USDJPY Plunges to 149 JPY: Risk-Off Sentiment and BOJ Rate Hike Speculation in Focus【February 21, 2025】

Fundamental Analysis

- Tensions Between President Zelensky and Former President Trump Over Ukraine Ceasefire Negotiations

- Decline in U.S. Personal Consumption Expenditure, Strengthening JPY as USD Selling Intensifies

- Japan’s Consumer Price Index (CPI) Rises to 4%, Market Fully Pricing in a Rate Hike by September

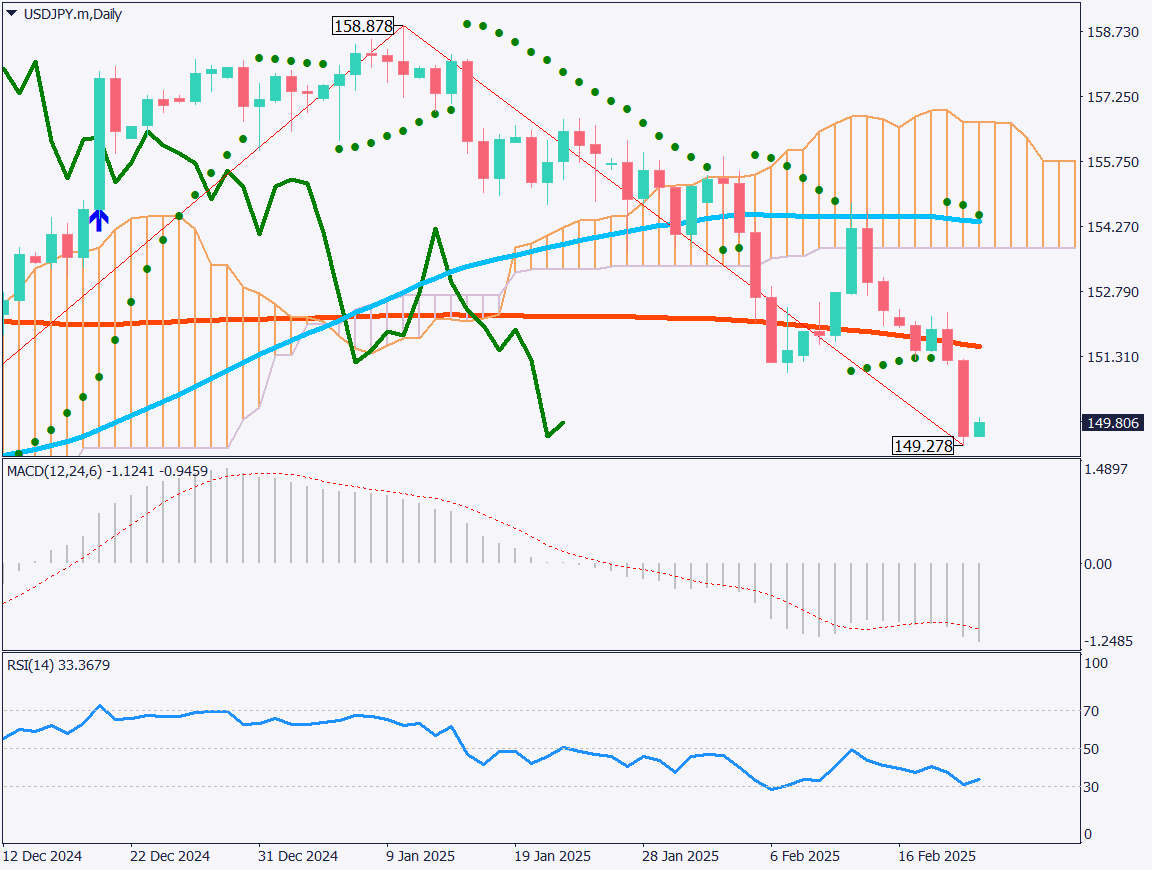

USDJPY Technical Analysis

Analyzing the daily chart for USDJPY, the pair has clearly broken below the 200-day moving average, dropping to the lower 149 JPY range. This marks the lowest level since December last year and reflects increasing speculation about a Bank of Japan (BOJ) rate hike.

The background factors include accelerating wage growth in Japan alongside a stronger-than-expected rise in consumer prices. Japan’s headline CPI increased by 4.0% year-on-year, while core CPI (excluding food) rose by 3.2%, exceeding market expectations. The U.S. has also highlighted Japan’s low interest rates, adding political pressure for an interest rate hike.

USDJPY has reached the 149 JPY level, and the trend suggests further appreciation of JPY. The next key level to watch is 148.65 JPY. However, the Relative Strength Index (RSI) has rebounded at 30, indicating possible short-term buying pressure. With the Japanese market closed next week, there may be a temporary recovery forming a short-term high.

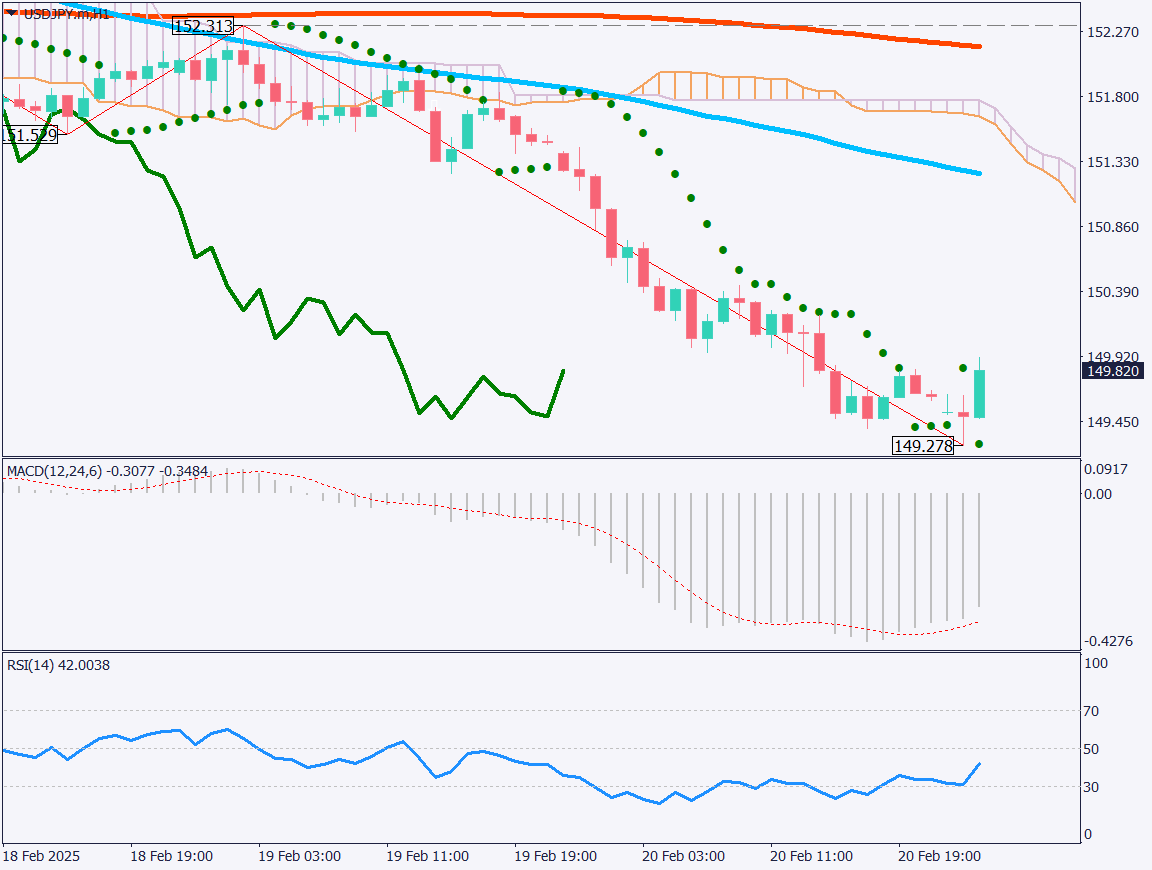

Day trading strategy (1 hour)

Analyzing the 1-hour chart for USDJPY, the pair hit a low of 149.25 JPY before rebounding. The Parabolic SAR has triggered a buy signal, suggesting the possibility of a short-term high formation. RSI also shows that lows are gradually rising, indicating a mixed market sentiment between buyers and sellers.

After testing the lower 149 JPY range, the market may pause. A potential rise towards 150 JPY is expected before a possible decline.

Trading Strategy: Sell on Retracement

- Sell Limit Order at the Lower Edge of the 150 JPY Cloud

- Take Profit at 149.25 JPY

- Stop Loss if USDJPY Breaks Above 150.85 JPY

Support/Resistance lines

Key support and resistance lines to consider:

- 149.25 JPY – Recent Low

Market Sentiment

USDJPY – Sell: 32% / Buy: 68%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan National Core CPI | 08:30 |

| UK Retail Sales | 16:00 |

| U.S. Manufacturing PMI | 23:45 |

| U.S. Existing Home Sales | 00:00 (Midnight) |

| University of Michigan Consumer Sentiment Index | 00:00 (Midnight) |

| Speech by Bank of Canada Governor Macklem | 02:45 (Next Day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.