US Stock Indices Plunge, USDJPY Drops to 147 JPY【March 7, 2025】

Fundamental Analysis

- Tariffs on Canadian and Mexican Automobiles Delayed by One Month

- No Market Easing Effect, US Stocks Plummet

- USDJPY Falls to 147 JPY, Will the Yen Appreciation Trend Continue?

USDJPY Technical Analysis

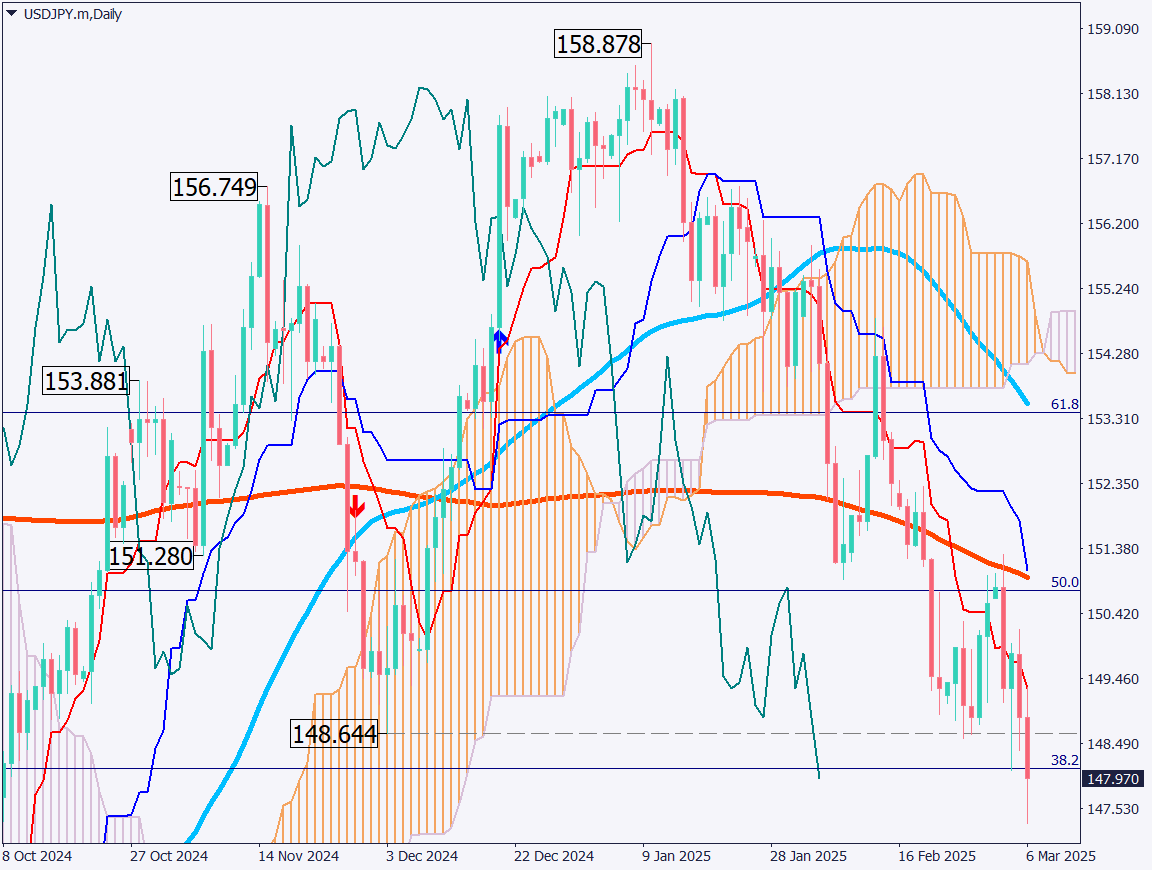

Analyzing the daily chart of USDJPY, a rebound high has formed near the 200-day moving average, strengthening the downtrend and pushing the pair into the 147 JPY range.

Drawing a Fibonacci retracement, the 50% level at 150.50 JPY is a key resistance, while the current price is influenced by the 38.2% level. If the pair breaks below 38.2%, the next potential support is at the 23.6% level, corresponding to 144.87 JPY.

Today, the US Non-Farm Payrolls (NFP) report is scheduled. If the figures come in lower than expected, the market is likely to react sensitively. Traders should stay alert.

Day trading strategy (1 hour)

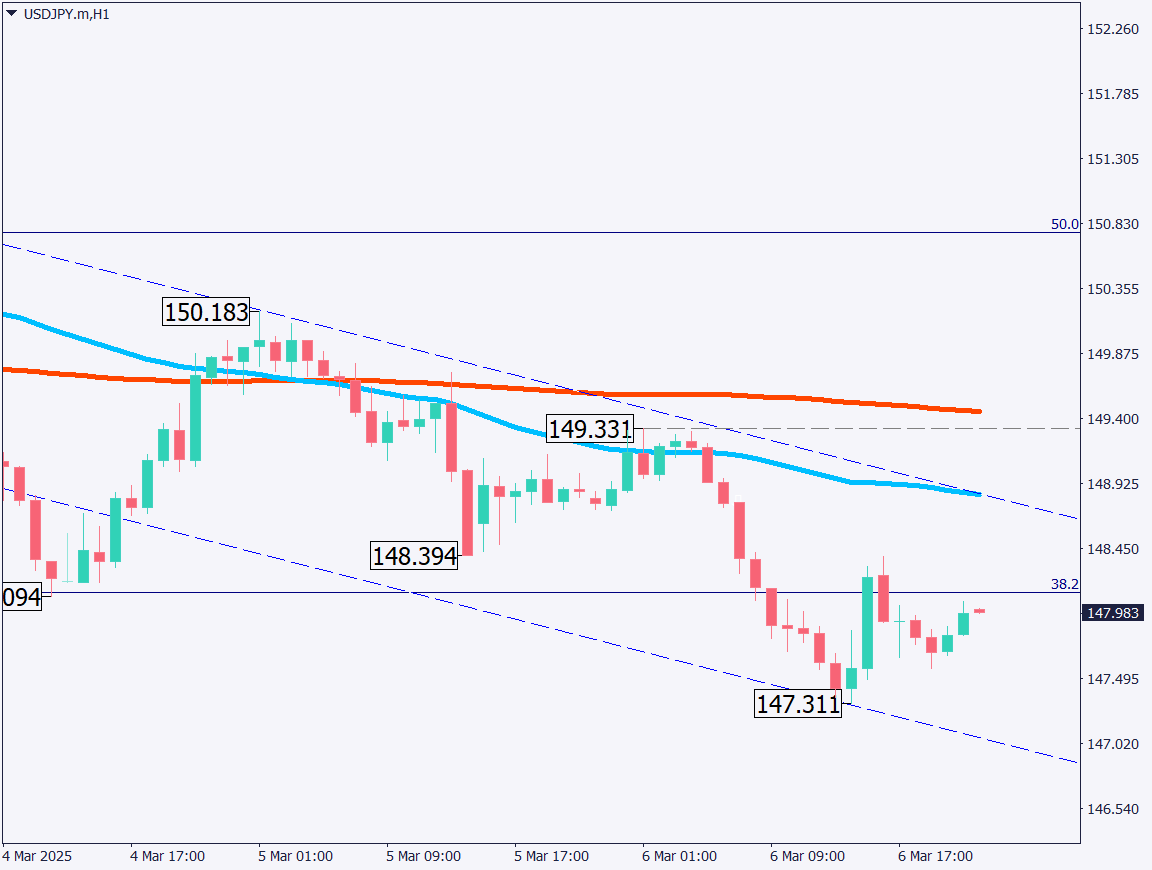

Analyzing the 1-hour chart of USDJPY, a descending channel is forming, with the upper band around 148.50 JPY. The highs are gradually declining, indicating a continued downtrend.

Today’s Day Trading Plan:

- Sell on rebounds while ensuring all positions are closed before the US Non-Farm Payrolls release.

- Sell limit order at 149.50 JPY, targeting 147.50 JPY, and stop-loss above 150 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- Around 149 JPY – Upper boundary of the ascending channel

- 147.310 JPY – Recent low

Market Sentiment

USDJPY: Sell: 41% / Buy: 59%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| EU GDP | 19:00 |

| US Non-Farm Payrolls | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.