EURUSD Pulls Back as Ukraine Ceasefire Talks Stall【March 26, 2025】

Fundamental Analysis

- The market remains cautious as the announcement of new US tariffs approaches.

- In Japan, year-end flows are observed, raising the risk of sudden market moves.

EURUSD Technical Analysis

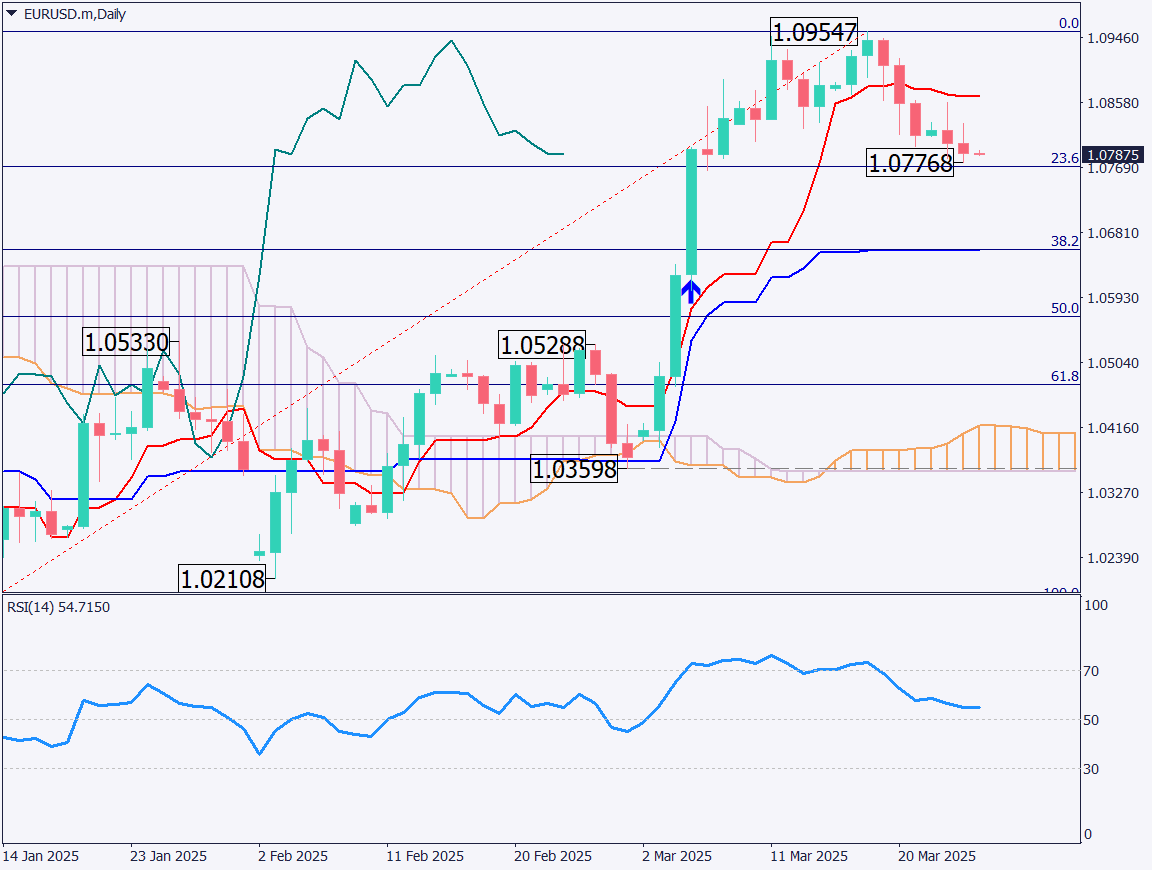

Analyzing the EURUSD daily chart: EURUSD rose to 1.095USD but pulled back. It has now dropped to the 23.6% Fibonacci retracement level. Selling pressure has eased near the 23.6% level, leading to limited price movements, suggesting that the correction may be coming to an end.

The RSI has fallen to 54.7, indicating increased buying interest on dips.

From a fundamental perspective, the market is waiting to see if a Ukraine ceasefire can be realized. Additionally, uncertainty over potential US tariffs on Europe under the Trump administration is keeping large movements in check. The market may remain quiet until the announcement on April 2.

Day trading strategy (1 hour)

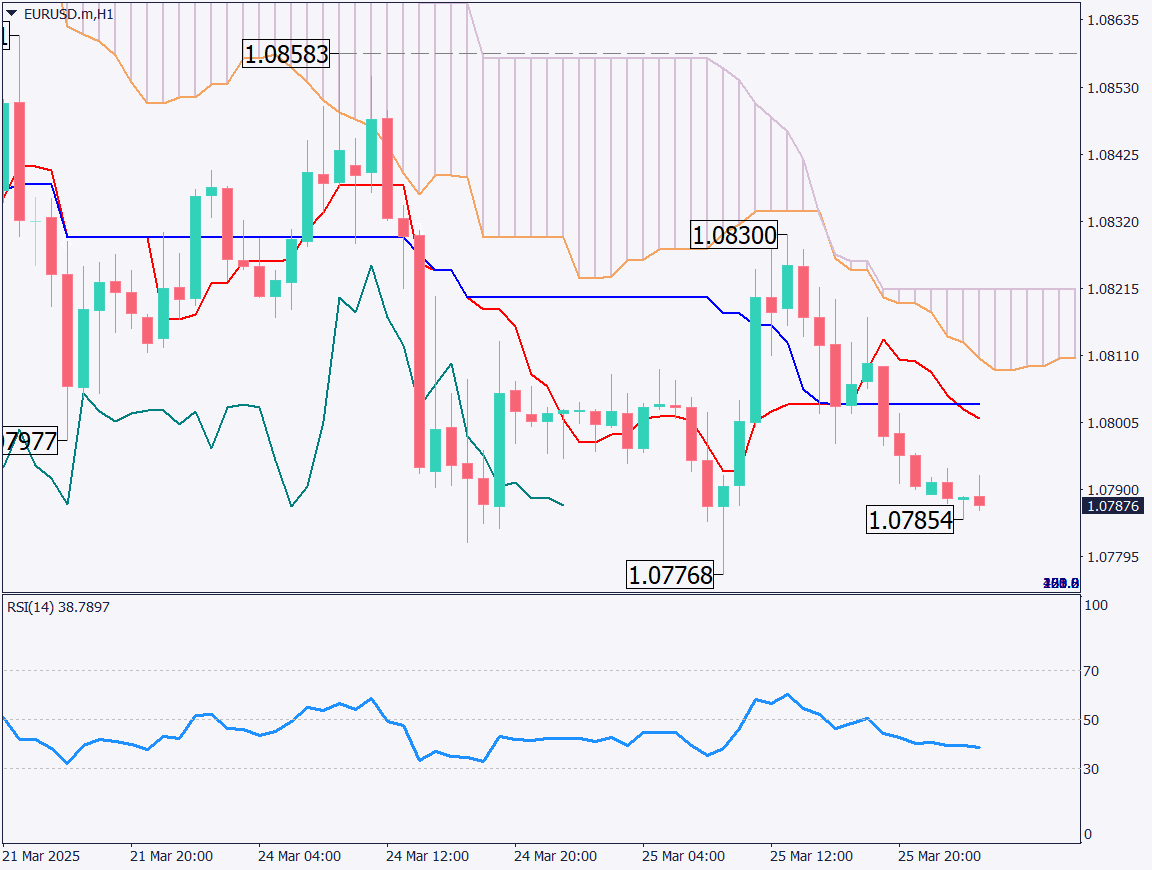

Analyzing the EURUSD 1-hour chart: Lower highs are observed, and a thick Ichimoku cloud is capping the upside. The 1.10USD level remains heavy, leading to intensified selling pressure. However, the 1.07USD level is also providing solid support.

The day trading strategy is challenging, but considering short-term dip buying could be an option. Given the Japanese fiscal year-end and the upcoming tariff announcement, market movements remain uncertain. A rebound from the 23.6% Fibonacci level is a potential trade setup. A stop loss should be placed below the 23.6% level, with the target set at 1.095USD.

Support/Resistance lines

Key support and resistance lines to consider:

- 1.08USD – Psychological round number

- 1.075USD – Key technical level

Market Sentiment

EURUSD Sell: 63% / Buy: 37%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| UK Consumer Price Index | 16:00 |

| US Crude Oil Inventories | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.