Has the Stock Market Rebound Run Its Course? Signs of Recovery in the NIKKEI225【April 8, 2025】

Fundamental Analysis

- Uncertainty remains over how the EU’s retaliatory tariffs will develop.

- There are concerns about a potential escalation of reciprocal tariffs, drawing attention to the stock market rebound.

- Prime Minister Ishiba held a phone call with President Trump—tariff removal seems unlikely.

NIKKEI225 Technical Analysis

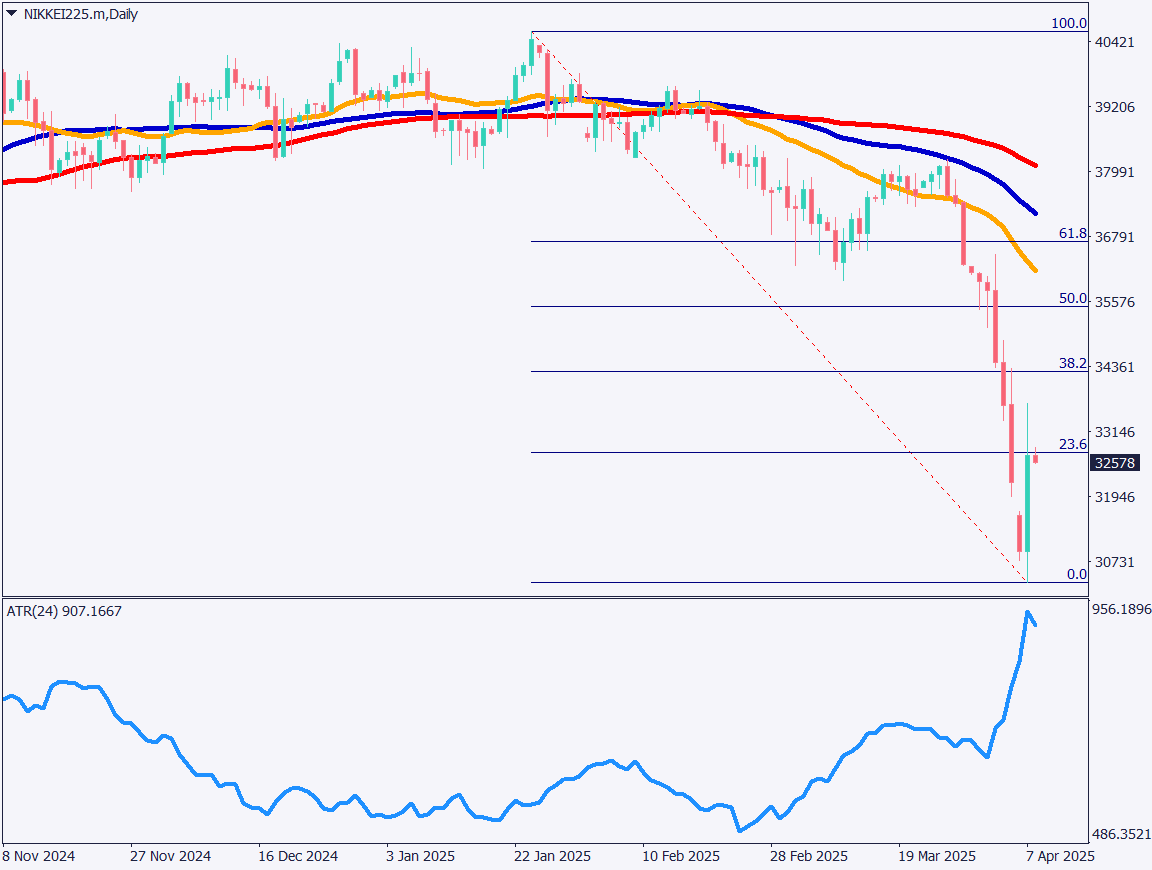

Analyzing the daily chart of the NIKKEI225, the index has dropped from above 40,000JPY to the 30,000JPY range due to consecutive days of sharp declines. However, a phone call yesterday between Prime Minister Ishiba and President Trump resulted in an agreement to continue negotiations. As a surprise move, President Trump ordered a review of the US Steel acquisition deal.

A Fibonacci retracement shows a rebound near the 23.6% level, increasing the likelihood of a recovery.

However, tariffs have not been lifted, and the US-China trade war continues to intensify. Although negotiations have begun, the additional tariffs scheduled for April 9 are expected to be implemented. Unless President Trump decides to “postpone” them, the rebound may remain limited to a technical correction.

Day trading strategy (1 hour)

Analyzing the 1-hour chart, the 23.6% Fibonacci level is being closely watched. The 32,700JPY level is acting as resistance. Given the NIKKEI225 was heavily oversold, a rebound is expected, and previously sold-off stocks are likely to be bought back.

The key question is whether the index can recover above 33,000JPY. Since the fundamental issue of tariffs has neither been lifted nor postponed, trades should be approached with caution. ATR readings also show a sharp rise in volatility.

For individual stock trades, it may be worth buying short-term oversold stocks.

Support/Resistance lines

Key support and resistance lines to consider:

- 34,250JPY – Fibonacci 38.2%

- 32,700JPY – Fibonacci 23.6%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Current Account | 08:50 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.