EURUSD Continues to Surge, Approaching 1.09 USD Amid Stop-Loss Triggers【March 10, 2025】

Fundamental Analysis

- EURUSD continues its sharp rise as expectations for increased German defense spending boost economic activity.

- EURUSD is forming a band walk within the Bollinger Bands.

EURUSD Technical Analysis

Analyzing the daily chart of EURUSD:

After breaking above the 1.05 USD range high, EURUSD surged beyond 1.08 USD, triggering stop-loss orders. The price has surpassed the 200-day moving average and touched the +3σ line of the Bollinger Bands. Although some profit-taking at the +3σ line led to a slight pullback, the strong uptrend remains intact.

The market is experiencing a bullish EURUSD sentiment, driven by expectations of Germany’s substantial increase in defense spending and capital flow into the euro due to trade uncertainties in the US.

A temporary adjustment may occur, but the primary strategy remains buying on dips.

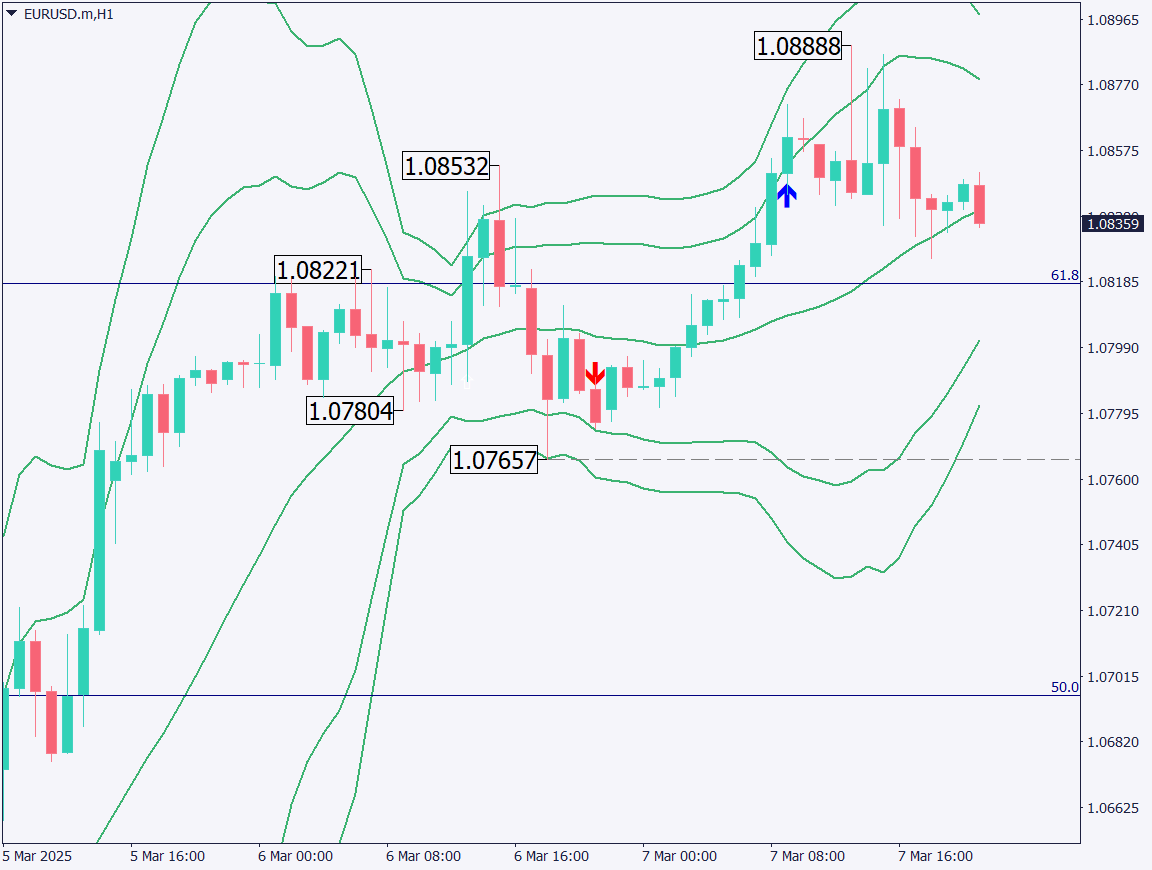

Day trading strategy (1 hour)

Analyzing the 1-hour chart of EURUSD:

The pair is approaching 1.09 USD but is slightly retracing due to profit-taking. Buying opportunities are expected around the 1.076 USD and 1.07 USD levels. Given the increased volatility, caution is advised.

Day trading plan:

- Buy limit orders at 1.076 USD and 1.07 USD.

- Take profit at 1.085 USD.

- Stop-loss at 1.069 USD.

Support/Resistance lines

Key support and resistance lines to consider:

- 1.0888 USD – Recent high

- 1.08 USD – Psychological round number

Market Sentiment

EURUSD: Sell: 83% / Buy: 17%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Germany Industrial Production | 16:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.