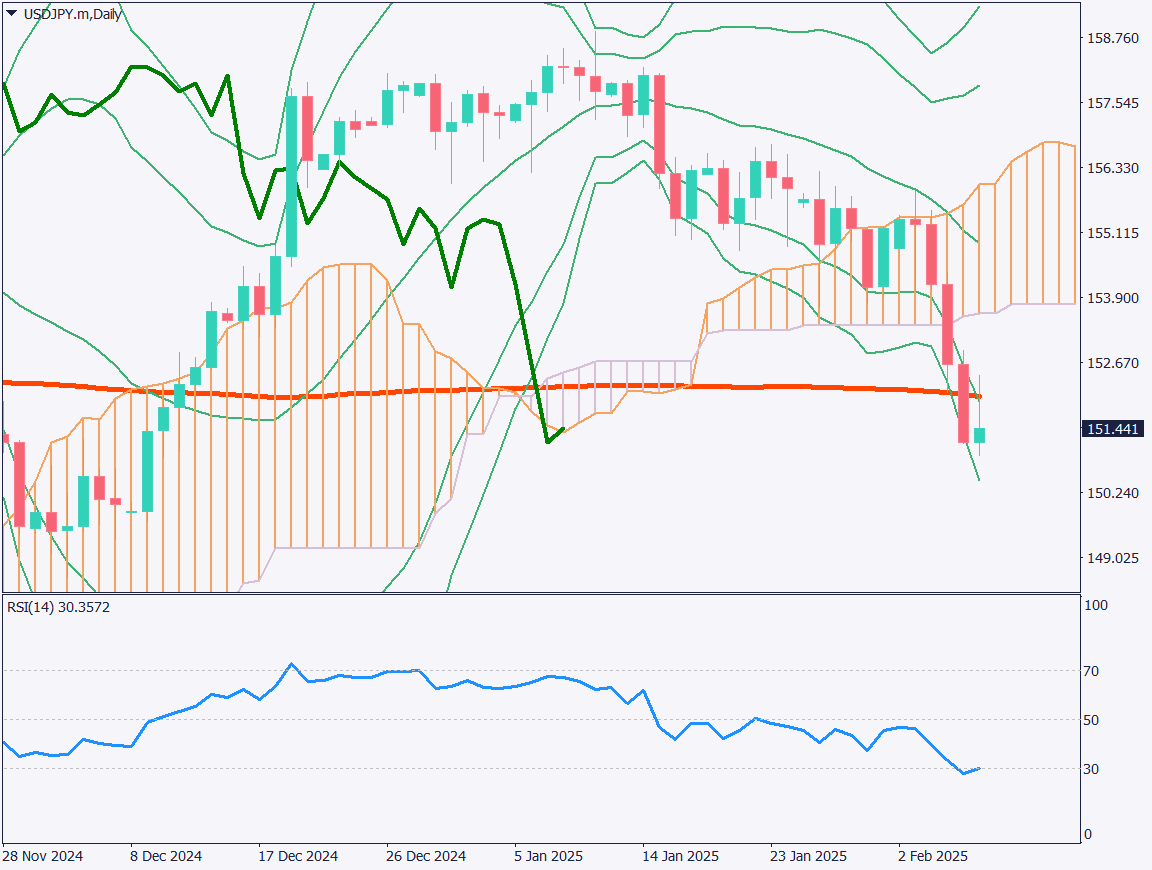

Analyzing the daily chart of USDJPY, the price has fallen below the 200-day moving average. Right after the U.S.-Japan summit, USDJPY briefly rose to 152.42 JPY. However, the 200-day moving average acted as a resistance level, leading to increased selling pressure on rebounds.

RSI is currently at 30, indicating strong selling momentum. The price is moving between the -2σ and -3σ lines of the Bollinger Bands, forming a band walk. Given that RSI is near 30, a temporary rise due to profit-taking may occur, but the overall trend suggests a strengthening JPY. A potential break below 150 JPY should also be considered as a possible scenario.

Day trading strategy (1 hour)

Looking at the 1-hour chart of USDJPY, the downward momentum is showing signs of weakening in the short term, with RSI forming higher lows. The support level around 151 JPY remains firm, making a temporary rise possible. It is advisable to avoid aggressive selling at current levels.

For day trading, a cautious approach to short-selling at rebounds is recommended. Entering short positions near the Ichimoku cloud resistance may be a viable strategy, with profit-taking suggested when RSI falls below 30.

If details of the Trump administration’s reciprocal tariff plan are announced, JPY appreciation could strengthen again. Since the timing remains uncertain, traders should remain vigilant.

Support/Resistance lines

Key support and resistance lines to consider:

- 150.75 JPY – Major monthly support line

- 148.65 JPY – Major monthly low

Market Sentiment

USDJPY – Sell: 37% / Buy: 63%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Australia Building Approvals | 9:30 AM |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.