Market Remains Quiet During Golden Week, USDJPY Moves Sideways【April 30, 2025】

Fundamental Analysis

- President Trump signed an executive order to reduce the burden of automobile tariffs.

- The second round of Japan–U.S. negotiations is scheduled for this week.

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY:

USDJPY is hovering around 142.42JPY. An engulfing candlestick pattern has appeared near the recent lows, which would normally suggest a potential market reversal. However, with the U.S. Dollar Index declining and the market tilted toward USD selling, it may take more time before a clear trend reversal is confirmed.

The price is currently facing resistance near the middle band of the Bollinger Bands. The 144JPY–144.50JPY range is a strong resistance zone with high selling pressure. Although large movements are uncertain during Golden Week, caution is advised.

Day trading strategy (1 hour)

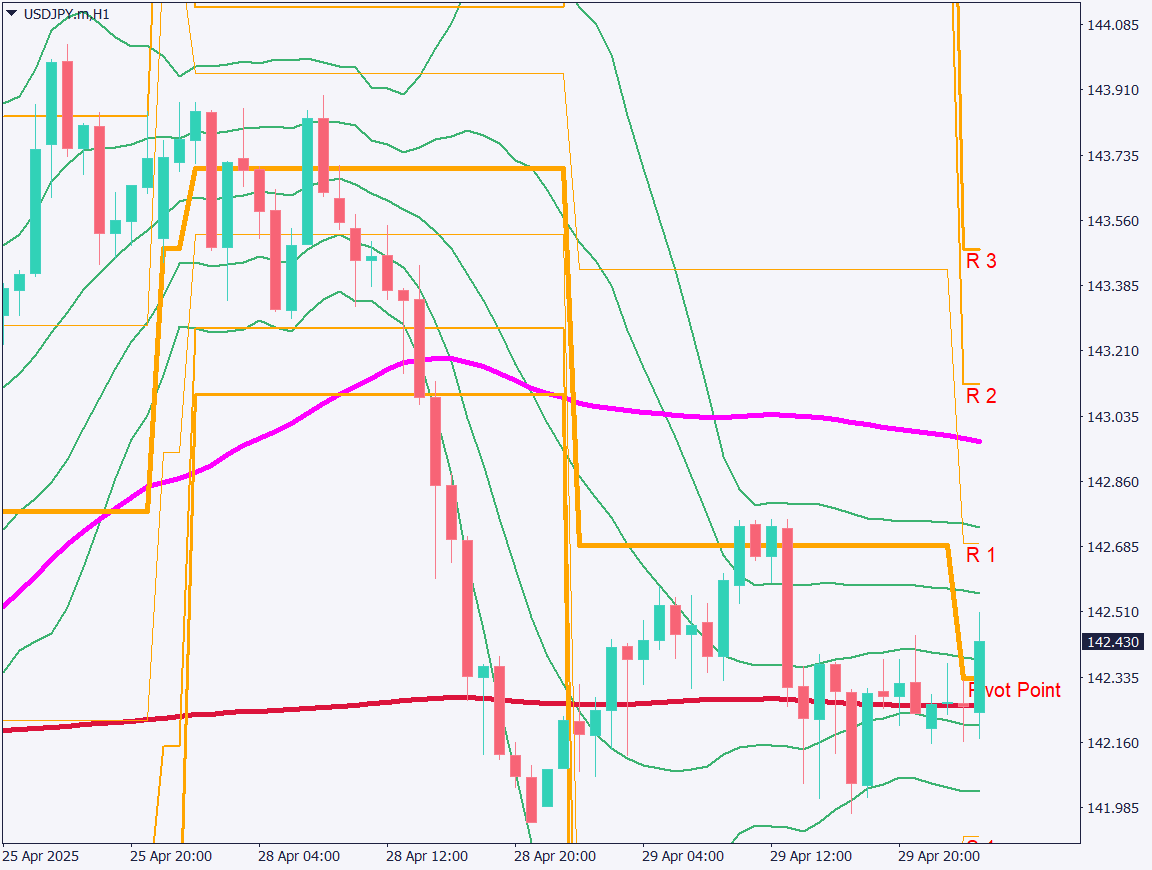

Analyzing the 1-hour chart of USDJPY:

The price has been stagnating around the 200-period moving average, but there are signs of a slight rebound. The pivot point is around 142.30JPY, and at the time of writing, a rebound trend is observed.

As it is Golden Week, no significant movement is expected in the Tokyo session. The area around 142.65JPY, corresponding to R1, is expected to act as a resistance level.

Today’s strategy is range trading.

Assume a range between 142.30JPY and 142.65JPY—buy near the lower bound, and sell near the upper bound. If the range is clearly broken, consider stopping the trade.

Support/Resistance lines

Key support and resistance lines to consider:

- 142.65JPY – Pivot R1

- 142.30JPY – 200-period Moving Average

Market Sentiment

USDJPY Sell: 41% / Buy: 59%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Retail Sales | 8:50 |

| Australian CPI | 10:30 |

| German GDP | 17:00 |

| Eurozone GDP | 18:00 |

| U.S. ADP Employment Report | 21:15 |

| U.S. GDP | 21:30 |

| Canadian GDP | 21:30 |

| U.S. Core PCE Price Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.