USDJPY Falls to the 148JPY Range for the First Time in Two Months Amid Concerns Over the US Economic Outlook【February 24, 2025】

Fundamental Analysis

- Weak US consumer and housing-related indicators led to a sharp decline in US stock prices.

- USDJPY rebounded to the low 150JPY range following the BOJ Governor’s comments aimed at curbing rapid interest rate hikes.

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY, the pair has fallen to the 148JPY range for the first time since early December. This drop is attributed to weakening US economic indicators and a sharp decline in US stock indices. Nikkei 225 futures have also plunged.

Previously, strong US economic indicators had stabilized stock prices, but new concerns have emerged. Although inflation expectations remain high, economic uncertainty is weighing on the market.

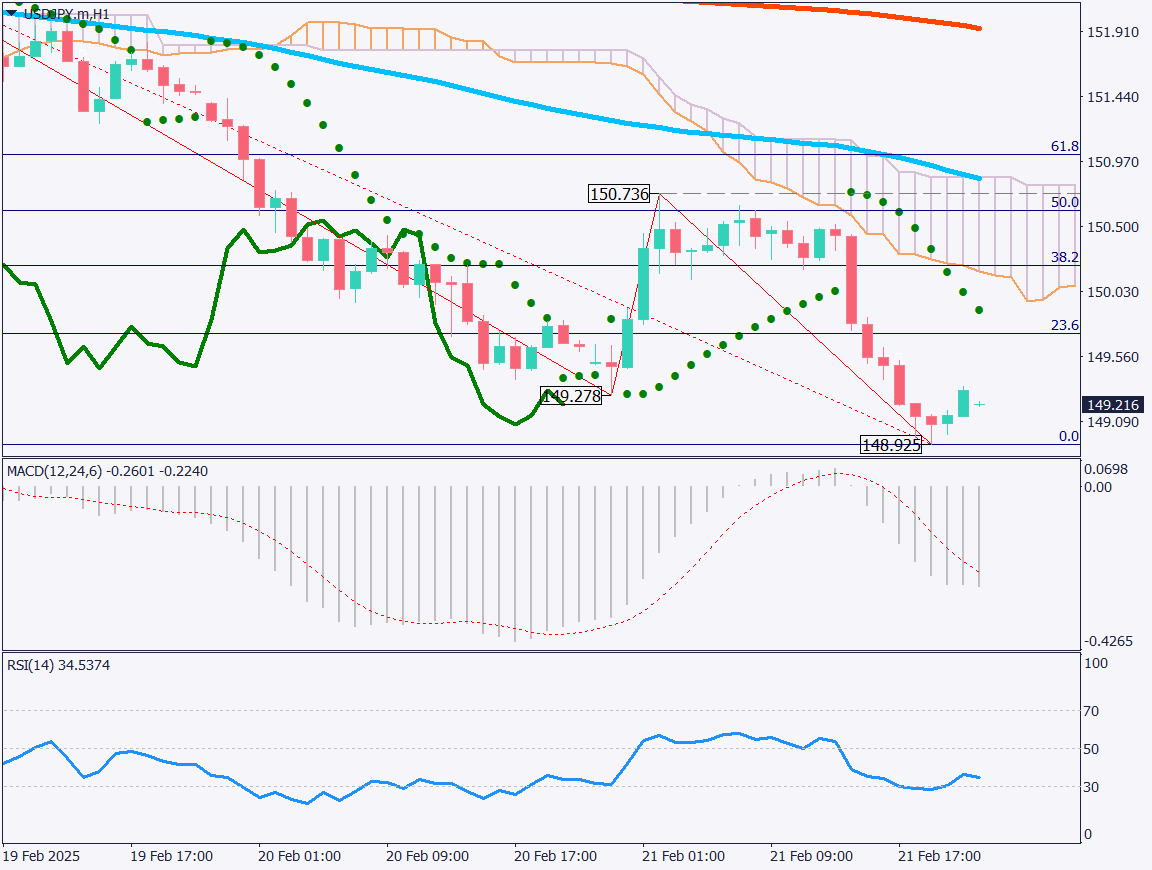

USDJPY has broken below the 200-day moving average and already updated its recent low. The next key support level is 148.65JPY. The RSI fell from 50 to 30. A broader Fibonacci retracement indicates that the 50% level corresponds to around 149.20JPY.

A key point to watch is whether USDJPY will clearly break below the 149JPY range and update its low to 149.65JPY.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY, the pair rebounded at 148.92JPY and closed in the low 149JPY range. Fibonacci retracement is also in focus on the 1-hour chart, with 149.75JPY, corresponding to the 23.6% level, serving as a target for a rebound high.

The US Dollar Index is trending downward, and USD selling pressure continues. The strategy remains to sell on rebounds in USDJPY. The day trading plan is to place a sell limit order at 149.80JPY, set a take profit at 148.65JPY, and a stop loss at 150.30JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 149.25JPY – Recent low / Fibonacci level

- 148.65JPY – Major low

Market Sentiment

USDJPY – Sell: 22% / Buy: 78%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japanese Holiday (Stock Market Closed) | – |

| German Federal Election | – |

| EU Consumer Price Index | 19:00 |

| Speech by Bank of England Committee Member | 22:15 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.