EURUSD Remains in Uptrend, Conversion Line Acting as Support【March 19, 2025】

Fundamental Analysis

- The US-Russia meeting was held, but Russia showed reluctance toward a ceasefire in Ukraine.

- EURUSD is aiming for 1.10USD, breaking above 1.09USD.

EURUSD Technical Analysis

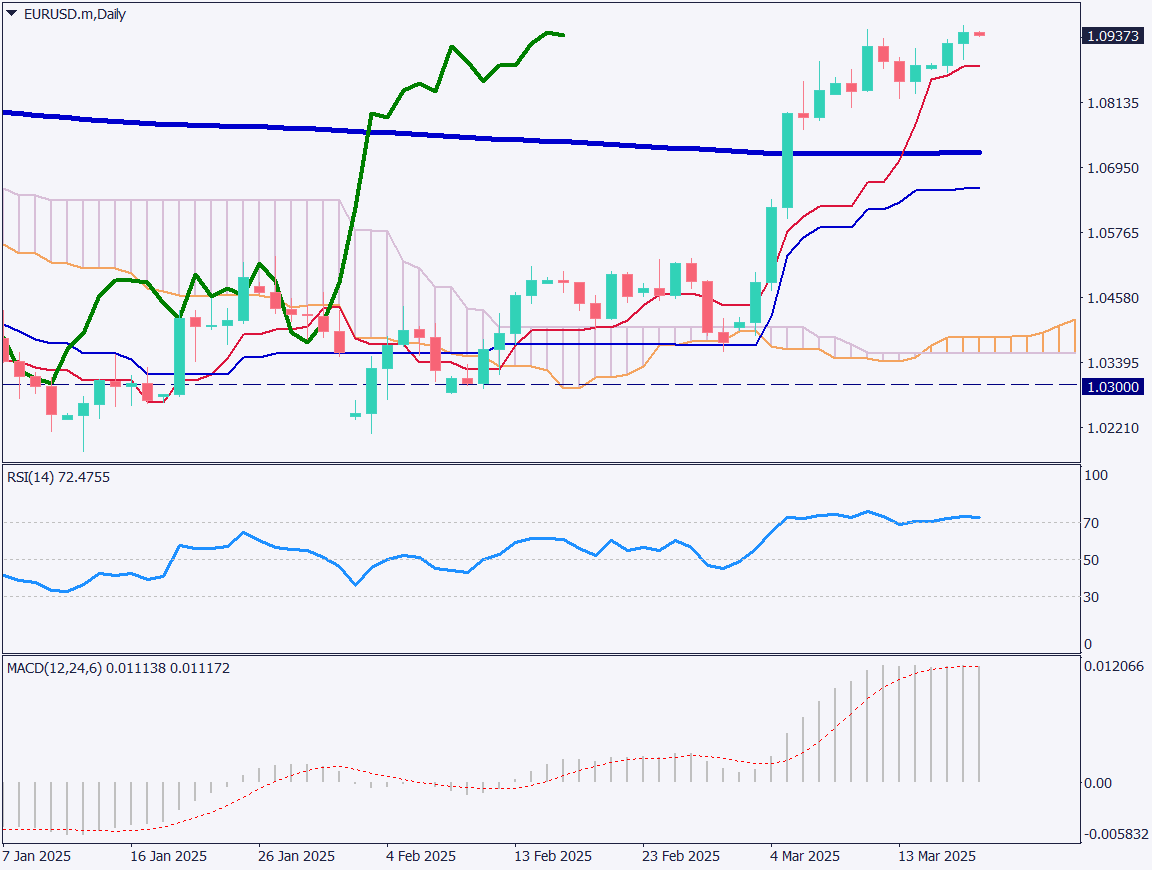

Analyzing the EURUSD daily chart:

EURUSD continues its uptrend as the conversion line serves as a support level. The pair has broken above 1.09USD.

Although no immediate ceasefire was agreed upon during the US-Russia meeting, both parties reached an agreement to halt attacks on energy facilities for 30 days.

EURUSD is approaching the key psychological level of 1.10USD. If reached, profit-taking pressure is expected to increase.

The price remains above the 200-day moving average, indicating that the uptrend continues.

The RSI is at 72, indicating slight overheating. However, no sell signal has appeared yet. It is advisable to be cautious with sell entries until the RSI drops below 70.

Day trading strategy (1 hour)

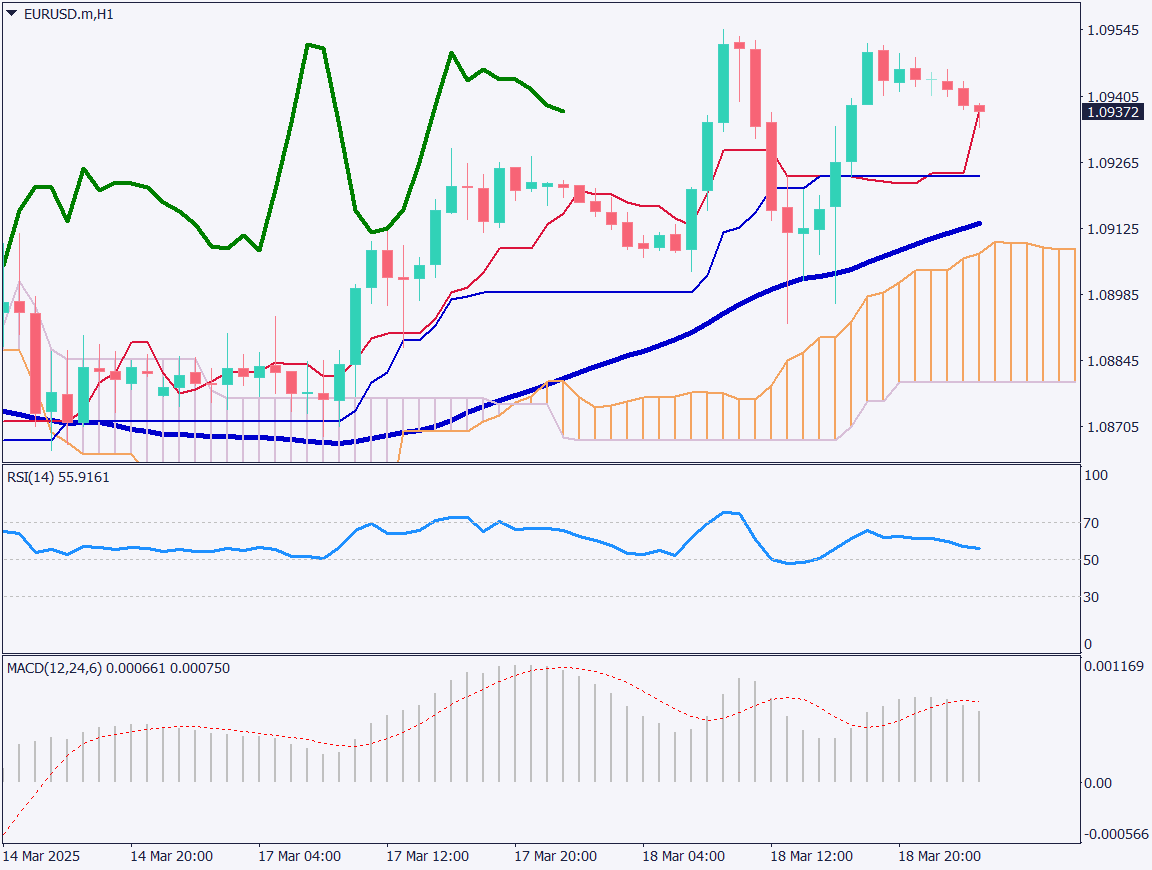

Analyzing the EURUSD 1-hour chart:

EURUSD rebounded from the 52-period moving average and rose. However, it pulled back near 1.095USD.

As EURUSD approaches 1.10USD, profit-taking pressure is expected to intensify.

For the day trading strategy, consider entering a short position on a pullback:

- Sell limit around 1.12USD

- Take profit at 1.095USD

- Stop loss at 1.145USD

Support/Resistance lines

Key support and resistance lines to consider:

- 1.10USD – Psychological round number

Market Sentiment

EURUSD Sell: 71% / Buy: 29%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Bank of Japan Monetary Policy Announcement | 11:30 |

| Japan Policy Rate Decision (Forecast: No Change) | 12:00 |

| Bank of Japan Press Conference | 15:30 |

| EU Consumer Price Index | 19:00 |

| US Crude Oil Inventories | 22:30 |

| US Interest Rate Outlook | 03:00 (next day) |

| FOMC Meeting (Forecast: No Change) | 03:00 (next day) |

| US Federal Reserve Chair Press Conference | 03:30 (next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.