USDJPY in the Upper 151 JPY Range as Concerns Rise Over Potential Auto Tariffs on Japan【February 17, 2025】

Fundamental Analysis

- Trump Administration Plans Auto Tariffs, Possible Implementation in April

- Accelerated Efforts to End the Ukraine Conflict, Diverging Stances Between the EU and the US

USDJPY Technical Analysis

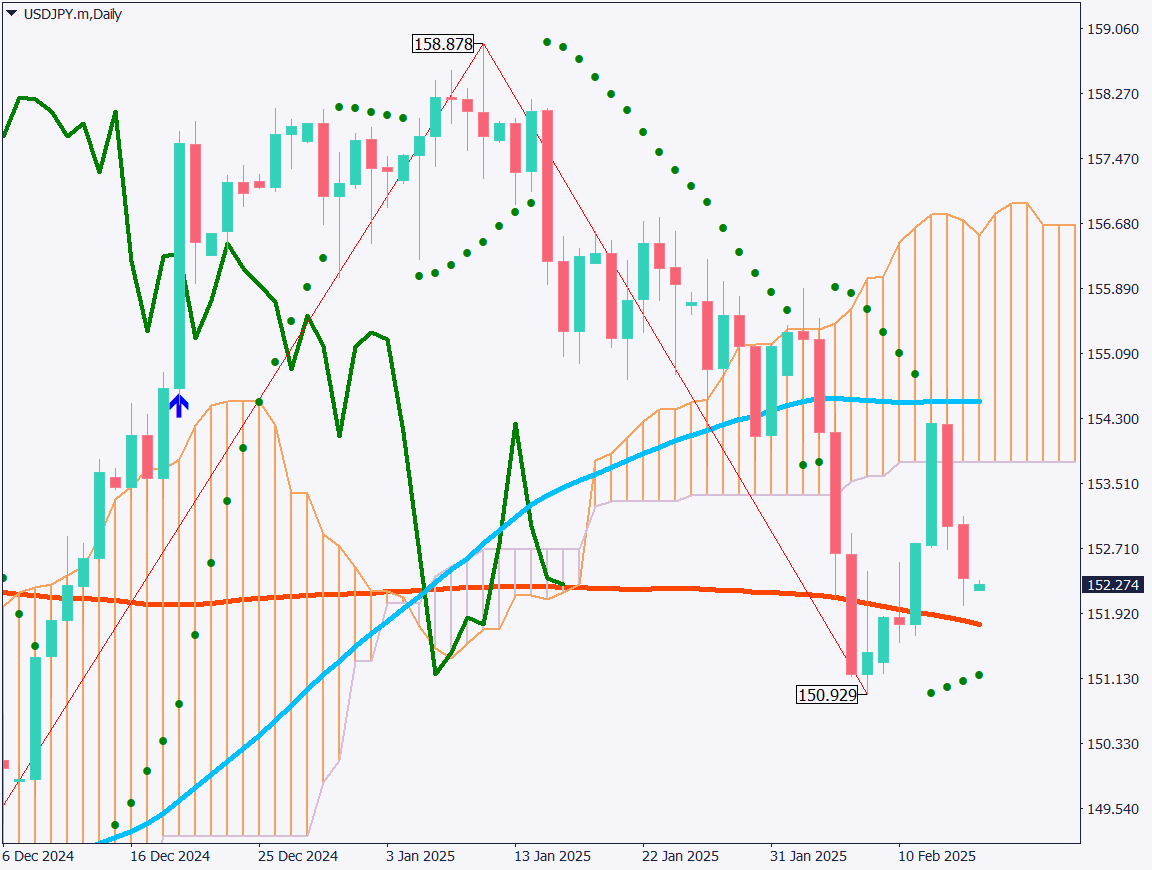

The USDJPY pair is currently fluctuating between the 90-day moving average and the 200-day moving average. A downward trend is becoming evident, with selling pressure emerging on rebounds. The pair briefly climbed into the Ichimoku cloud but was pushed back down after encountering resistance at the 90-day moving average.

With the Trump administration’s potential auto tariffs on Japan creating uncertainty, the JPY may strengthen in response to risk aversion.

Key levels to watch include the 200-day moving average and the recent low of 150.93 JPY. Attention should also be paid to when the Parabolic SAR signals a shift to a selling trend.

Day trading strategy (1 hour)

Analyzing the 1-hour USDJPY chart, the downtrend has intensified. The pair fell sharply from 154.80 JPY to 151.97 JPY, breaking below the 200-period moving average. A further decline toward the 150.93 JPY support level is expected. Key levels to monitor are 151.57 JPY and 150.93 JPY.

Day Trading Strategy

- Sell Limit Order: Near 152.50 JPY

- Take Profit: 151.57 JPY

- Stop Loss: Above the 200-period moving average

Given the current trend, a sell-biased approach is preferred.

Support/Resistance lines

Key support and resistance lines to consider:

- 151.95 JPY – Recent low

- 151.57 JPY – Major support level

Market Sentiment

USDJPY Sell: 42% / Buy: 58%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| US Holiday (Stock Markets Closed) | – |

| Japan GDP Release | 8:50 |

| Speech by FOMC Member | 23:30 |

| Speech by FOMC’s Bowman | 0:20 (Next Day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.