U.S. Administration Considering Tariff Reductions, Risk-On Sentiment Pushes USDJPY Higher【March 25, 2025】

Fundamental Analysis

- President Trump commented that he is considering narrowing the scope of tariffs or implementing tariff reductions.

- The stock and forex markets turned risk-on, with USDJPY recovering to the 150JPY range.

USDJPY Technical Analysis

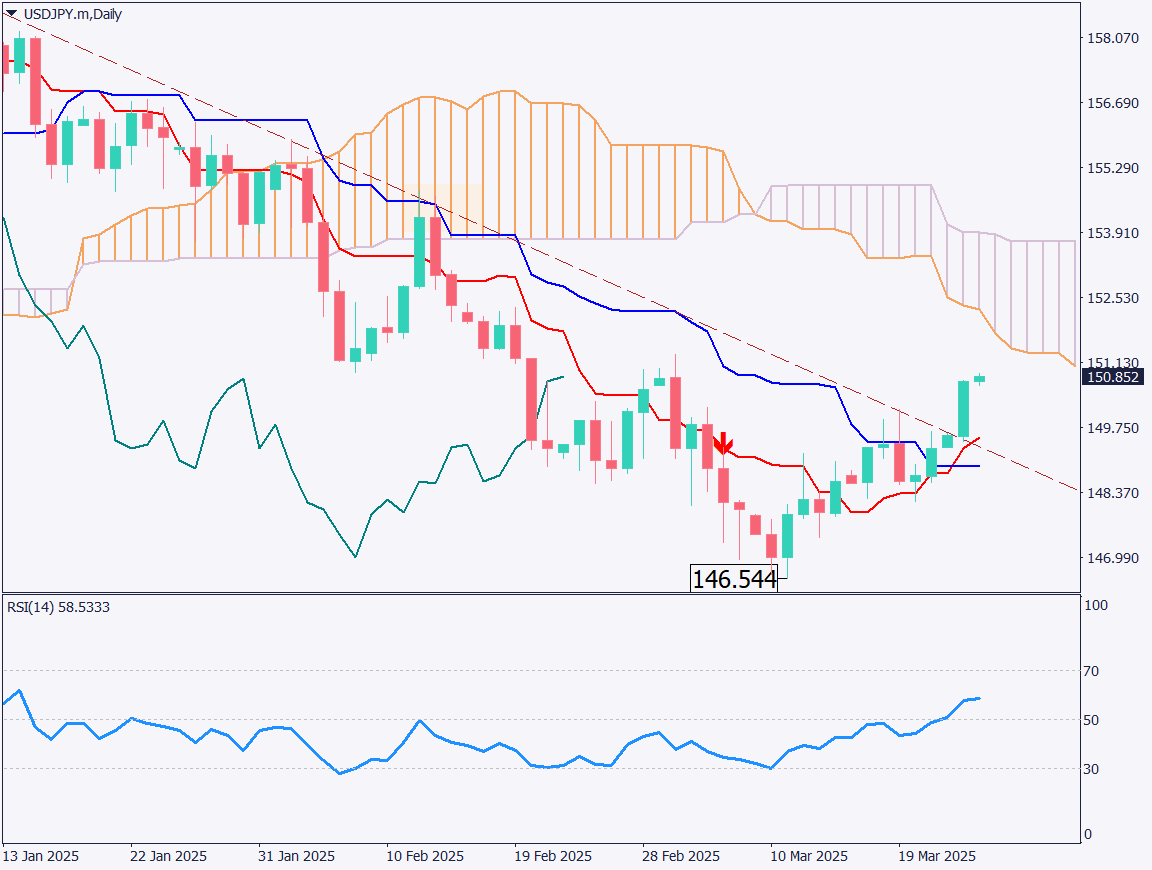

Analyzing the daily chart of USDJPY: The pair has broken above the downward trendline, showing an upward momentum. It has clearly surpassed the trendline, which had previously acted as resistance. The Conversion Line has crossed above the Base Line, and the Lagging Span has also broken above the candlesticks.

Looking ahead, the Ichimoku Cloud is expected to act as resistance. If USDJPY reaches the 151JPY range, it may hit the cloud, potentially slowing the upward momentum.

The RSI stands at 58, indicating a stable upward trend.

Day trading strategy (1 hour)

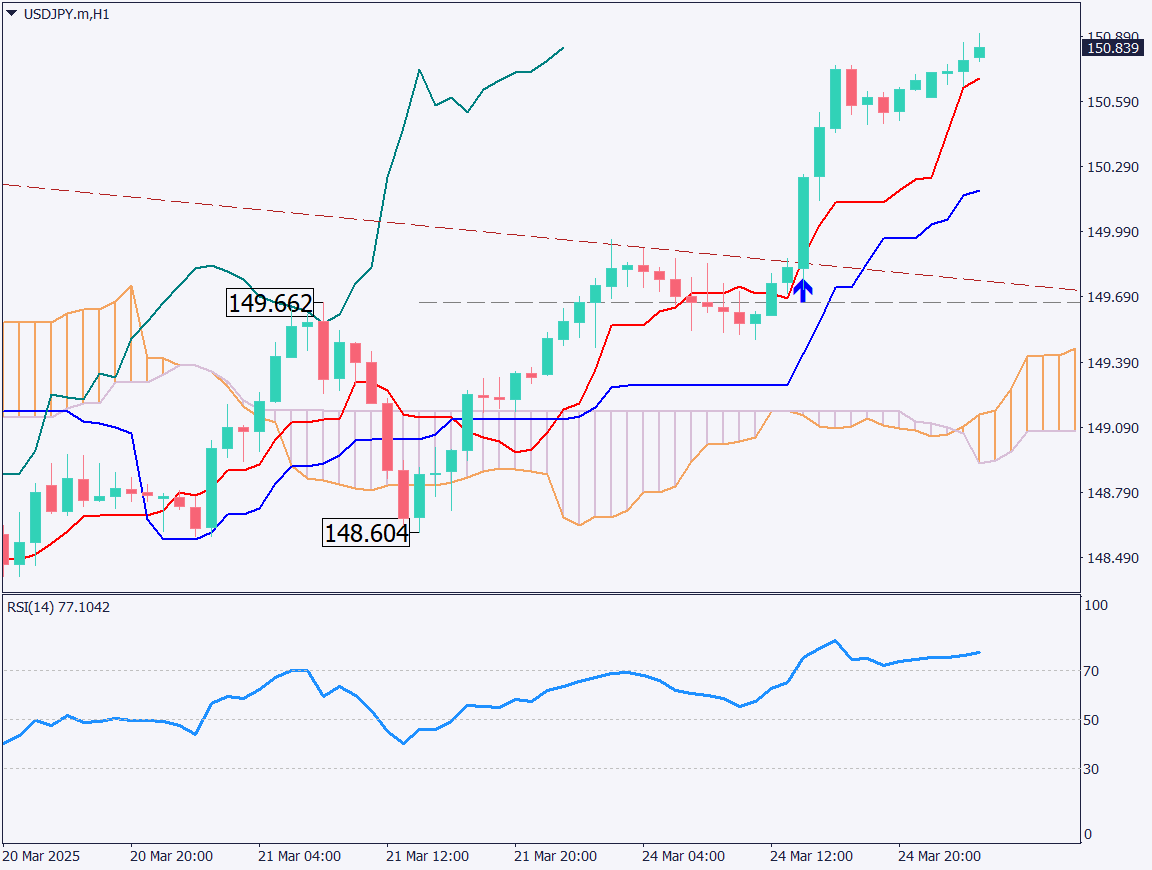

Analyzing the 1-hour chart of USDJPY: The Conversion Line is acting as support, with the pair rising to 150.83JPY. The RSI is at 77, suggesting slight overheating. If USDJPY touches the 151JPY range, a pullback is possible.

There is a pivot point R1 at 151.15JPY, so caution is needed for potential pullbacks.

The day trading plan is to aim for a short-term counter-trade by selling at 151.15JPY for a correction. Take profit at 150.30JPY and set the stop loss at 151.85JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 151.15JPY – Pivot Point R1

Market Sentiment

USDJPY – Sell: 53% / Buy: 47%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Bank of Japan Monetary Policy Meeting Minutes | 8:50 |

| U.S. Consumer Confidence Index | 23:00 |

| U.S. New Home Sales | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.