Gold Eyes USD 3,000 Amid Uncertainty Over Trump’s Tariff Policy【February 19, 2025】

Fundamental Analysis

- The Trump administration is expected to announce details on tariffs for pharmaceuticals and automobiles around April 2.

- Gold is approaching its all-time high, with market participants considering the possibility of USD 3,000 becoming a reality.

XAUUSD Technical Analysis

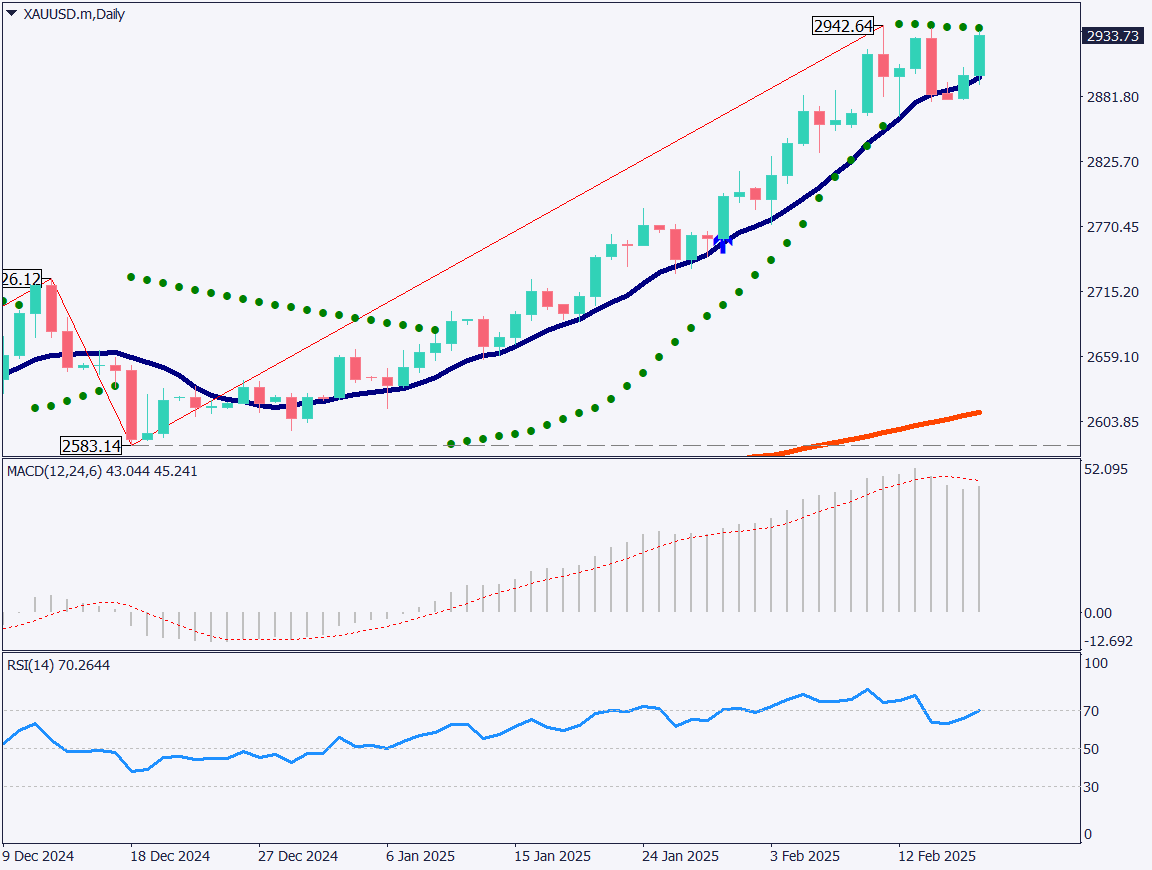

Gold’s daily chart shows that the price is approaching a high of USD 2,934, with a parabolic buy signal expected to be triggered soon. Since January, the price has consistently remained above the 10-day moving average, indicating a strong upward trend. The continuation of this trend above the 10-day moving average suggests that buying pressure is supported not only by technical factors but also by fundamental ones.

The highest price recorded so far is USD 2,942, and attention will be on whether this level can be surpassed within February. The projected high for the month is USD 2,987, making it unlikely for gold to reach USD 3,000 within February. However, March appears to be a more realistic timeframe for achieving that level. The RSI is hovering around 70, staying within the overbought zone, while the MACD histogram is once again showing signs of upward momentum.

Day trading strategy (1 hour)

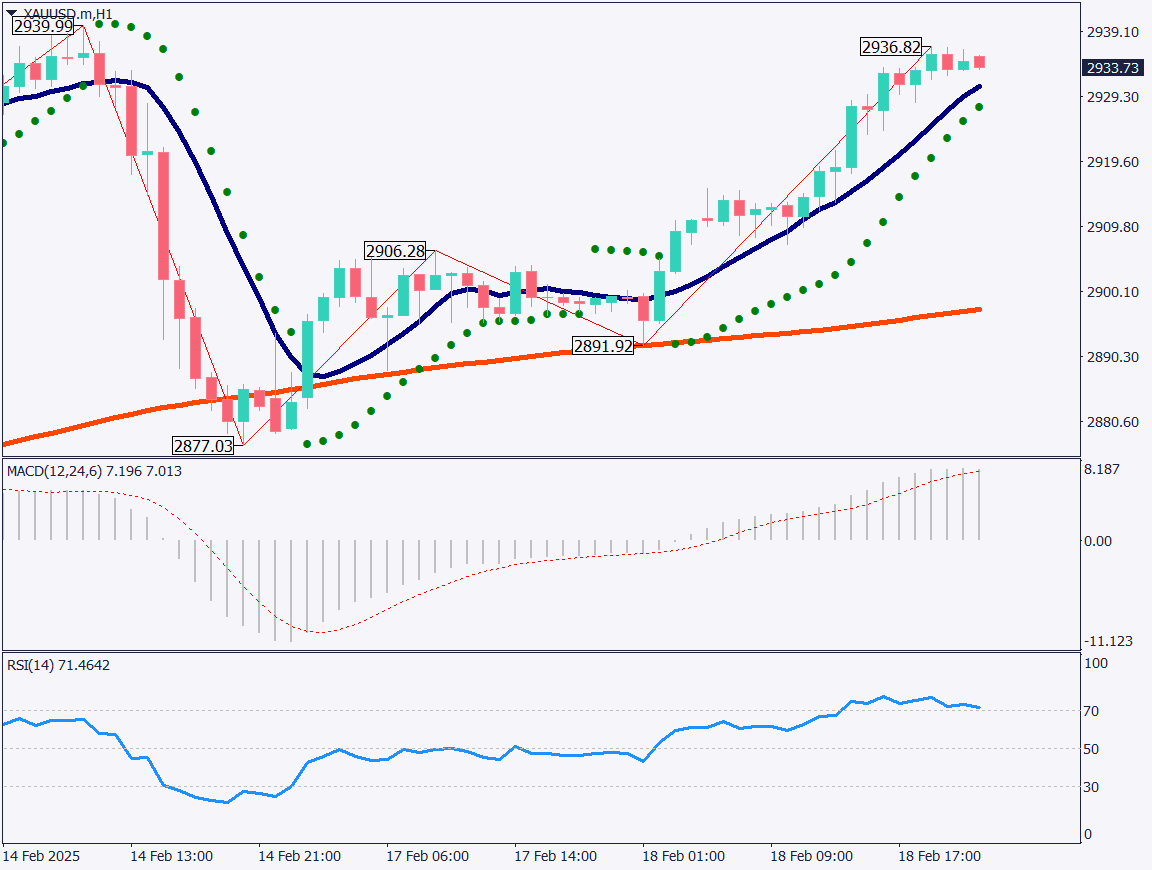

Gold’s 1-hour chart indicates that after rebounding off the 200-period moving average, the price reached a high of USD 2,936. The strong upward momentum continues, with the price remaining in the high range and the RSI reaching 71.

Although the bullish trend is intact, the market remains in overbought territory. If the rally stabilizes, a correctional decline may occur. As the price nears USD 3,000, profit-taking and selling pressure could emerge.

For today’s trading plan, a sell limit order at USD 2,960 is recommended, with a take profit at USD 2,935. If the price exceeds USD 2,965, a stop loss should be set while monitoring further market movements.

Support/Resistance lines

Key support and resistance lines to consider:

- USD 2,972 – Expected resistance

- USD 2,960 – Expected resistance

Market Sentiment

XAUUSD: Sell: 55% / Buy: 45%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| UK CPI | 16:00 |

| US Housing Starts | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.