Trump Administration’s New Tariff Plans, Safe-Haven Gold Surging【February 11, 2025】

Fundamental Analysis

- The Trump administration plans to impose a 25% tariff on steel and aluminum.

- A reciprocal tariff plan may also be announced this week.

- Gold surpasses 2,900 USD, with demand for safe-haven assets increasing daily.

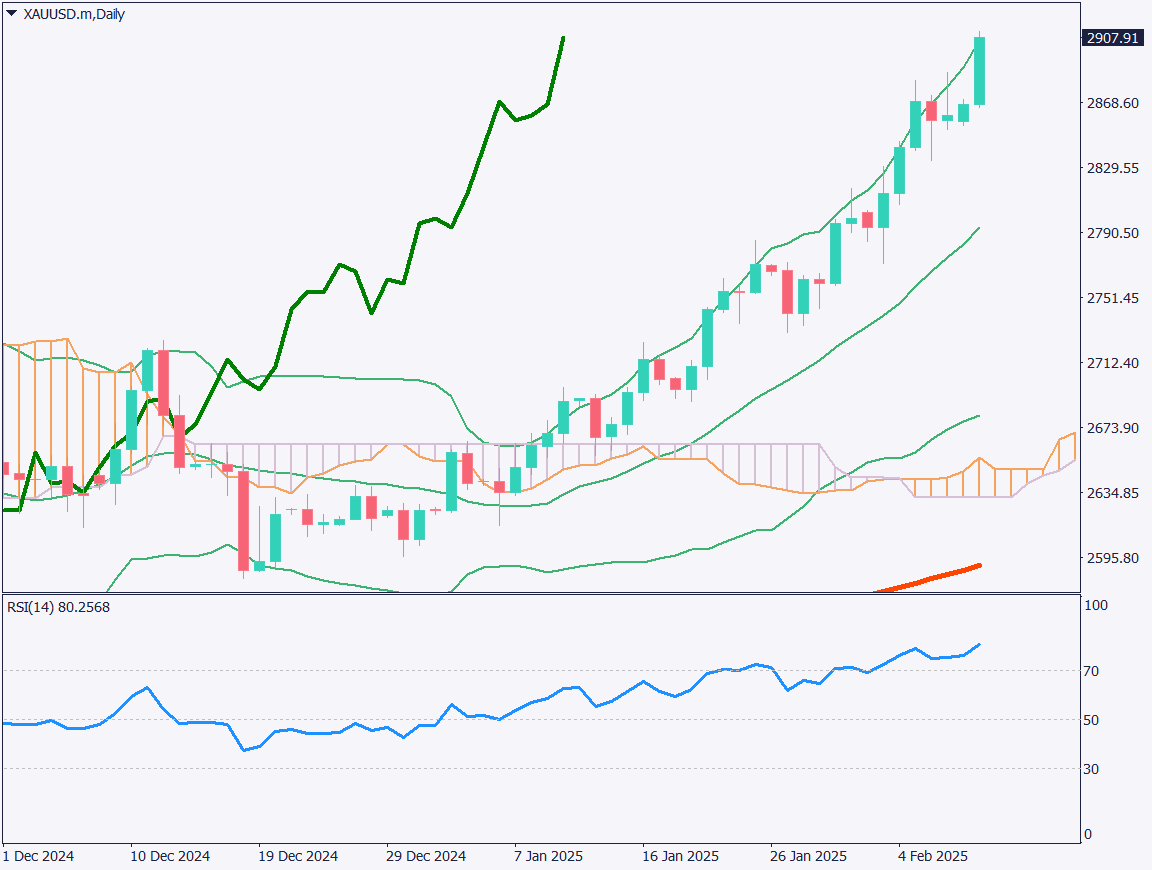

XAUUSD Technical Analysis

Analyzing the daily chart of gold, the uptrend has become prominent since the beginning of the year. Following the inauguration of the Trump administration in late January, the upward momentum has intensified. Gold, which started the year at 2,624 USD, has now risen to 2,907 USD, marking a nearly 300 USD increase in two months.

The Trump administration is planning to impose a 25% tariff on steel and aluminum, and the market expects an announcement regarding the reciprocal tariff plan this week. The uncertainty surrounding these developments is fueling concerns, making gold an attractive asset regardless of technical factors.

The RSI stands at 80, indicating strong momentum. However, if the tariff plan is postponed or altered, there is a risk of a pullback. While the overall trend remains bullish, cautious trading is advised.

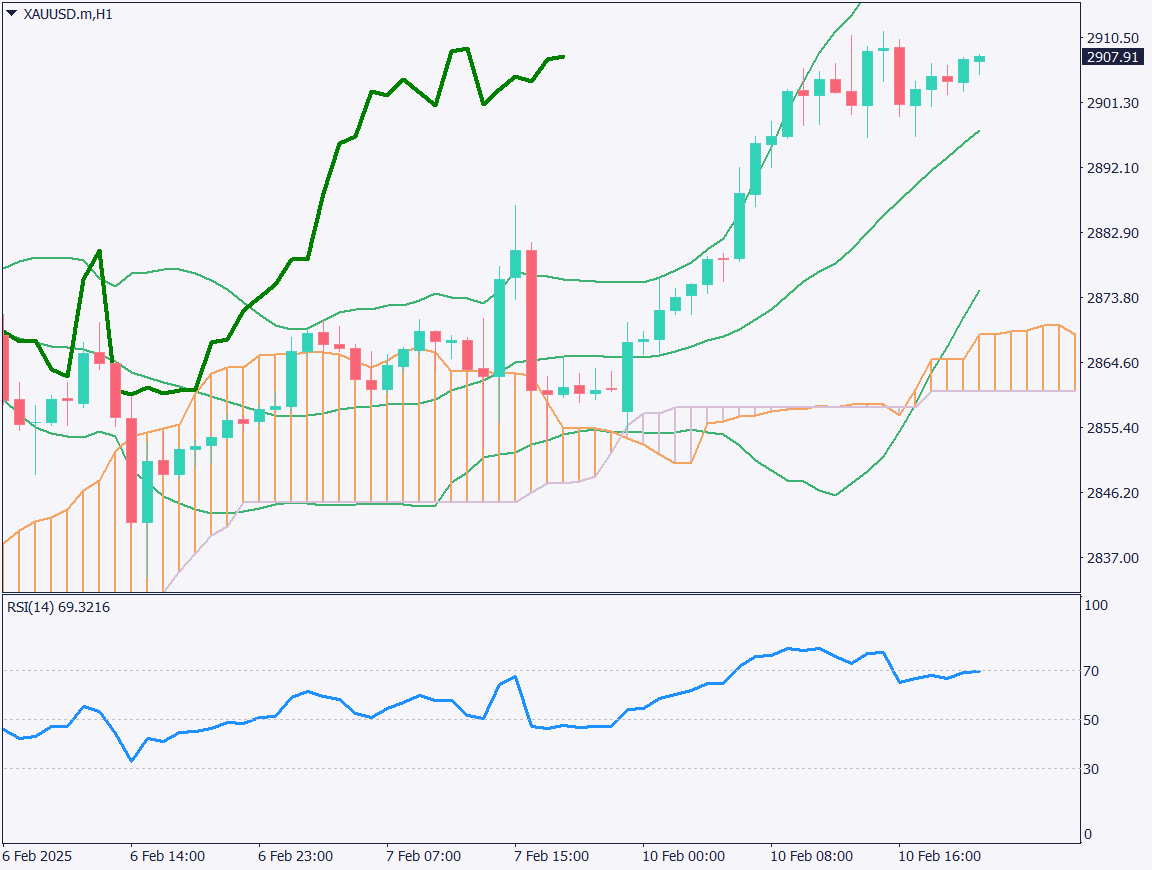

Day trading strategy (1 hour)

Analyzing the 1-hour chart of gold, prices surged sharply following comments from President Trump on the new tariff plan. Gold broke above the key level of 2,880 USD, reaching 2,913 USD.

The RSI on the 1-hour chart is at 69, a level where a potential pullback should be considered. While the uptrend is expected to continue, traders should look for buying opportunities on dips rather than chasing high prices.

Day Trading Plan:

- Buy Limit Order: Around 2,880 USD

- Take Profit: Around 2,920 USD

- Stop Loss: If gold drops to 2,870 USD

Support/Resistance lines

Key support and resistance lines to consider:

- 2,925 USD – Expected resistance level

- 2,880 USD – Major support level

Market Sentiment

XAUUSD Sell: 65% / Buy: 35%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Speech by BOE Monetary Policy Committee Member Mann | 17:45 |

| Speech by BOE Governor Bailey | 21:15 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.