Gold Remains Sluggish, Daily Kijun-sen Acts as Support【May 5, 2025】

Fundamental Analysis

- Concerns Grow Over U.S. Manufacturing; Imports of Chinese Machinery Halted

- Despite Strong U.S. Employment Data, USD Continues to Weaken

XAUUSD Technical Analysis

An analysis of the daily chart for gold shows the market continues to move in a narrow range, with the daily Kijun-sen acting as a key support level. The Tenkan-sen is gradually sloping downward, limiting both upward and downward movement.

The U.S. employment report exceeded market expectations. However, the impact of tariff policies has not yet shown in the data. The market perceives that the U.S. Federal Reserve must wait before considering rate cuts.

The key focus moving forward is whether gold can hold above the USD 3,230 level where the daily Kijun-sen lies.

Day trading strategy (1 hour)

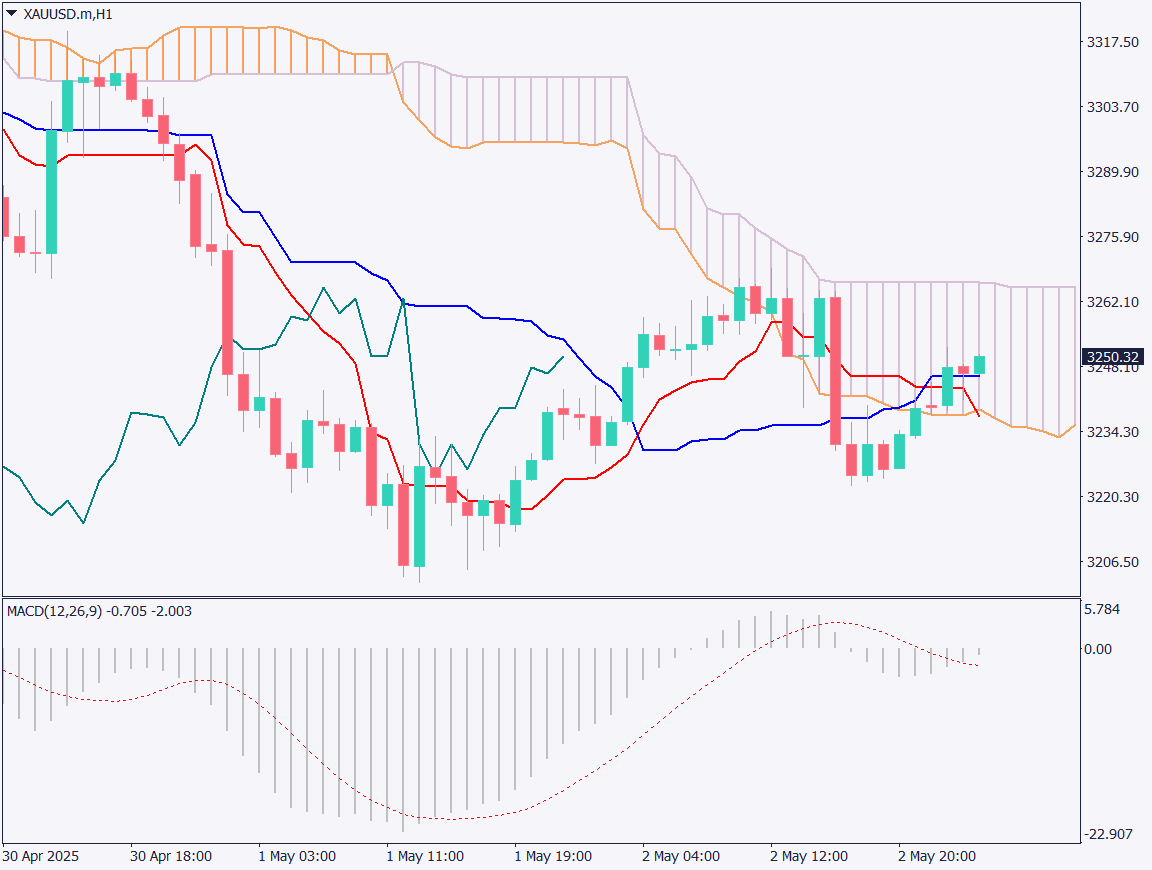

On the 1-hour chart, higher lows are forming. At the time of writing, gold is moving within the Ichimoku cloud, but if it breaks above the recent high, a sharp rise toward around USD 3,290 is possible. The key level to watch is a clear break above USD 3,270.

The trading strategy is to enter long after confirming a breakout above the cloud, supported by the upper cloud boundary and a break of the recent high. The target is around USD 3,290, with a stop placed below USD 3,250.

Support/Resistance lines

Key support and resistance lines to consider:

- USD 3,230 – Daily Kijun-sen

- USD 3,190 – Weekly Tenkan-sen

- USD 3,100 – Fibonacci 23.6%

Market Sentiment

XAUUSD – Sell: 52% / Buy: 48%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| U.S. Purchasing Managers’ Index (PMI) | 22:45 |

| U.S. ISM Non-Manufacturing Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.