EURUSD Declines Amid Lack of Progress in EU-US Trade Talks【April 16, 2025】

Fundamental Analysis

- Despite ongoing trade negotiations between the EU and the US, no progress has been made. Meanwhile, expectations are rising in the market for a potential US-UK trade agreement.

- EURUSD failed to break above 1.15USD and is now showing signs of a gradual pullback.

EURUSD Technical Analysis

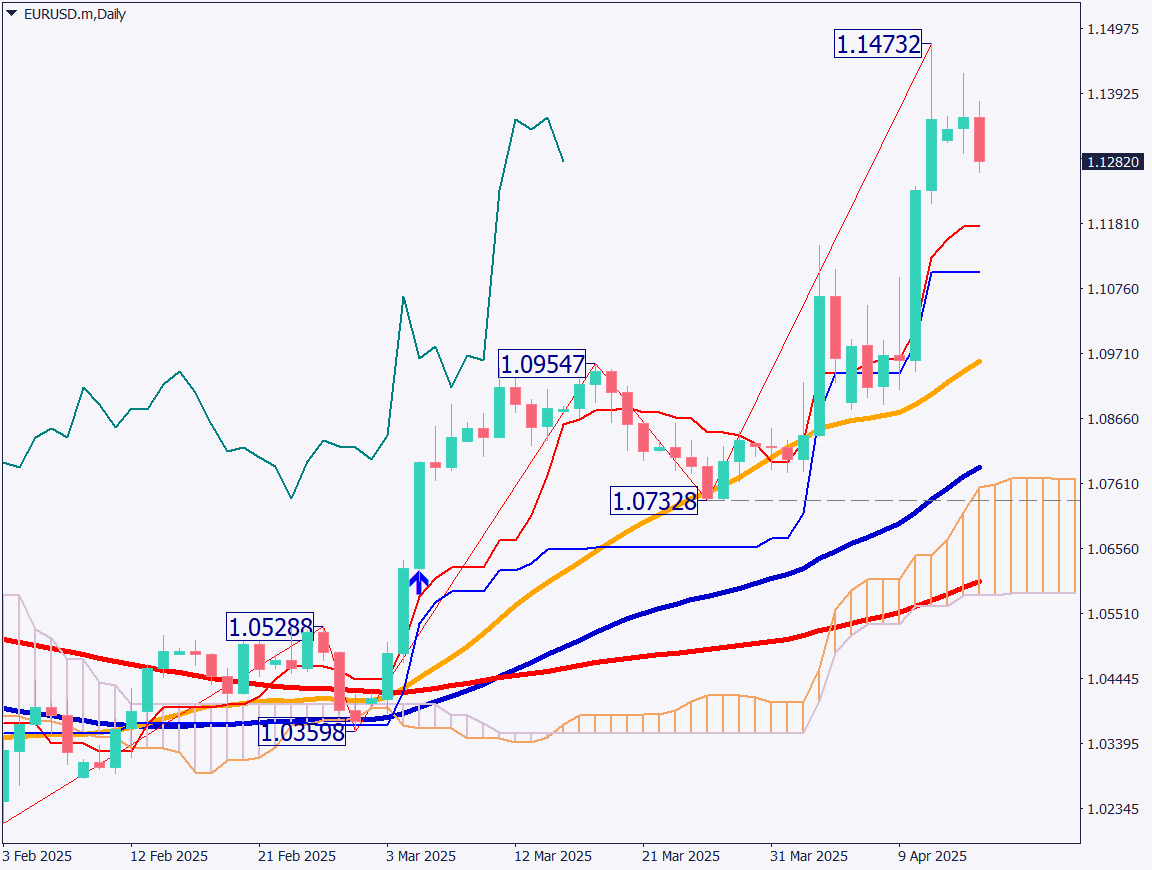

The daily chart shows EURUSD climbed up to 1.147USD, but faced strong resistance around 1.15USD and subsequently declined. The lack of progress in EU-US trade talks is contributing to this downward movement.

Looking at the moving averages, the 26-day, 52-day, and 90-day lines are aligned from top to bottom, forming a perfect order. Although there may be some corrective selling due to the wide gap from the 26-day moving average, the overall trend is still upward.

The area around 1.12USD, where the conversion line and base line are located, may serve as a key support level.

Day trading strategy (1 hour)

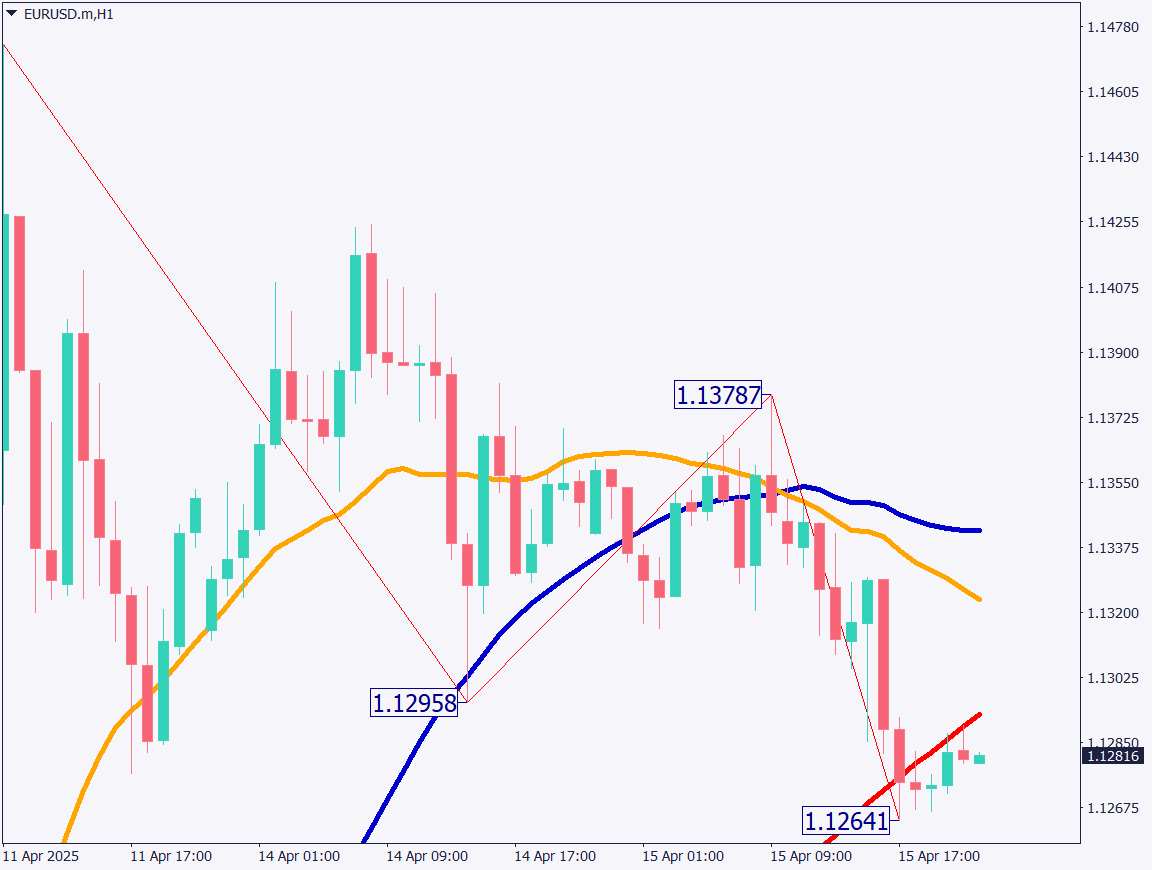

On the 1-hour chart, EURUSD has formed a death cross as the 26-period moving average crosses below the 52-period moving average. The price is now trending below the 90-period moving average, suggesting a possible gradual decline ahead.

Applying Fibonacci expansion to the 1-hour chart indicates the 100% level is near 1.12USD. This is consistent with the daily chart, where the conversion and base lines are also found around this price, making it a notable support level. Additionally, it is a round number.

Since the overall trend remains bullish, this may be a good opportunity for dip-buying.

Day Trading Plan:

Place a buy limit at 1.12USD, a stop at 1.1165USD, and take profit around 1.13USD.

Support/Resistance lines

Key support and resistance lines to consider:

- 1.12USD – 100% Fibonacci expansion on the 1-hour chart

Market Sentiment

EURUSD: Sell: 66% / Buy: 34%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| China GDP | 11:00 |

| UK Consumer Price Index | 15:00 |

| Eurozone Consumer Price Index | 18:00 |

| US Retail Sales | 21:30 |

| Canada Interest Rate Decision | 22:45 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.