Gold Continues to Hit Record Highs Amid Strong Risk-Off Sentiment【March 31, 2025】

Fundamental Analysis

- Concerns about U.S. stagflation are growing as both the inflation rate and unemployment rate rise simultaneously.

- U.S. stocks have plunged, and the Nikkei 225 has also dropped significantly.

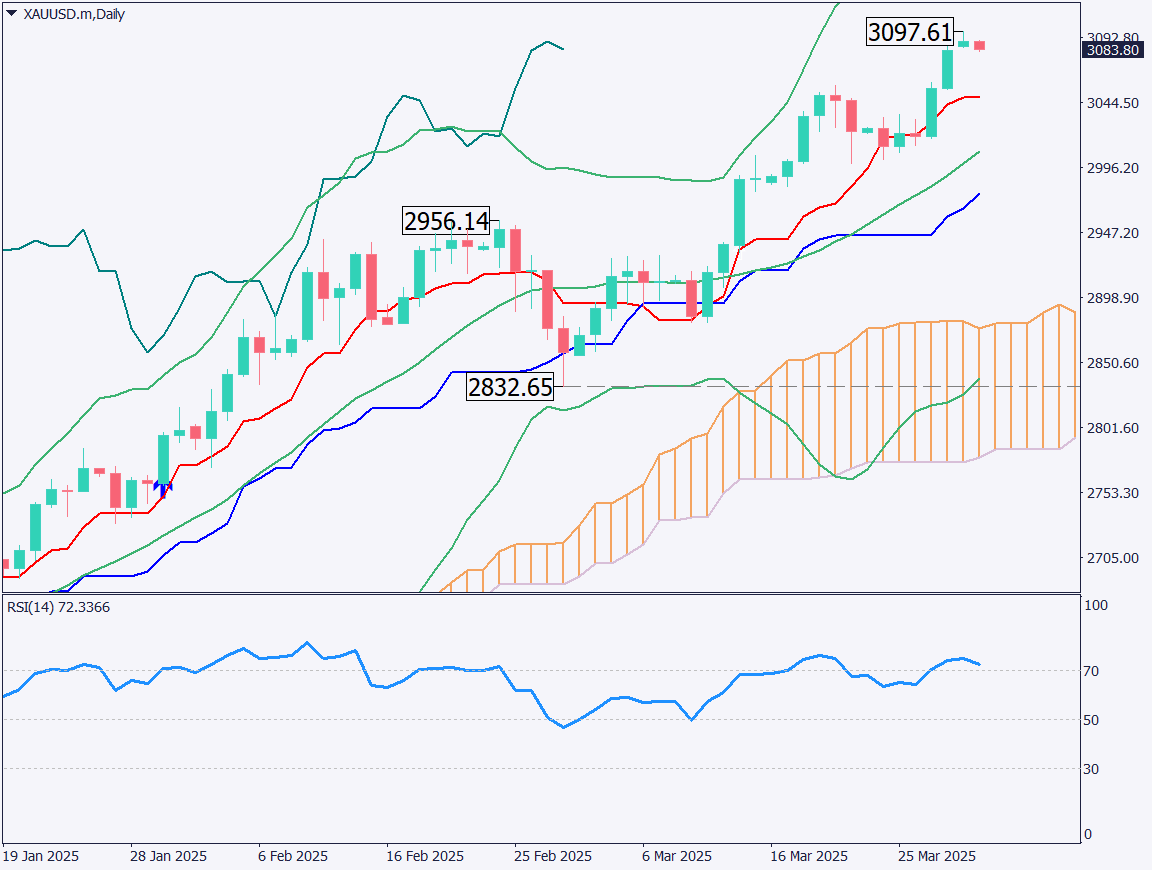

XAUUSD Technical Analysis

This is an analysis of the daily chart for gold. Gold has reached a record high of 3097USD, marking a new all-time high for the second consecutive day. The backdrop is growing concern over a rapid economic downturn in the U.S. Due to an aggressive tariff policy, inflation and unemployment are both expected to rise, making the threat of stagflation increasingly realistic.

Furthermore, diplomatic relations with Russia are deteriorating, further worsening investor sentiment.

As a safe-haven asset, gold is in a favorable position to rise. Since the beginning of the year, gold has gained more than 400USD, and on the monthly chart, it is trading above the +2σ line of the Bollinger Bands. While profit-taking may occur once tariff policies are officially announced, there remains anxiety over the potential for additional policies.

With stock prices also falling sharply, this is a situation that warrants caution.

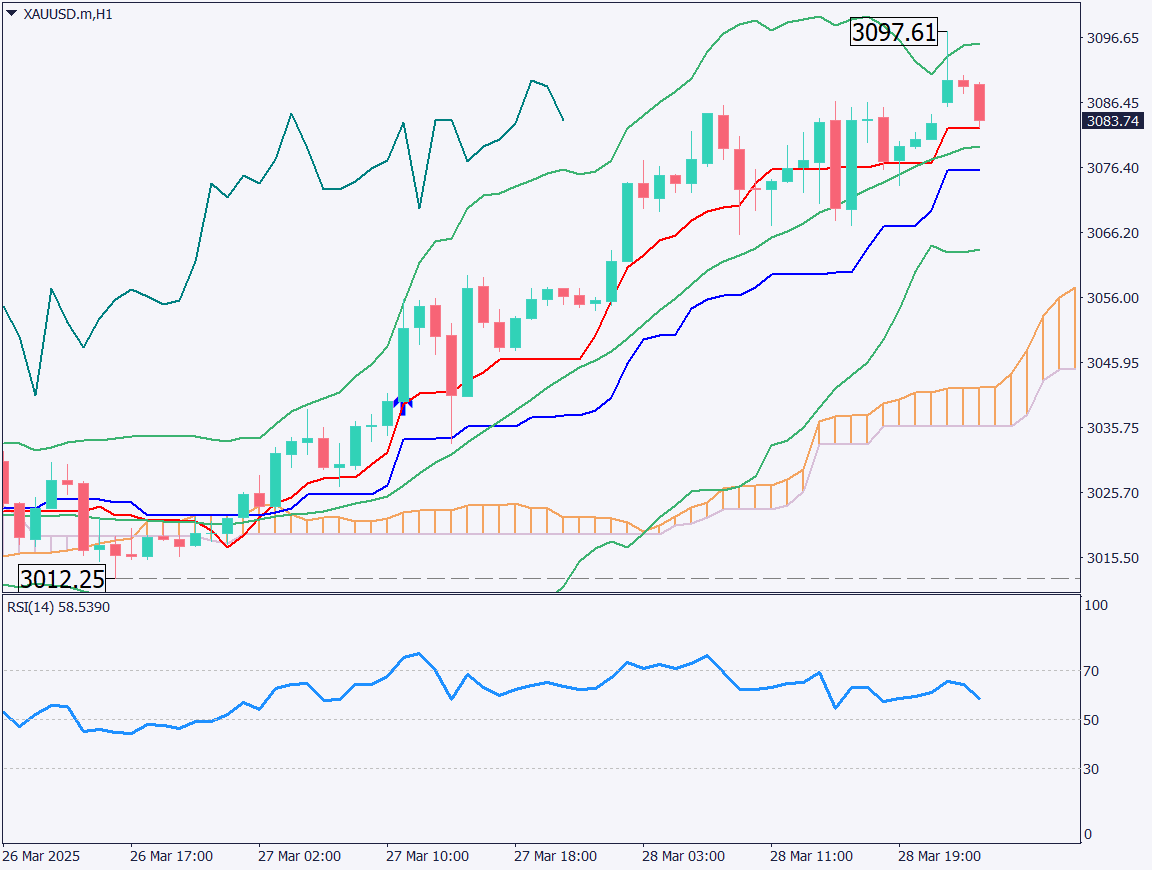

Day trading strategy (1 hour)

This is an analysis of the 1-hour chart for gold. Uncertainty remains high, making technical analysis less reliable. A buy-on-dips strategy is preferred. The 3060USD level aligns with the +2σ line on the monthly chart and the +1σ line on the daily chart, and there is a possibility of a band walk forming across multiple time frames. A short-term rebound may be possible.

If the price falls below 3000USD, strong buying pressure is expected. The recommended strategy is to accumulate on dips. The market is currently waiting for the tariff policy announcement on April 2.

Support/Resistance lines

Key support and resistance lines to consider:

- 3100USD – Recent high

- 3060USD – Key level on the monthly chart

Market Sentiment

XAUUSD: Sell: 67% / Buy: 33%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Germany Consumer Price Index | 21:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.