USDJPY Rises as Strong U.S. CPI Boosts the Dollar【February 13, 2025】

Fundamental Analysis

- U.S.-Russia Ceasefire Talks Begin for Ukraine Conflict Resolution

- Crude Oil Prices Face Downward Pressure, Trading Near USD 71

- USDJPY Strengthens as U.S. Consumer Price Index (CPI) Increases

USDJPY Technical Analysis

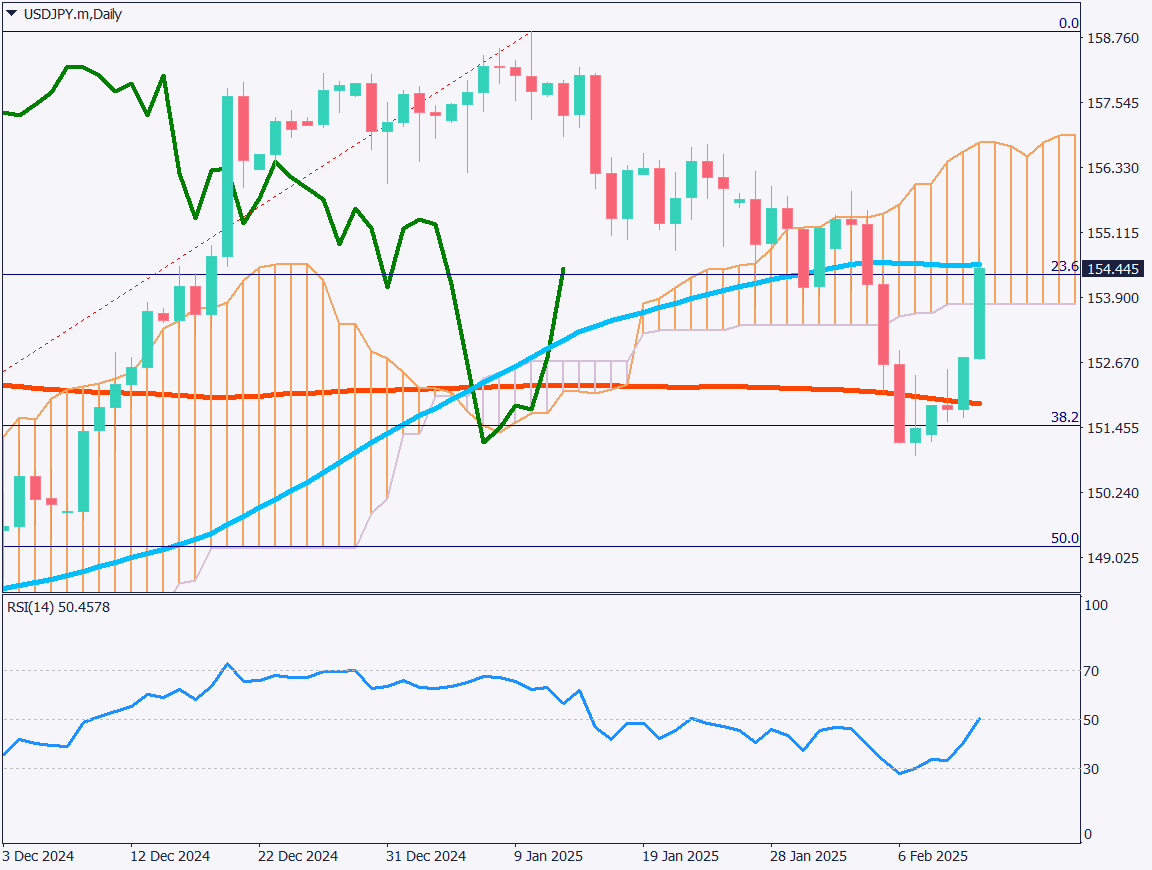

Analyzing the daily chart of USDJPY, the 90-day moving average is acting as a resistance level. The pair is trading within the Ichimoku cloud, indicating strong resistance. Additionally, the 23.6% Fibonacci retracement level is present, further reinforcing the upper resistance zone.

USDJPY strengthened following the higher-than-expected U.S. CPI, leading to a stronger dollar. While concerns remain over trade issues related to tariffs, the key focus will be whether USDJPY can break above the 90-day moving average. The RSI has recovered to 50, signaling a potential return to an uptrend. However, further confirmation is needed to determine a definitive trend reversal.

Day trading strategy (1 hour)

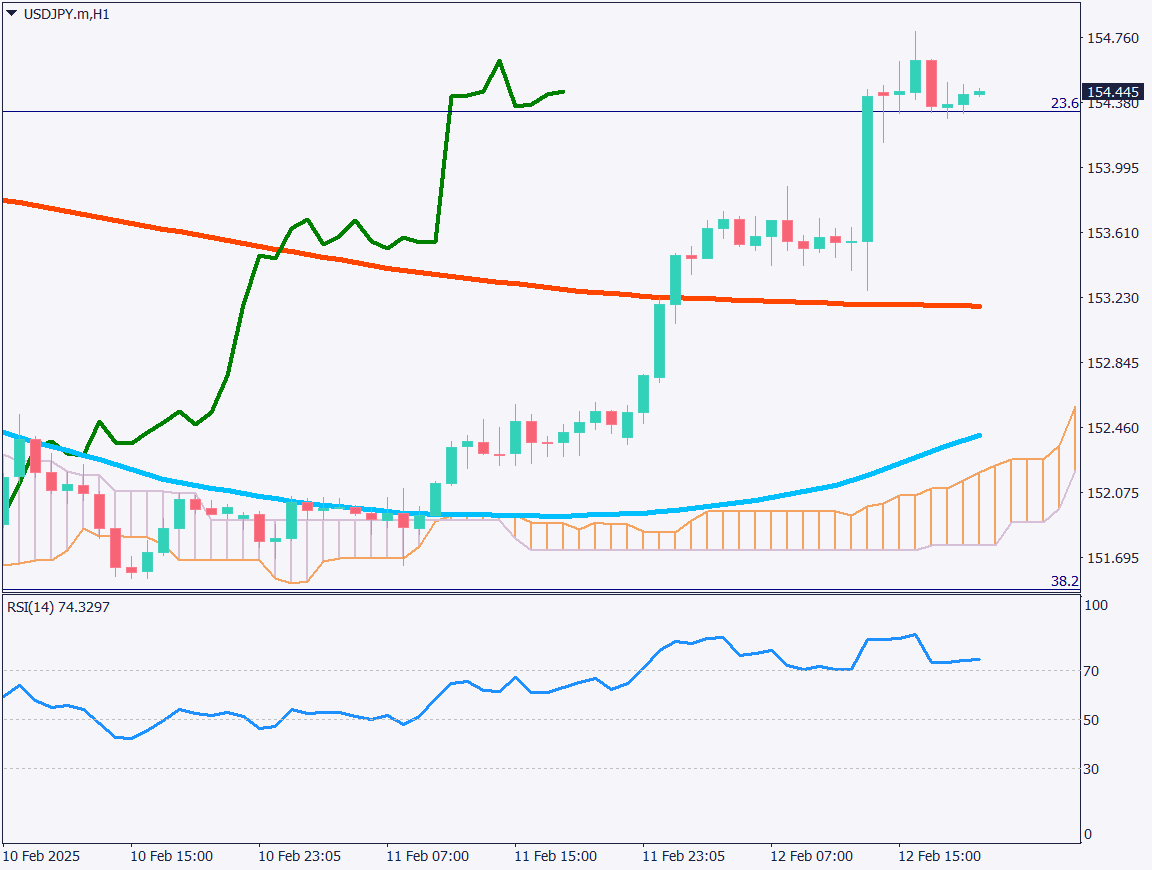

Analyzing the 1-hour chart of USDJPY, the stronger-than-expected U.S. CPI has driven the dollar higher. USDJPY has surged past the 153 JPY resistance level, reaching the 154 JPY range. However, with RSI rising to 74, a short-term pullback may be expected.

Given multiple resistance levels on the daily chart, profit-taking or selling at resistance highs could emerge.

For intraday trading, a sell limit order around 155 JPY, with take profit at 154.35 JPY and stop loss at 155.25 JPY, is recommended.

Support/Resistance lines

Key support and resistance lines to consider:

- 154.50 JPY – 90-day moving average

- 154.35 JPY – Fibonacci level

Market Sentiment

USDJPY: Sell: 67% / Buy: 33%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| UK GDP | 16:00 |

| EU Economic Outlook | 19:00 |

| U.S. Jobless Claims | 22:30 |

| U.S. Producer Price Index (PPI) | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.