USDJPY Faces Selling Pressure, May Test New Lows Again【March 20, 2025】

Fundamental Analysis

- The Federal Reserve decided to hold rates steady at the FOMC meeting. The Fed Chair expressed concerns over stagflation.

- USDJPY remains under pressure, while Gold continues to hit new all-time highs.

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY:

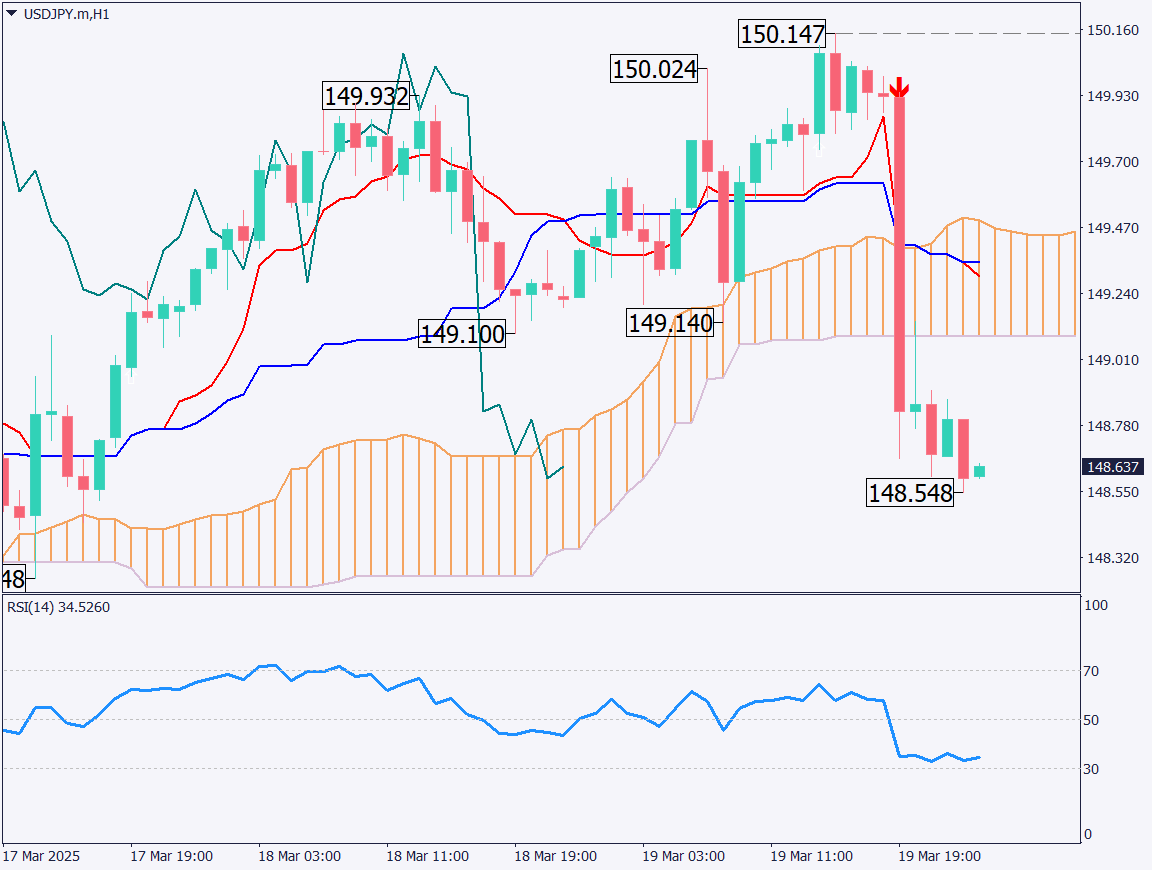

As noted in yesterday’s report, USDJPY reacted to the downward trendline. The price is also hovering around the Base Line. Although USDJPY temporarily reached the 150JPY level, it failed to sustain the upside momentum. The Conversion Line is acting as support, but if the price breaks below the Conversion Line, a test of the 146JPY low is highly possible.

It is also worth noting that the RSI reversed at the 50 level. This is considered a sign of selling pressure strengthening. Watch closely for a break below the Conversion Line.

Day trading strategy (1 hour)

Although today is a holiday, this is a good timing to look for sell opportunities. If USDJPY returns inside the Ichimoku Cloud, it is worth trying a short entry. Ideally, we would like to enter a sell position near 149JPY.

Today’s day trading strategy:

Sell entry at 149JPY, take profit at 146.75JPY, and stop loss if it breaks above 150.15JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 150.15JPY – 1-hour chart high

- 148.35JPY – Daily Conversion Line

Market Sentiment

USDJPY – Sell: 34% / Buy: 66%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Australia Employment Data | 09:30 |

| UK Employment Data | 16:00 |

| UK Interest Rate Decision | 21:00 |

| Bank of England Governor Speech | 21:30 |

| US Existing Home Sales | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.