USDJPY Seeks Lower Levels as BOJ Member Comments on Further Policy Shift【February 20, 2025】

Fundamental Analysis

- BOJ member emphasizes a hawkish stance, stating that the central bank is entering a phase of policy shift.

- USDJPY is searching for lower levels, with a decline into the 150 JPY range now within sight.

USDJPY Technical Analysis

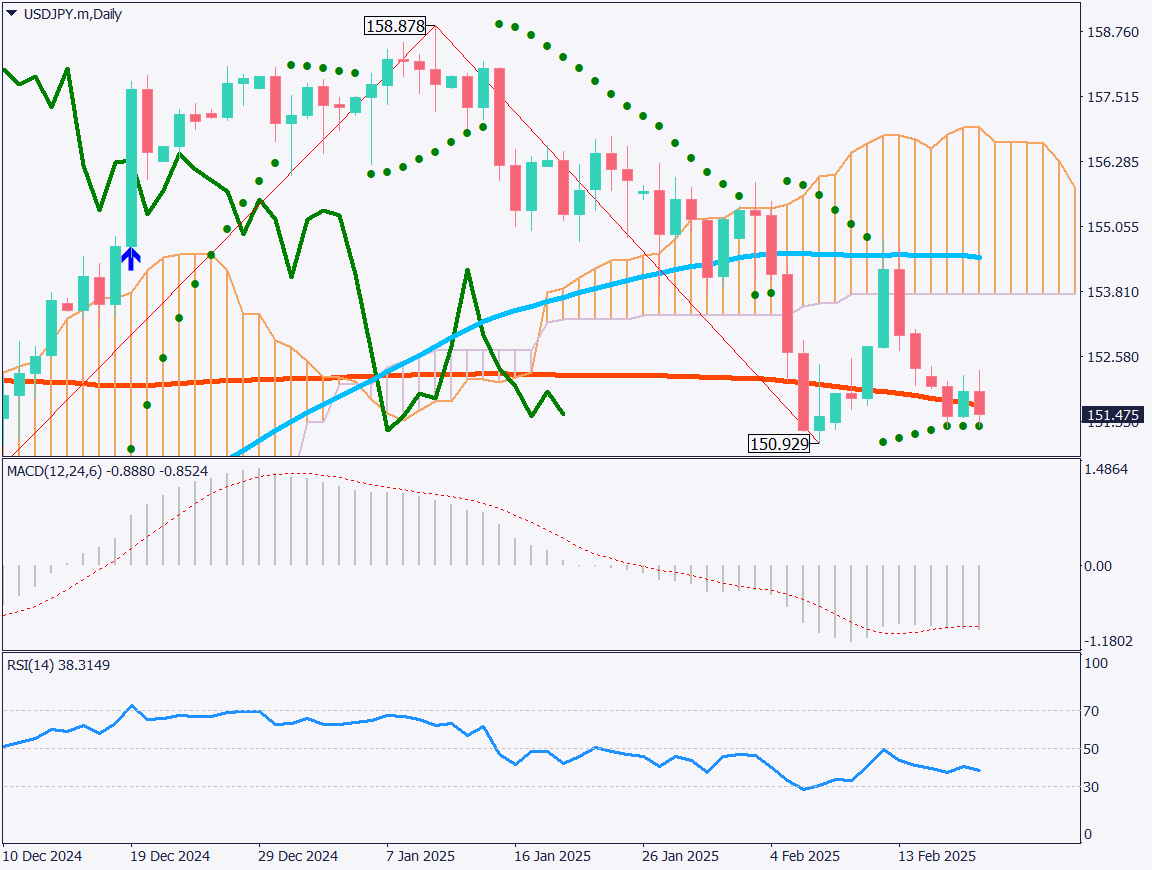

Analyzing the daily chart for USDJPY, the pair has once again fallen below the 200-day moving average. While the Parabolic SAR has not yet signaled a sell, it appears to be only a matter of time. The 151.22 JPY support level remains strong, keeping the downside relatively firm.

Meanwhile, comments from the BOJ member have reinforced the hawkish stance on rate hikes. Additionally, U.S. economic data has started to show signs of weakening, which could lead to increased selling pressure on the USD. Bearish factors for USDJPY are gradually aligning.

If USDJPY breaks below 150.20 JPY, it may trigger stop-loss orders and push the price down toward the 150.75 JPY level.

Day trading strategy (1 hour)

Examining the 1-hour chart for USDJPY, the pair has struggled to break below 151.23 JPY. However, the 90-period moving average is capping the price, and a downward breakout could trigger stop-loss orders. The RSI is currently at 41, and the MACD histogram is gradually forming deeper valleys.

For a day trading strategy, a short position is preferred near the 90-period moving average. The target for closing the position is set at 150.75 JPY, while a move above 152 JPY would warrant a reassessment of the strategy.

Support/Resistance lines

Key support and resistance lines to consider:

- 151.220 JPY – Major support level

- 150.75 JPY – Monthly support level

Market Sentiment

USDJPY Sell: 34% / Buy: 66%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Australia Employment Data | 9:30 |

| U.S. Initial Jobless Claims | 22:30 |

| Philadelphia Fed Manufacturing Index | 22:30 |

| U.S. Leading Economic Index | Midnight |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.