USDJPY Rises to 148.70 JPY, Driven by U.S. Stock Rebound【March 17, 2025】

Fundamental Analysis

- U.S. Government Shutdown Likely Avoided, Risk-On Sentiment in Markets

- Gold Hits New All-Time High, Temporarily Surpasses 3,000 USD

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY, the pair has risen above the conversion line and reached 148.77 JPY. The rebound continues toward the baseline and the descending trendline. The rise in U.S. equities is also impacting Nikkei 225 and other markets, supporting further gains.

USDJPY may temporarily rise to the 149 JPY level. However, as RSI approaches 50, selling pressure may increase, limiting further gains. Traders should monitor the position of the baseline and trendline closely and consider short-term rebound opportunities.

Day trading strategy (1 hour)

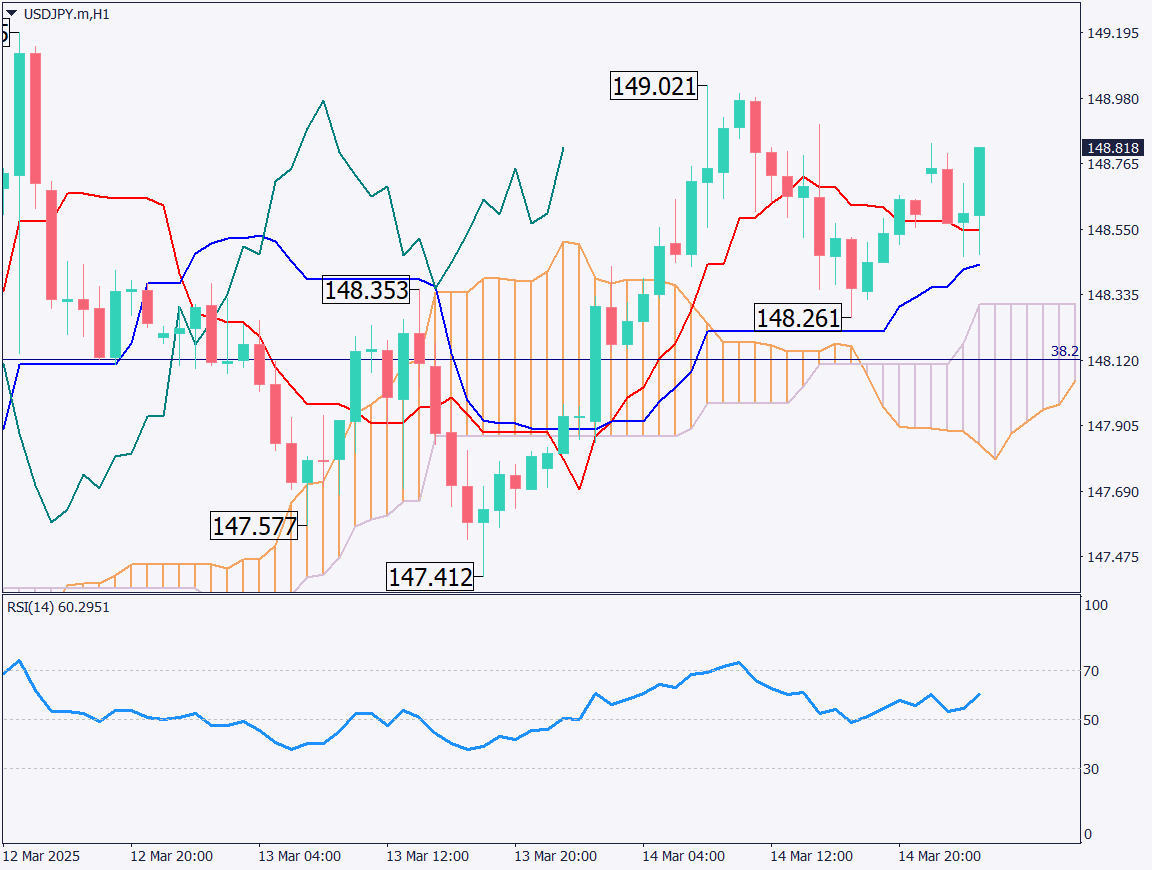

Analyzing the 1-hour chart of USDJPY, the recent high is at 149.02 JPY, and traders are watching to see if it will break above this level. The conversion line provides strong support, and pullbacks have been met with buying interest. RSI has rebounded from 50, indicating that short-term buying pressure is present.

The day trading strategy focuses on short-term buying. Traders may consider rotating buy positions up to the daily baseline at 149.46 JPY. However, if the price touches the trendline, a shift to selling should be considered.

Support/Resistance lines

Key support and resistance lines to consider:

- 149.46 JPY – Daily Baseline

- 148.12 JPY – Fibonacci Level

Market Sentiment

USDJPY: Sell: 47% / Buy: 53%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| U.S. Core Retail Sales | 21:30 |

| New York Fed Manufacturing Index | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.