Will Trump’s Auto Tariffs Spark a Risk-Off Shift?【March 27, 2025】

Fundamental Analysis

- The Trump administration has announced auto tariffs, including on Japanese cars.

- Auto parts are excluded, and attention is also focused on the April 2 tariffs.

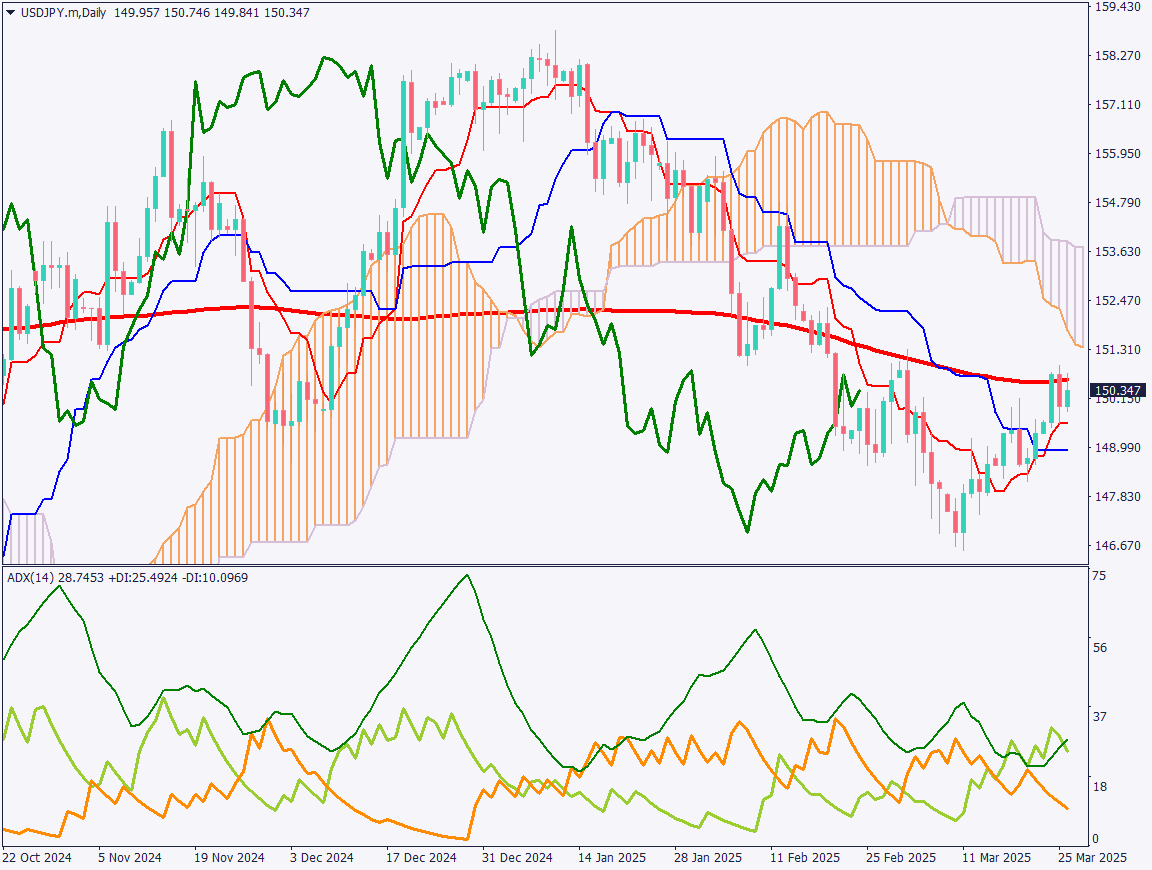

USDJPY Technical Analysis

Analyzing the USDJPY daily chart. USDJPY is currently hitting the 200-day moving average. However, major U.S. stock indices fell sharply yesterday, which is expected to affect USDJPY. The 200-day moving average is expected to function strongly as a resistance line.

The Trump administration announced a 25% tariff on imported cars, including Japanese vehicles. Auto parts are expected to be excluded, but the impact on Japanese companies is significant. With factors such as exhaustion of market-moving news and the fiscal year-end, as well as the upcoming detailed announcement of the April 2 tariffs, future movements are difficult to predict.

If risk-off sentiment intensifies, there is a possibility of a pullback to around 149.50 JPY, where the conversion line is moving.

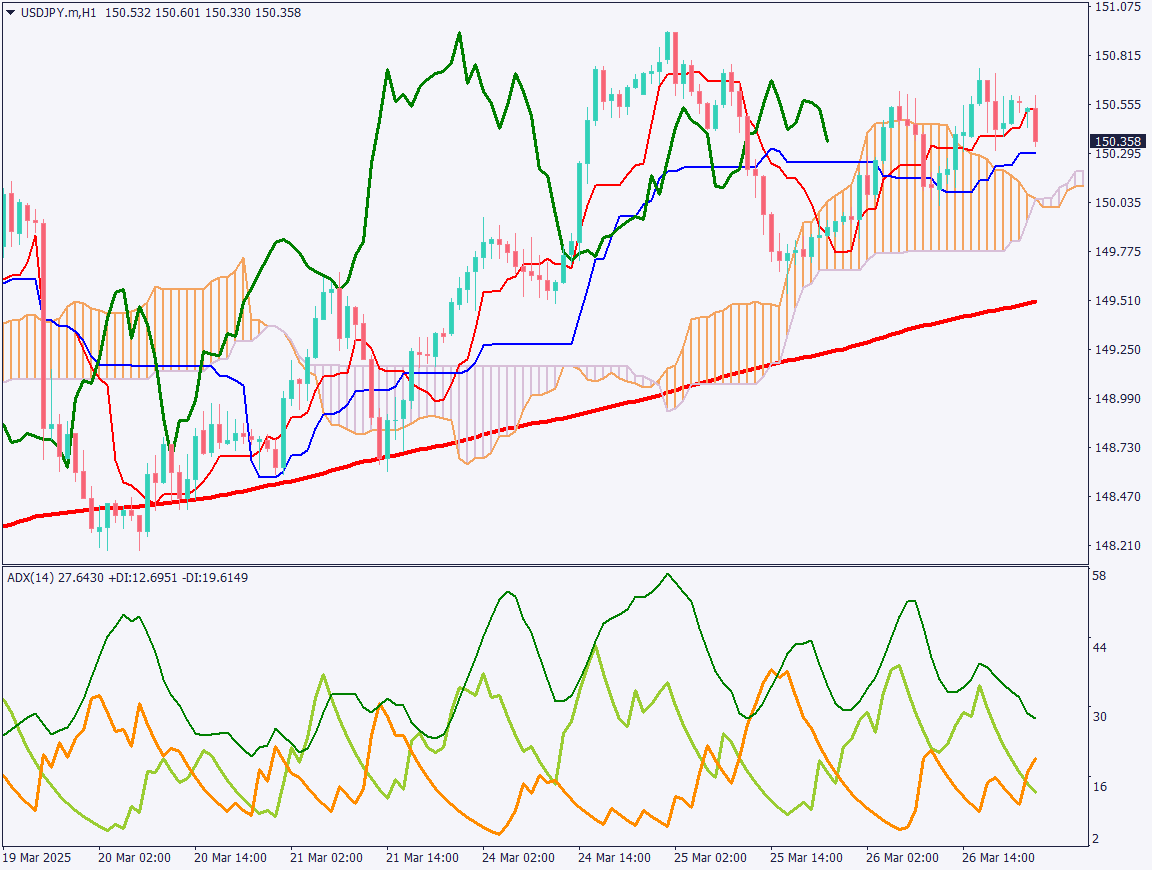

Day trading strategy (1 hour)

Analyzing the USDJPY 1-hour chart. From the ADX analysis, it can be confirmed that the -DI has crossed above the +DI, indicating increasing downward pressure. As the cloud is thinning, the price may drop to around the 200-hour moving average. Since the 200-day moving average is above in the daily chart, it is a market that is hard to rise.

The day trading policy is to newly sell. Entry around 150.35–55 JPY, with settlement around 149.50 JPY. If it exceeds 150.70 JPY, consider it a stop.

Support/Resistance lines

Key support and resistance lines to consider:

- 150.60 JPY – 200-day moving average

Market Sentiment

USDJPY – Sell: 48% / Buy: 52%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| U.S. GDP | 21:30 |

| U.S. Initial Jobless Claims | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.