USDJPY Plunges as Tariff Concerns and Fed Independence Trigger Selloff in U.S. Assets【April 22, 2025】

Fundamental Analysis

- U.S. stock markets dropped sharply due to renewed tariff concerns and growing doubts over the Federal Reserve’s independence.

- Reports that President Trump is considering dismissing the Fed Chair have directly led to USD weakness.

USDJPY Technical Analysis

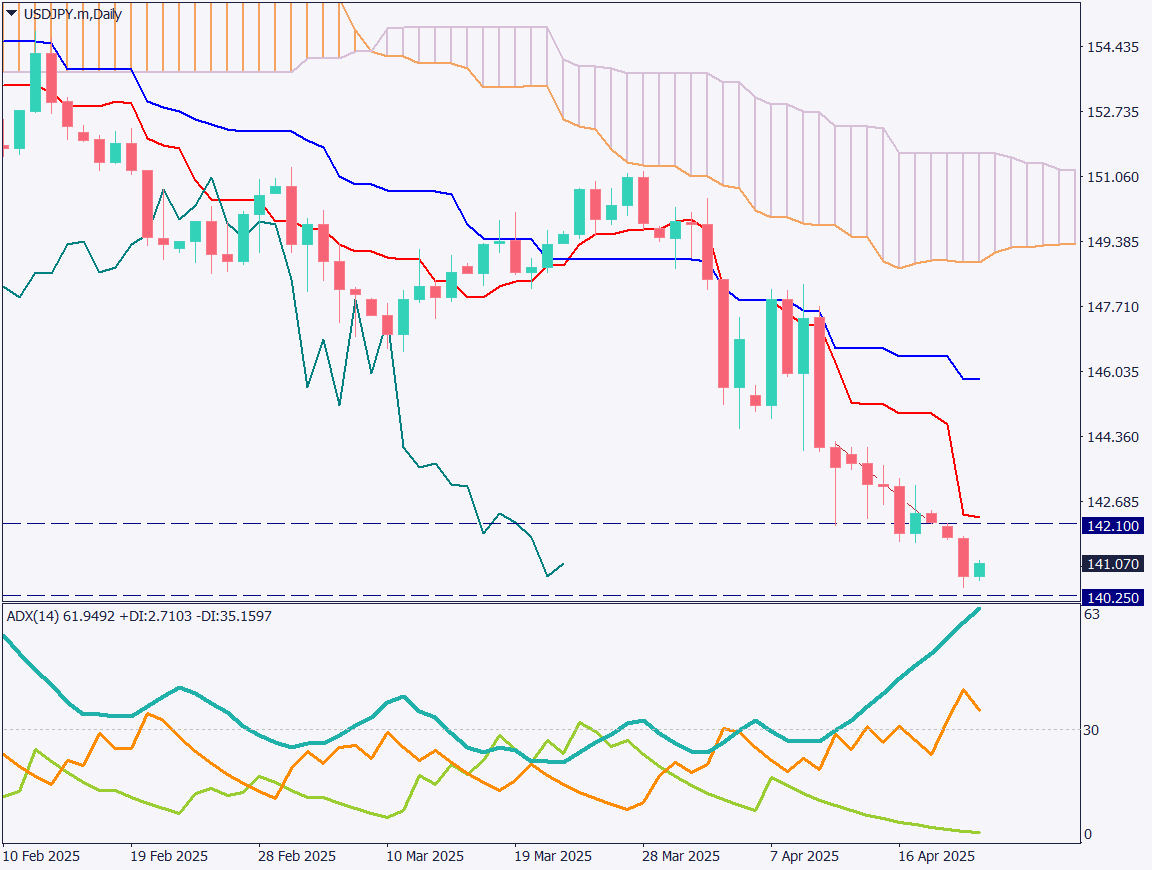

Analyzing the daily chart of USDJPY, the pair is approaching a low of 140.25JPY. The ADX has surged to an extraordinary level of 61.9.

The primary driver is USD depreciation, which in turn is strengthening the JPY.

In addition to tariff issues, the dominating fundamental factor in the market is the report that the Trump administration is considering dismissing the Fed Chair.

Even the mere suggestion of such a move has a profound market impact. The fact that it is being considered at all is a serious concern.

The Fed, responsible for setting monetary policy, must maintain independence.

This independence is now under threat, causing a rapid decline in USD.

This triple blow of falling stocks, bonds, and USD represents one of the worst-case scenarios. While a corrective rebound is possible, the overall trend is likely to favor further JPY appreciation.

Day trading strategy (1 hour)

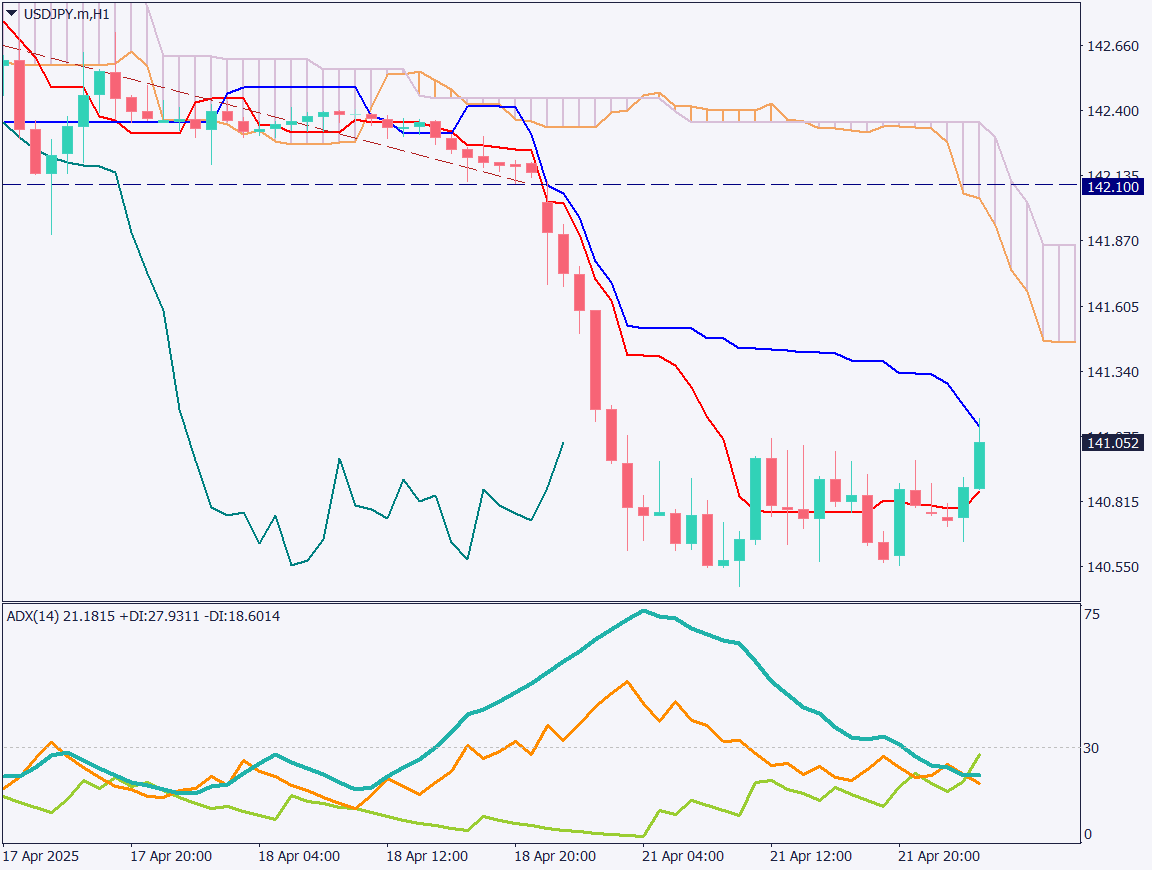

Looking at the 1-hour chart of USDJPY, support can be seen around 140.55JPY, with the price showing a slight rebound.

However, the baseline on the 1-hour chart is capping gains, and given the fundamental backdrop, a trend reversal is unlikely.

The preferred strategy remains selling on rebounds.

Consider selling near the baseline. If the price exceeds the baseline, look to sell again near 141.35JPY, which corresponds to the lower edge of the Ichimoku cloud.

In case of a sudden spike due to breaking news, set a stop at 142.25JPY and monitor the situation.

Support/Resistance lines

Key support and resistance lines to consider:

- 142.25JPY – Daily Conversion Line

- 139.65JPY – Key Daily Support Level

Market Sentiment

USDJPY: Sell: 36% / Buy: 64%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| BoJ CPI | 14:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.