USDJPY Drops to 143, Total Tariffs on China Reach 145%【April 11, 2025】

Fundamental Analysis

- The total tariff rate targeting China has reached 145%, intensifying what is now a China-focused trade war.

- Both U.S. and Japanese stock markets declined, with recent gains failing to sustain, reflecting deteriorating market sentiment.

USDJPY Technical Analysis

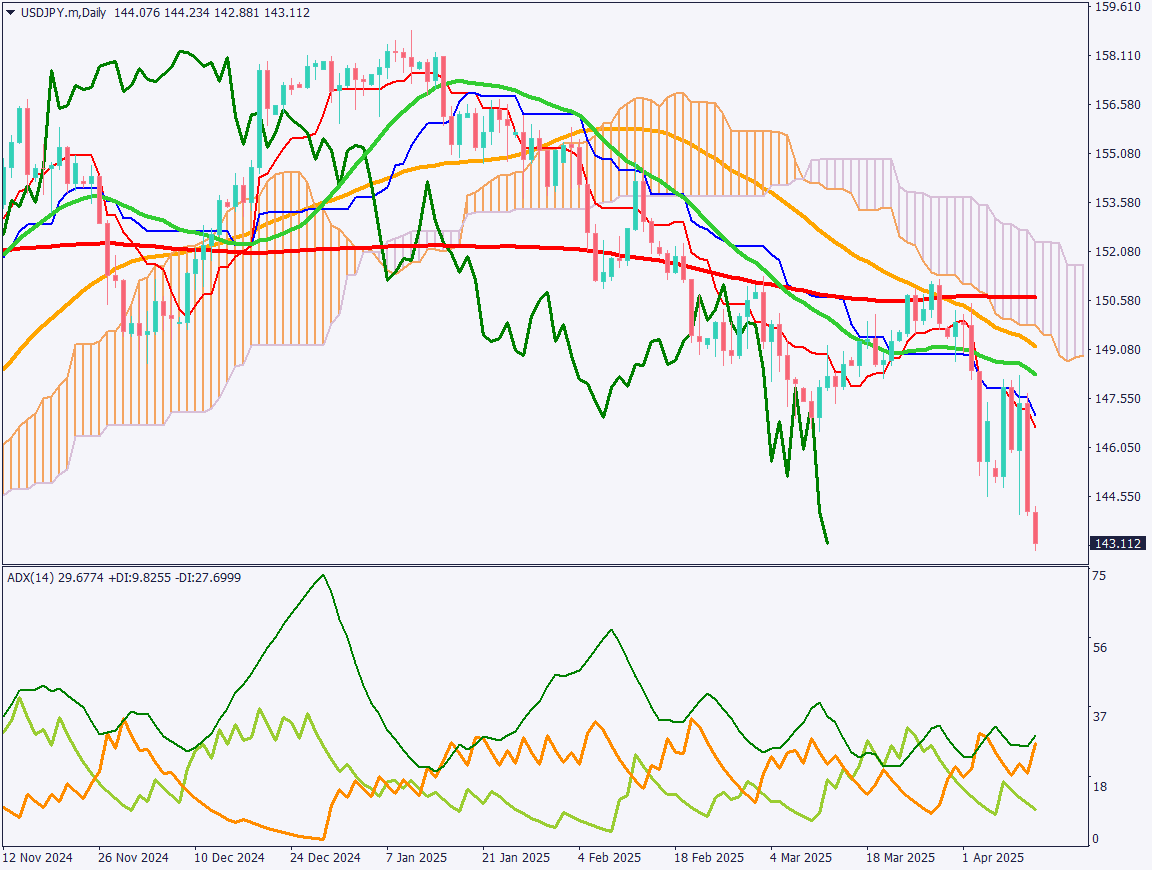

Analyzing the daily chart of USDJPY: the pair has clearly broken below 144JPY and breached the support line, strengthening the trend toward JPY appreciation. Although the additional tariffs on countries outside China have been postponed, the escalation in tariffs specifically against China has renewed risk-off sentiment.

The Tenkan-sen and Kijun-sen are capping the upside, suggesting that the yen-strength trend may continue. The ADX indicator shows a -DI reading of 27, which may indicate a strengthening downward trend.

Day trading strategy (1 hour)

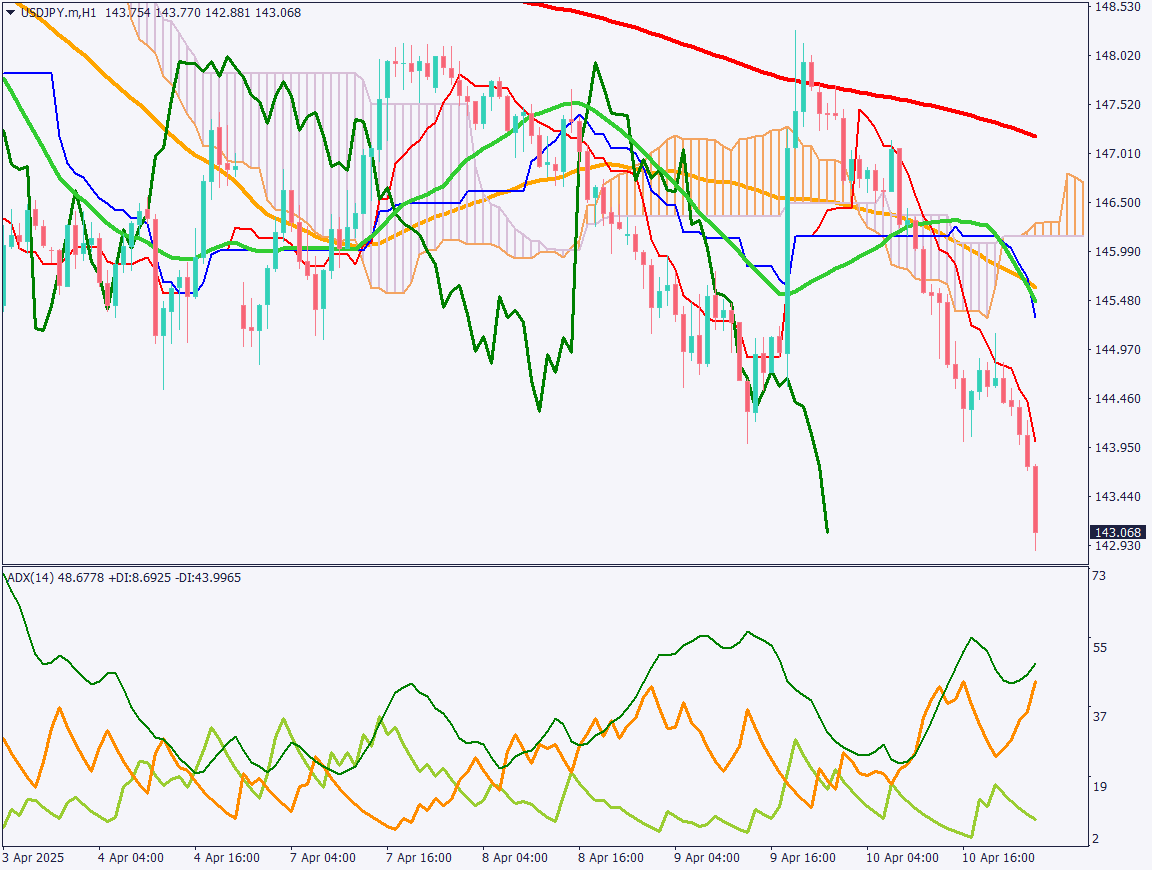

The 1-hour chart shows a rejection at the 200-period moving average, with USDJPY falling from the 148JPY level to the 143JPY level in just two days. Despite the high volatility, the overall direction remains JPY bullish. A short-selling strategy on a rebound seems appropriate.

Plan to sell on a rebound near 145.30JPY (where the Kijun-sen lies) and target a take-profit near 140JPY. Set a stop-loss if the price exceeds 145.65JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 139.50JPY – Previous support level

Market Sentiment

USDJPY: Sell: 28% / Buy: 72%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| UK Gross Domestic Product | 15:00 |

| Germany Consumer Price Index (CPI) | 15:00 |

| U.S. Producer Price Index (PPI) | 21:30 |

| U.S. University of Michigan Inflation Expectations | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.