USDJPY Weakens Again as U.S. Economic Indicators Worsen Beyond Expectations【April 29, 2025】

Fundamental Analysis

- Dallas Fed Manufacturing Index declines, worst level since May 2020

- Market reacts to tariffs, leading to USD weakness in forex markets

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY. USDJPY is declining, now trading in the 141JPY range. Recently, the price was hovering above the Conversion Line, but attention is now on whether it will break below it again. While the support at 140JPY remains firm, a break below recent lows could trigger stop-losses and accelerate the downtrend.

Due to the Golden Week holiday, unexpected market movements may occur. The projected downside target is around 139.89JPY. Traders should keep an eye on the Conversion Line and recent lows for trading strategies.

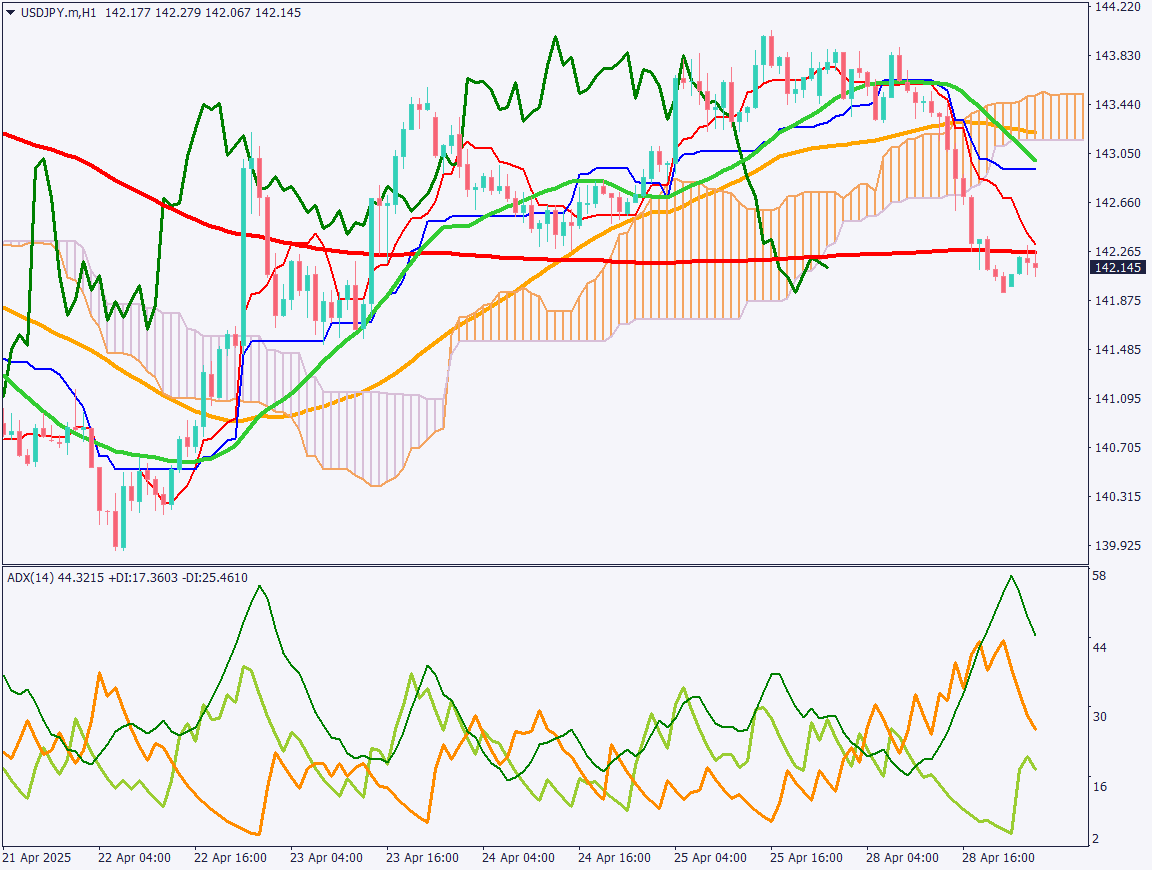

Day trading strategy (1 hour)

Analyzing the 1-hour chart of USDJPY. USDJPY has broken below the 200 Moving Average, and the 200MA has now shifted from support to resistance, suggesting heavy upside pressure.

The U.S. Dollar Index is also declining, pushing the overall market toward USD weakness. Market sentiment shows nearly 70% holding long positions, but if the downward momentum strengthens, it could trigger stop-losses and further declines.

Unless USDJPY clearly breaks above the 200MA, it is advisable to focus on short-selling strategies. As Japan has a public holiday today, trading in overseas markets is recommended.

Support/Resistance lines

Key support and resistance lines to consider:

- 146.35JPY – Major resistance level

- 142.72JPY – Major support level

Market Sentiment

USDJPY Sell: 31% / Buy: 69%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| U.S. Consumer Confidence Index | 23:00 |

| U.S. JOLTS Job Openings | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.