EU Warns of Retaliatory Tariffs, Trade Friction Concerns, but USDJPY Rises【February 12, 2025】

Fundamental Analysis

- The EU is reportedly planning retaliatory tariffs against the US, potentially escalating trade friction.

- The forex market remains directionless, with slight fluctuations continuing.

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY, the pair has once again risen above the 200-day moving average. Fed Chair Powell has stated that there is no urgency to implement rate cuts, reinforcing expectations that high-interest rates will persist. This has led to a stronger USD, driving USDJPY higher. However, resistance is expected at the Ichimoku Cloud, and the 153 JPY level is likely to act as a significant barrier.

With former President Trump continuously introducing new factors into the market, traders are reacting to each headline, creating a sense of market fatigue. For the time being, USDJPY is likely to remain in a wait-and-see mode, with resistance expected around the high 153 JPY range.

Day trading strategy (1 hour)

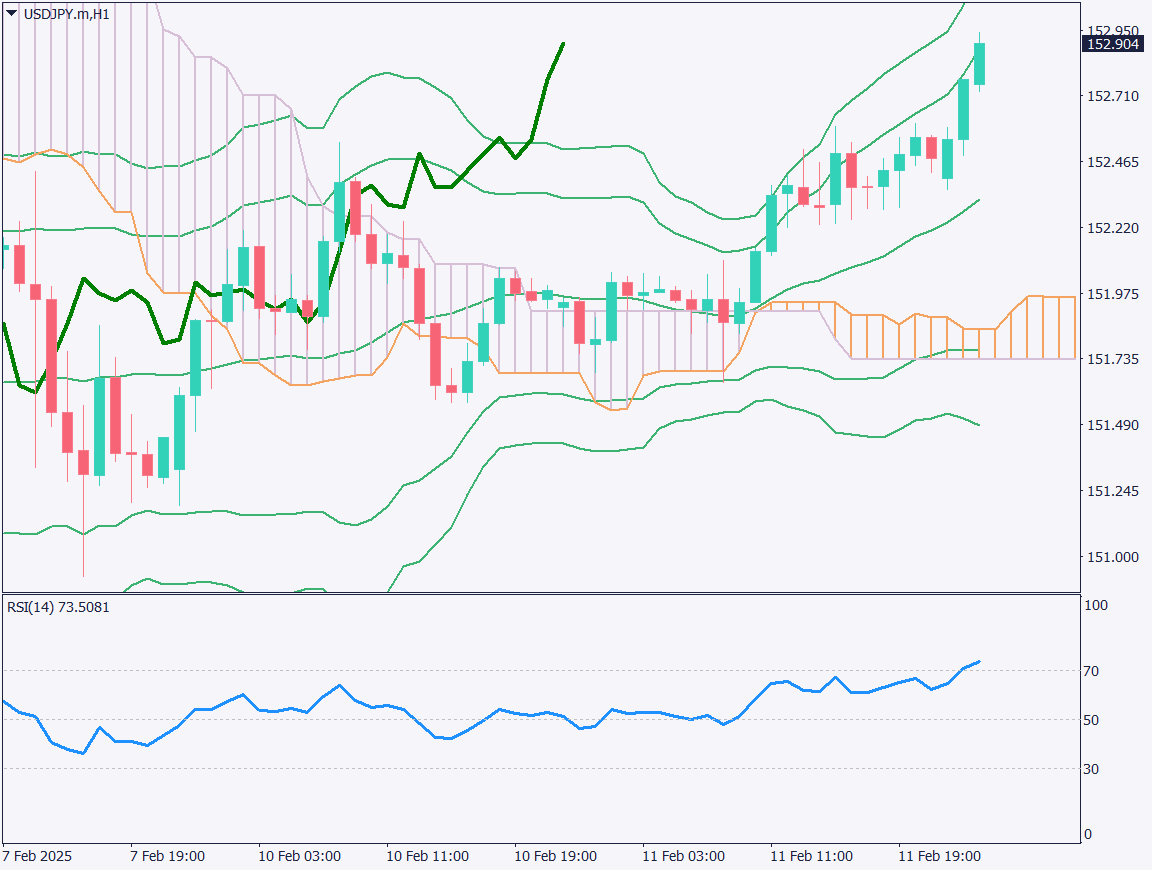

Analyzing the 1-hour chart of USDJPY, the pair has strengthened following Fed Chair Powell’s congressional testimony, which signaled a cautious stance on rate cuts. USDJPY has climbed to around 152.90 JPY, nearing the 153 JPY level.

Since the pair is currently trading above the +2σ line of the Bollinger Bands, selling pressure is expected once it reaches the 153 JPY range. A trading strategy has been set with a sell limit order at 153.05 JPY, a second sell limit order at 153.18 JPY, and a stop-loss at 153.40 JPY. The target take-profit level is set at 152.50 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 153.76 JPY – Lower boundary of the Ichimoku Cloud

- 153.05–153.15 JPY – Resistance zone

Market Sentiment

USDJPY Sell: 43% / Buy: 57%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| US Core Consumer Price Index (CPI) | 22:30 |

| US Crude Oil Inventory | 00:00 (midnight) |

| FOMC Member Bostic Speaks | 02:00 (next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.