USDJPY Slightly Rebounds as US-Japan Trade Talks Begin【April 18, 2025】

Fundamental Analysis

- USDJPY saw a slight rebound as exchange rates were not included in the agenda of the US-Japan trade negotiations.

- Japan’s Consumer Price Index (CPI) rose, showing resilient price trends despite ongoing uncertainty.

USDJPY Technical Analysis

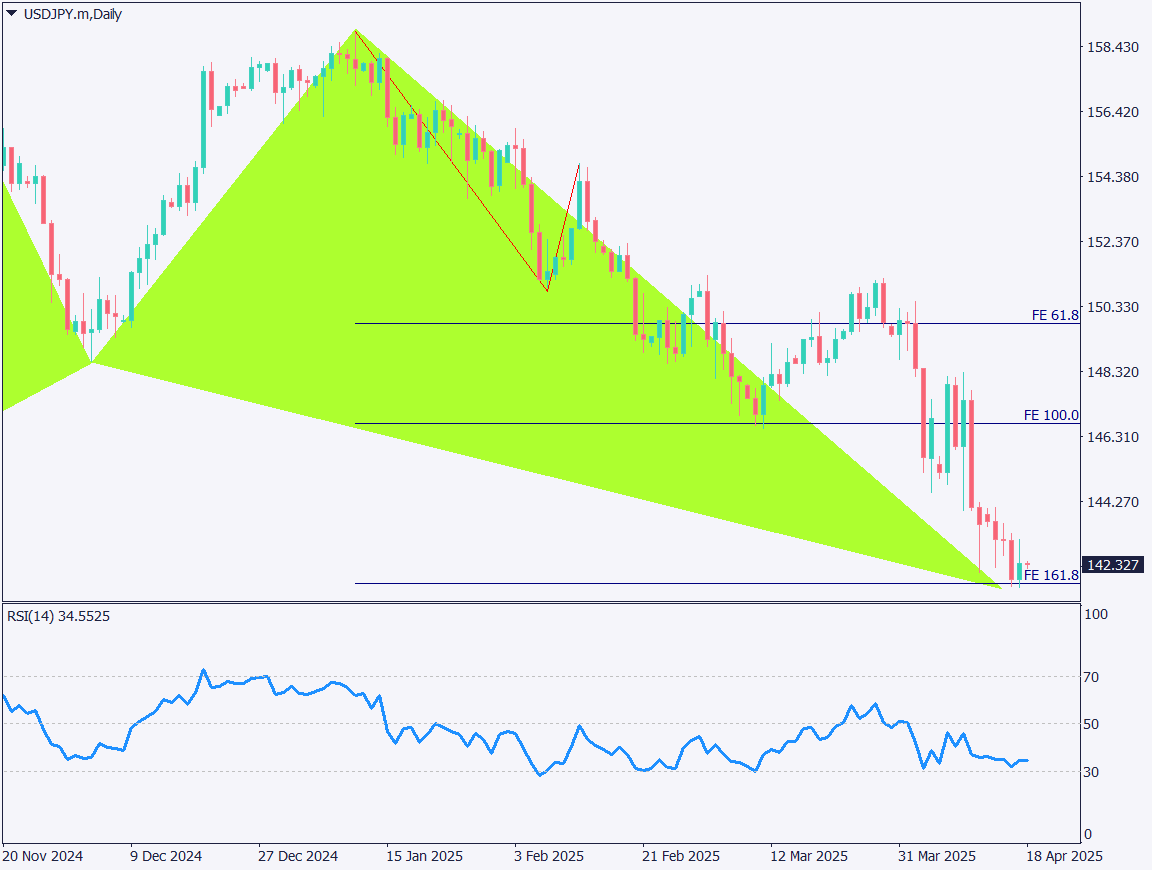

The daily chart of USDJPY suggests the potential formation of a “Shark” harmonic pattern, indicating a possible short-term rebound. A Fibonacci expansion shows the 161.8% level aligning with 142.30JPY, a key price point to watch.

In the first round of US-Japan trade talks, the foreign exchange rate was not discussed. However, as negotiations progress, it is possible that the US administration—seeking to boost exports—may eventually raise this issue.

Day trading strategy (1 hour)

On the 1-hour chart, USDJPY is forming a descending triangle, suggesting a potential breakout in either direction.

Market sentiment shows that over 60% of traders hold long positions. Given that the price is reaching a key level on the daily chart and with the Easter holidays approaching, a stronger rebound may be likely.

The basic strategy remains to sell on rallies. Ideally, if the price returns to around 145JPY, it may present a good selling opportunity. Set the stop-loss above 145.35JPY and the take-profit at 142JPY. If the rebound is shallow, avoid entering a position.

Support/Resistance lines

Key support and resistance lines to consider:

- 142.30JPY – Fibonacci level

Market Sentiment

USDJPY – Sell: 34% / Buy: 66%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Japan Consumer Price Index | 8:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.