USDJPY Falls to 146 JPY Level as U.S. Stocks Suffer Biggest Decline of the Year【March 11, 2025】

Fundamental Analysis

- The U.S. stock market experienced a sharp decline, intensifying concerns over an economic recession.

- The fear index (VIX) surged to 24, marking its highest level since August last year.

USDJPY Technical Analysis

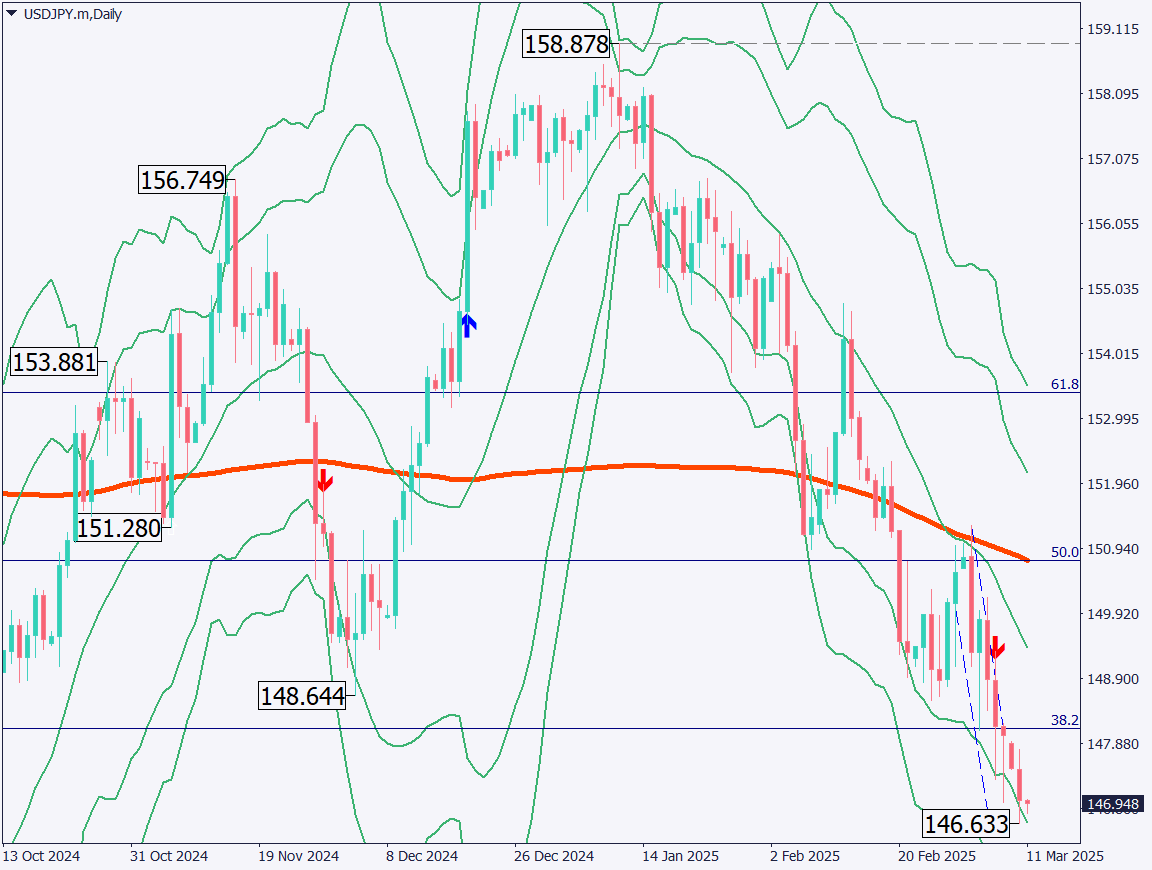

Analyzing the daily chart of USDJPY, the pair continues to hit new lows, falling to the 146 JPY range. The downward momentum remains strong, driven by growing concerns over a U.S. economic downturn.

U.S. stocks recorded their largest drop of the year, with Tesla plunging 15%. The Dow Jones Industrial Average, S&P 500, and Nasdaq all fell below their 200-day moving averages—critical levels that long-term investors closely monitor. This could trigger further panic selling.

If both the U.S. and Chinese stock markets continue to decline simultaneously, the global economic impact could be severe. USDJPY is likely to accelerate its downward movement, searching for lower support levels.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY, the pair is forming a downward channel, steadily posting lower highs. Given the decline in the Nikkei 225, U.S. stocks, and the rise in Japan’s long-term interest rates, JPY appreciation is expected to continue.

The day trading strategy favors selling. Given the high volatility, a sell entry around 148.30 JPY is recommended, with a target at 145 JPY. If USDJPY rebounds to 149 JPY, the position should be stopped.

Support/Resistance lines

Key support and resistance lines to consider:

- 148.20 JPY – Fibonacci Level

- 146.63 JPY – Recent Low

Market Sentiment

USDJPY – Sell: 45% / Buy: 55%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Household Spending | 8:30 |

| Japan GDP | 8:50 |

| U.S. JOLTS Job Openings | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.