USDJPY Faces Resistance Amid Market Volatility Following Trump’s Statements【March 12, 2025】

Fundamental Analysis

- Former President Trump reversed his decision on Canadian tariff hikes just hours after announcing them.

- The U.S. stock market continues its decline, while USDJPY rebounds.

USDJPY Technical Analysis

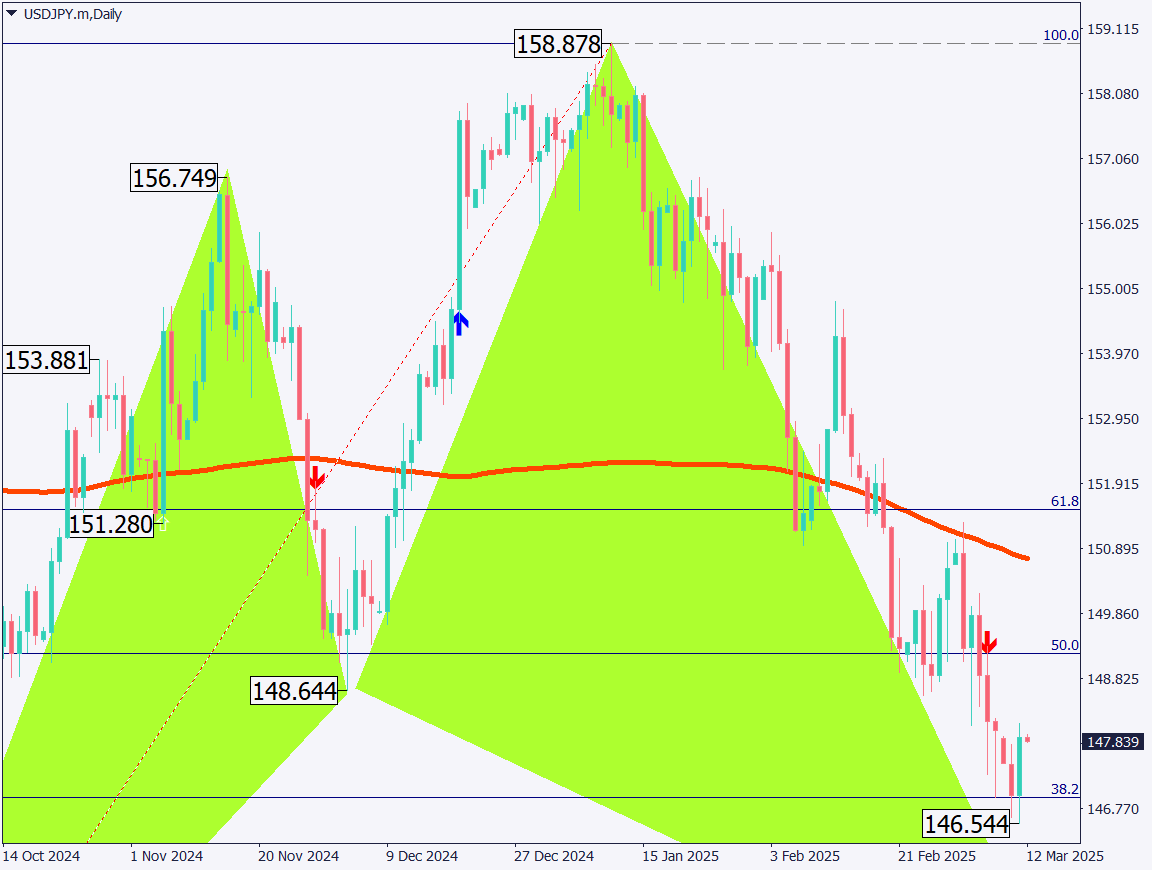

Analyzing the daily chart of USDJPY, a harmonic Cypher pattern may be forming. Without delving into details, if point D of the XABCD pattern reaches 143.38 JPY, the Cypher pattern criteria will be met. Generally, this suggests a potential reversal.

143.38 JPY is slightly below the 23.6% Fibonacci retracement level. If USDJPY breaks below the current support at 146.54 JPY, it may drop to the 143 JPY range.

Traders should continue targeting selling opportunities on rebounds at higher levels.

Day trading strategy (1 hour)

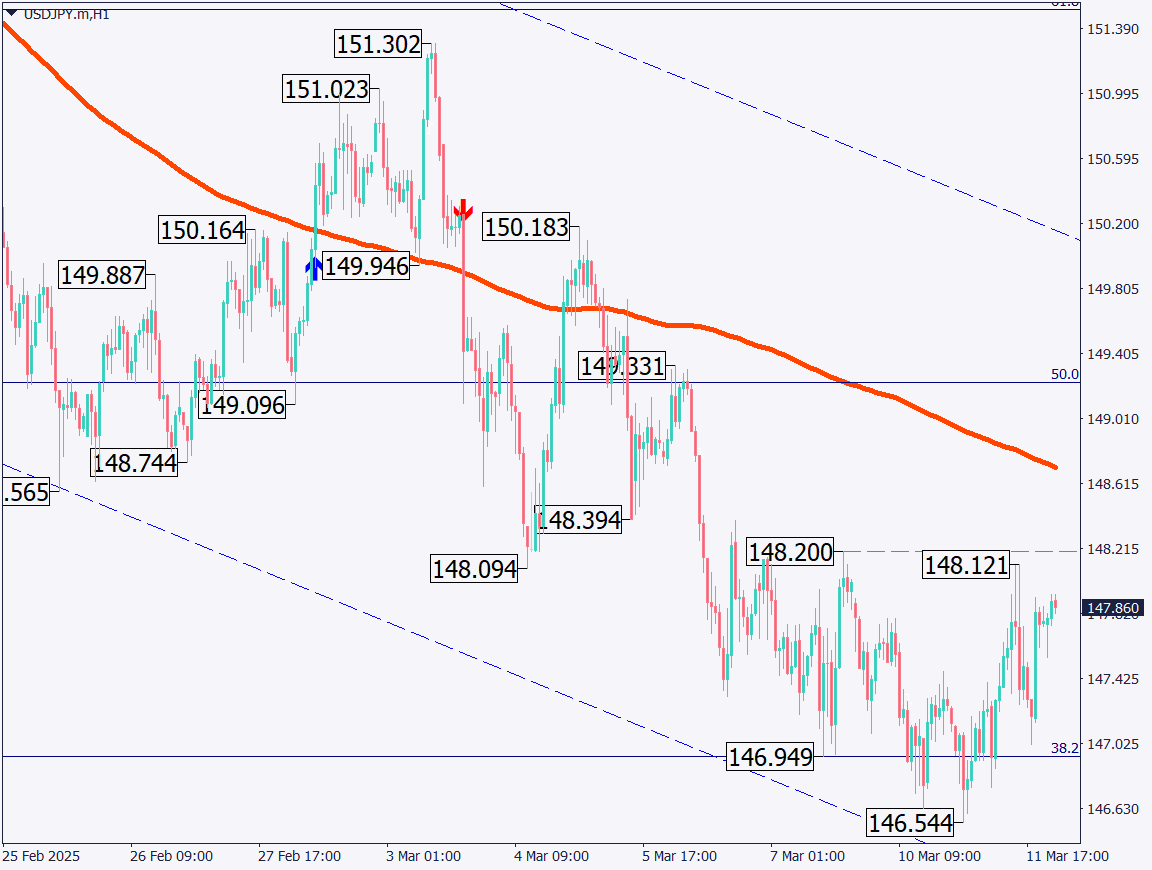

Analyzing the 1-hour chart of USDJPY, the pair is moving downward within a descending channel. It rebounded at 146.54 JPY and approached 148 JPY, where selling pressure temporarily eased.

However, the downtrend remains intact, and selling on rebounds remains the preferred strategy.

Day Trading Plan: Sell

- Sell Limit Order: 148.15 JPY

- Take Profit: 146.50 JPY

- Stop Loss: 148.35 JPY (if the price breaks above this level)

Support/Resistance lines

Key support and resistance lines to consider:

- 149.20 JPY – 50% Fibonacci Retracement

- 146.55 JPY – Recent Low

Market Sentiment

USDJPY – Sell: 40% / Buy: 60%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Corporate Goods Price Index | 08:50 |

| U.S. Consumer Price Index (CPI) | 21:30 |

| U.S. Crude Oil Inventory | 22:30 |

| Canada Interest Rate Decision | 22:45 |

| Bank of Canada Governor’s Press Conference | 23:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.