USDJPY Faces Resistance Around 150 JPY, Tariff Policy Announcement Expected Early Tomorrow Morning【April 2, 2025】

Fundamental Analysis

- The Trump administration is scheduled to announce its new tariff policy early tomorrow morning, and the market is on high alert.

- USDJPY remains heavy on the upside and lacks clear direction.

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY: The base line is acting as a support level, leading to a rebound, pushing the pair up to 149.80 JPY. However, the conversion line failed to break upward. The price has been trapped between the base line and the conversion line for four consecutive days, indicating a lack of direction in the market.

The Trump administration’s tariff policy is expected to be announced around 4:00 AM tomorrow. Until details are disclosed, the market is likely to stay in a wait-and-see mode.

Day trading strategy (1 hour)

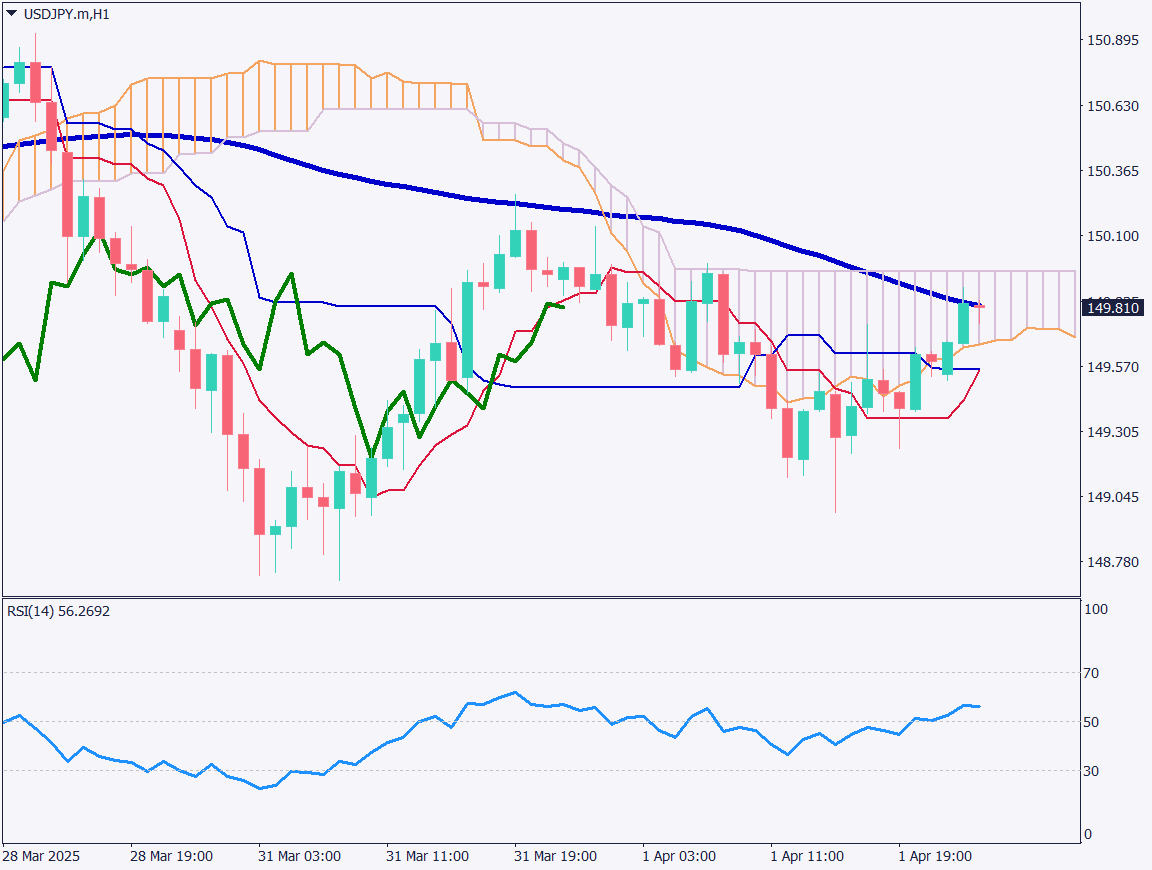

Analyzing the 1-hour chart of USDJPY: The 72-period moving average is capping the upside. It previously acted as a resistance level, and this marks the second attempt to break through. The pair is trading within the Ichimoku cloud, showing unstable direction.

With the tariff policy announcement looming early tomorrow, the market response from both the stock and forex markets remains uncertain. Unless the policy is overly strict, there may be a rebound. However, if tariffs are officially introduced, the negative impact would likely drive USD lower and JPY higher.

The suggested day trading strategy is to short USDJPY, with a stop at 150.27 JPY and a take-profit target around 148.80 JPY. Regardless of price movement, the position should be closed by the start of the New York session.

Support/Resistance lines

Key support and resistance lines to consider:

- 150.27 JPY – Recent high

- 148.97 JPY – Recent low

Market Sentiment

USDJPY Sell: 54% / Buy: 46%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Australia Building Permits | 09:30 |

| US ADP Employment Report | 21:15 |

| US Crude Oil Inventories | 23:30 |

| Trump Administration Tariff Policy Announcement | 04:00 (Next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.