USDJPY Moves in a Narrow Range, Sideways Market Continues【March 21, 2025】

Fundamental Analysis

- The Bank of England decided to keep rates unchanged, showing a slightly hawkish stance.

- Major central banks issued statements expressing concerns over the uncertain outlook for trade issues, making future projections extremely difficult.

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY, the pair remains in a range-bound market with the baseline acting as resistance. Although the April 3 tariff implementation date is approaching, the market is no longer reacting as sensitively as it did in early March, suggesting that it may be gradually priced in.

The recent high is at 150.15 JPY. Unless this high is breached, the trading bias remains on the selling side. RSI has not surpassed the 50 level that signals a shift to an uptrend. Meanwhile, the Parabolic indicator is currently flashing a buy signal.

Day trading strategy (1 hour)

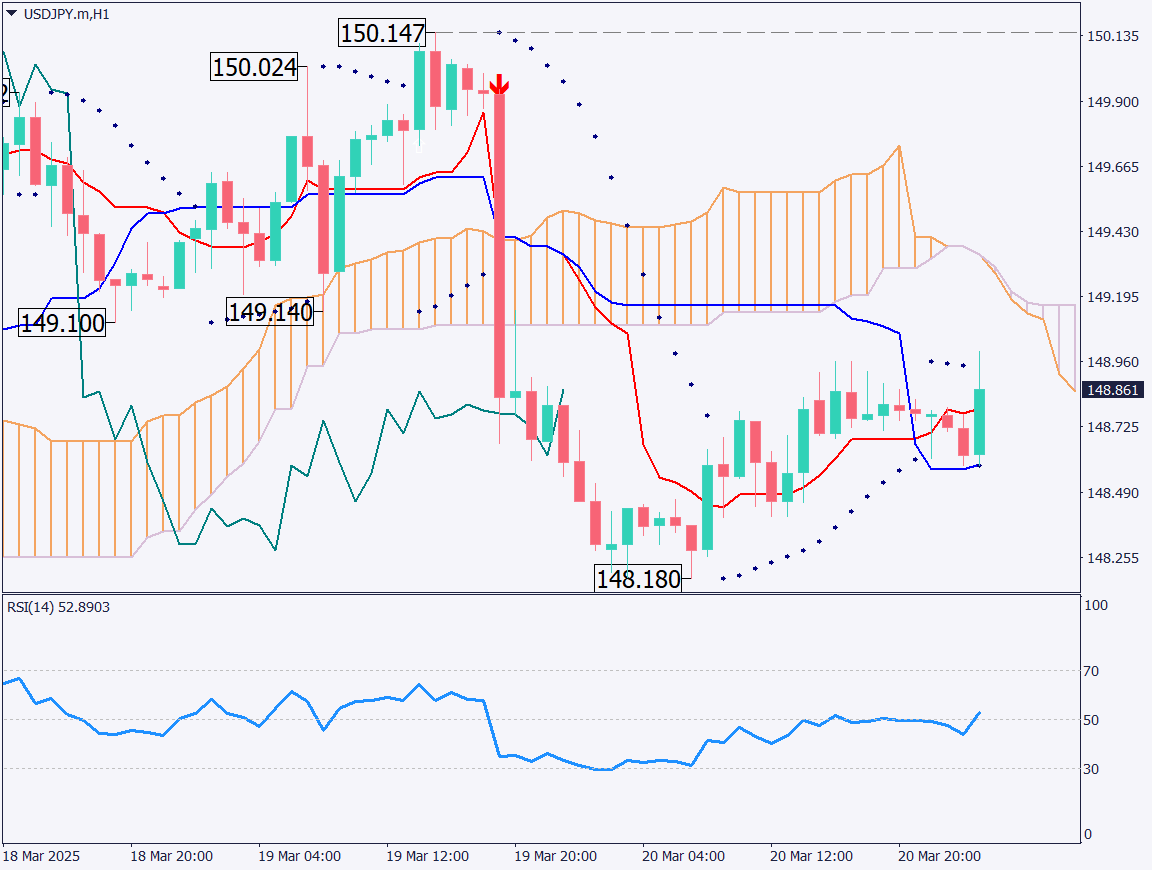

Analyzing the 1-hour chart of USDJPY, the pair rebounded from a low of 148.18 JPY and climbed to around 148.85 JPY. However, in the 149 JPY range, frequent upper shadows suggest heavy resistance above.

The Parabolic indicator is also showing a buy signal.

The basic strategy is to wait for a pullback and sell.

Sell limit at 149.15 JPY, take profit at 148.25 JPY, and stop loss at 149.35 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 149.10 JPY – Previously recognized price zone

Market Sentiment

USDJPY Sell: 45% / Buy: 55%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Consumer Price Index (CPI) | 8:30 |

| Canada Retail Sales | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.