USDJPY and Stocks Remain Volatile Amid Intensifying Risk-Off Sentiment【April 1, 2025】

Fundamental Analysis

- Gold has hit another all-time high, rising to 3,123 USD.

- The U.S. stock market remains unstable with increasing volatility.

USDJPY Technical Analysis

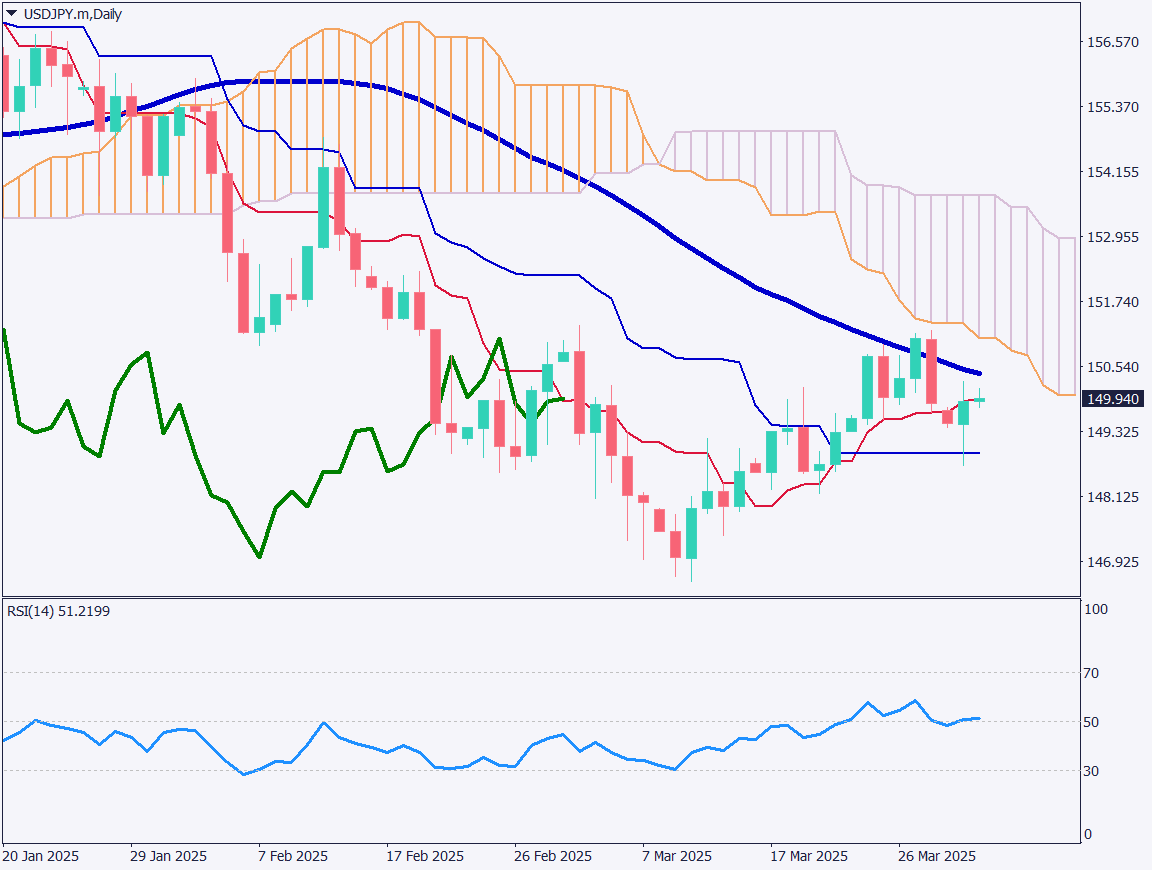

Analyzing the daily chart of USDJPY, the pair rebounded from the base line and climbed into the 149 JPY range, closing near the conversion line. With upcoming U.S. tariff policies, the market remains difficult to move decisively. Traders appear confused by the successive announcements of tariff details.

The Trump administration is expected to announce the specifics of the new tariffs tomorrow. Japan is anticipated to be among the targeted countries, which would be a blow to Japanese corporations. Uncertainty grows over whether the current rate hike policy will continue.

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY, the pair is showing signs of resistance near the 52-period moving average, suggesting a possible pullback. Capital is flowing out of the U.S. dollar, with risk-off movement into gold and the Japanese yen.

A drop toward the 149.50 JPY level, where the base line lies, is possible, and a more cautious stance may be seen tomorrow.

While aggressive trading is not recommended, if one chooses to trade, a short-term approach with a focus on quick sell-side rotations is preferred. Early profit-taking should be prioritized. It is advised to avoid holding positions during the NY session for the time being.

Support/Resistance lines

Key support and resistance lines to consider:

- 150 JPY – Recent high

- 149.48 JPY – 1-hour chart base line

- 148.95 JPY – Daily chart base line

Market Sentiment

USDJPY – Sell: 40% / Buy: 60%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Unemployment Rate | 8:30 |

| BOJ Tankan Report | 8:50 |

| Australia Retail Sales | 9:30 |

| Australia Policy Interest Rate | 12:30 |

| Eurozone Consumer Price Index | 18:00 |

| U.S. ISM Manufacturing Employment Index | 23:00 |

| U.S. JOLTS Job Openings | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.