Gold Continues Its Uptrend as Ukraine Agrees to U.S. Temporary Ceasefire Proposal【March 13, 2025】

Fundamental Analysis

- Ukraine Agrees to U.S. Temporary Ceasefire Proposal, Raising Hopes for a Truce

- Gold Eyes a New High, Aiming for 3,000 USD

XAUUSD Technical Analysis

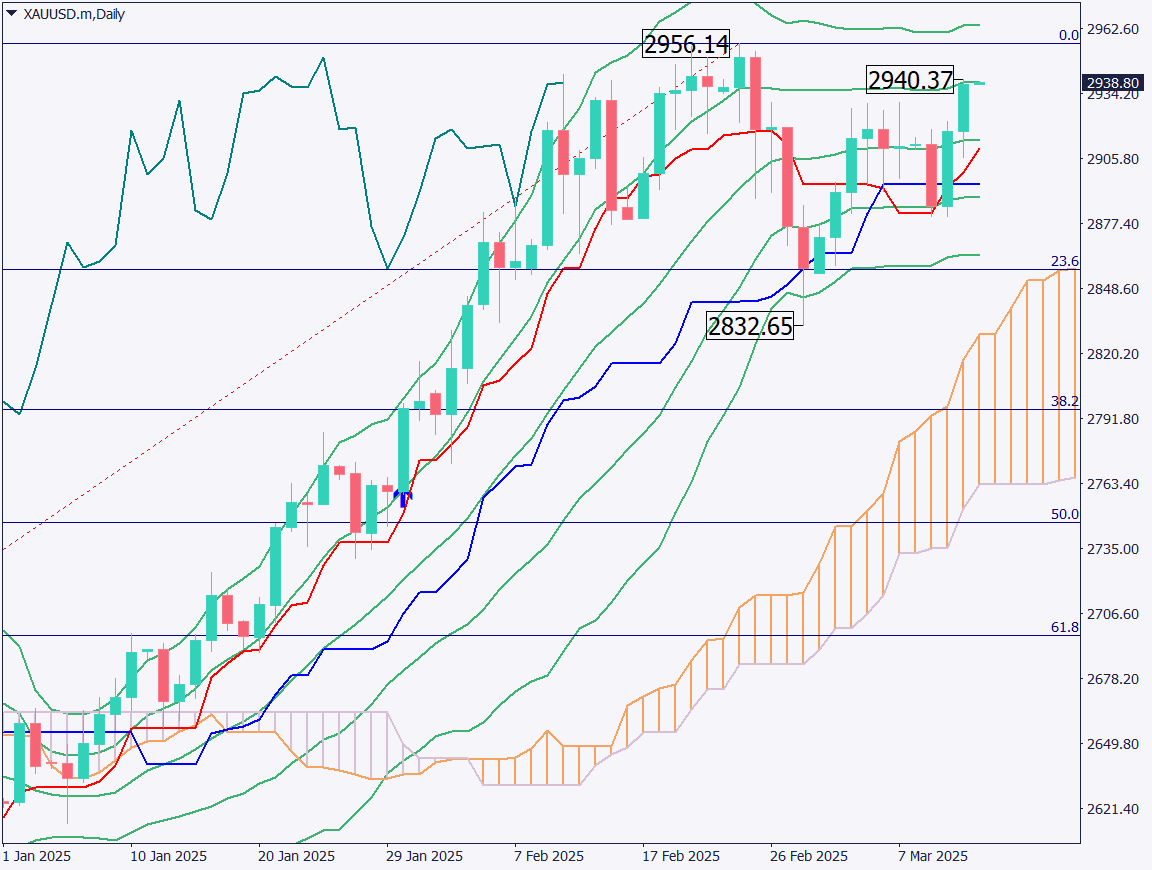

Analyzing the daily chart for gold, we see that gold has extended its rally for two consecutive days, reaching 2,940 USD. The price has touched the +1σ line of the Bollinger Bands. Looking at Fibonacci retracement levels, the 23.6% level is being observed, indicating that buying pressure quickly resumed after a shallow pullback. This suggests that the uptrend remains intact.

Additionally, the conversion line crossing above the base line is another positive signal. While news of Ukraine agreeing to a ceasefire proposal with the U.S. could lead to a partial shift from safe-haven assets to risk assets, uncertainty surrounding U.S. tariff policies keeps demand for gold strong.

Day trading strategy (1 hour)

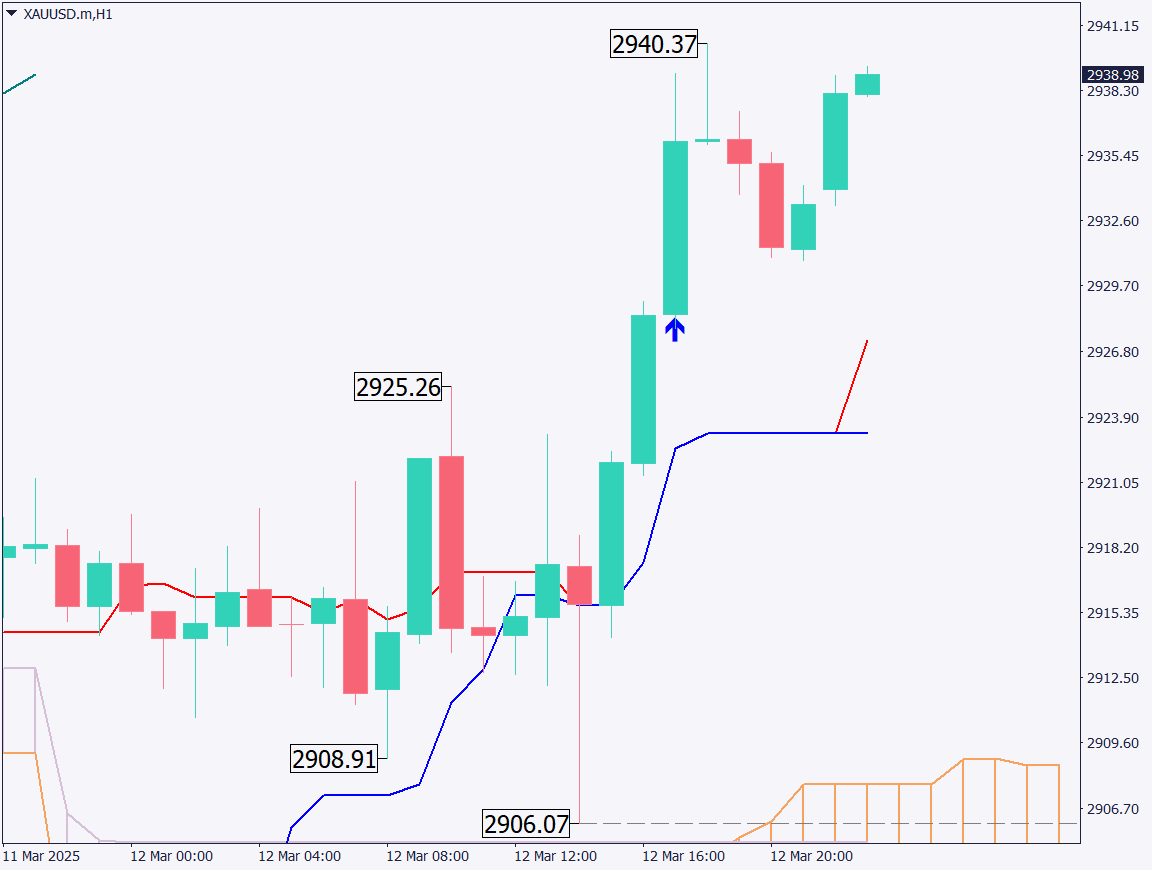

Analyzing the 1-hour chart, gold is hovering near its recent highs, with focus on whether it can break above 2,940 USD. The conversion line is trending upward, supporting the continuation of the uptrend.

The price has surpassed the 2,930 USD level, where an upper shadow previously formed on the daily chart, and is now trading near 2,940 USD. A key resistance level at 2,952 USD on the monthly chart warrants attention for a potential breakout.

- Sell limit at 2,952 USD

- Stop at 2,957 USD

- Target at 2,930 USD

Support/Resistance lines

Key support and resistance lines to consider:

- 3,000 USD – Psychological round number

- 2,952 USD – Monthly high

Market Sentiment

XAUUSD: Sell: 65% / Buy: 35%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| U.S. Initial Jobless Claims | 21:30 |

| U.S. PPI | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.