USDJPY Trading at Mid-151, Japan’s GDP Surpasses Expectations【February 18, 2025】

Fundamental Analysis

- Japan’s GDP exceeds expectations, marking growth for the third consecutive quarter.

- Speculation about a possible rate hike by the Bank of Japan rises, and the Nikkei targets 40,000.

USDJPY Technical Analysis

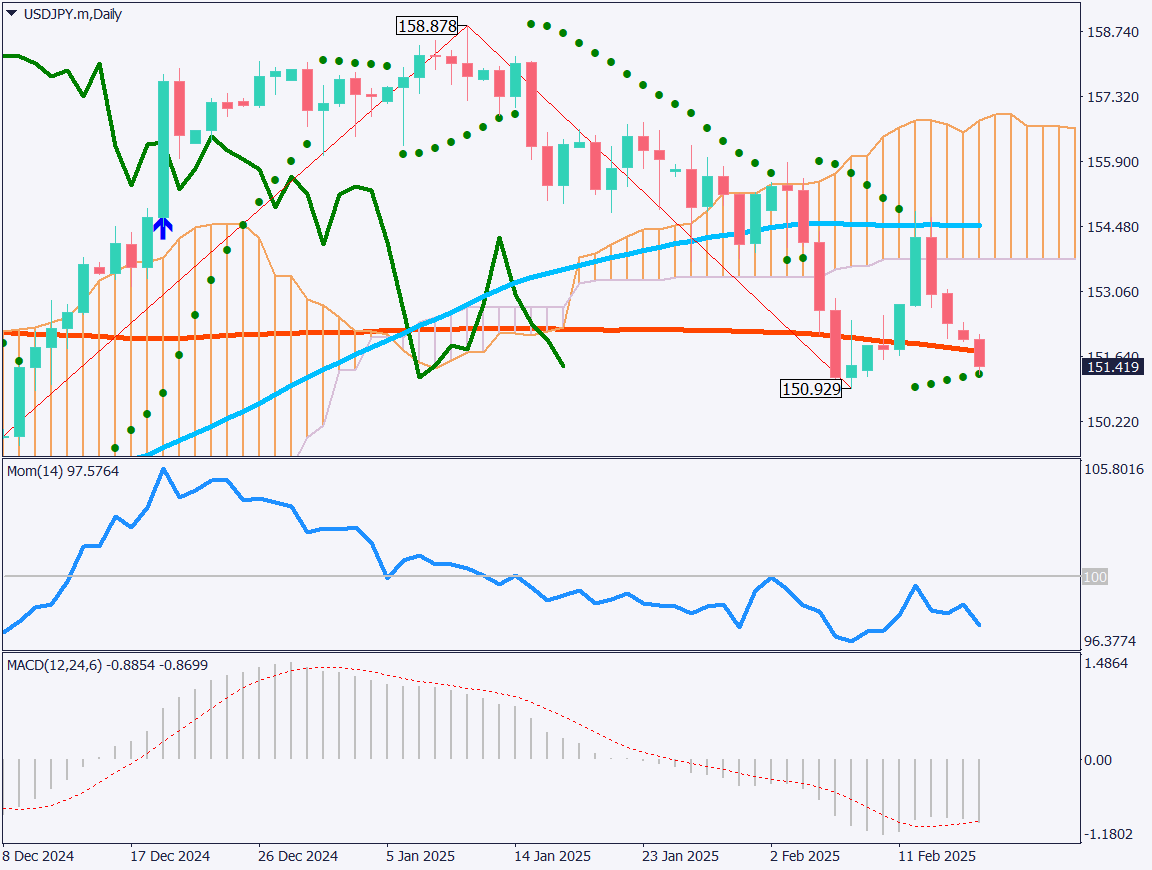

USDJPY is hovering in the mid-151 JPY range, approaching the 200-day moving average. It is about to hit the parabolic indicator, which could trigger a shift to a sell trend. While the moving average remains flat, it is gradually tilting downward.

Let’s examine momentum and MACD. Momentum has consistently stayed below 100, suggesting a bearish trend. The MACD histogram is also extending downward. The key level to watch is whether USDJPY breaks the recent low of 150.920 JPY.

Day trading strategy (1 hour)

Analyzing the USDJPY 1-hour chart, 151.35 JPY serves as a support level, and the price action remains in a consolidation phase. The support below 151 JPY is still holding firm, but the overall downtrend remains unchanged.

With major shifts in market conditions, including Ukraine negotiations, Japan’s economic growth, and a slight cooling of the US economy, traders should take an objective approach to the market.

The day trading strategy favors selling on rebounds. A sell limit order around 151.70 JPY with a target in the lower 151 JPY range is recommended. The stop-loss should be set at 152.15 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 152.12 JPY – Yesterday’s high

- 151.70 JPY – 200-day moving average

Market Sentiment

USDJPY: Sell 34% / Buy 66%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Australia Interest Rate Decision | 12:30 |

| UK Employment Data | 16:00 |

| US New York Fed Manufacturing Index | 22:30 |

| Canada CPI | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.