U.S.–U.K. Reach Trade Agreement, USDJPY Rises to the Upper-145 JPY Zone【May 9, 2025】

Fundamental Analysis

- The new U.S.–U.K. trade pact boosted risk appetite, lifting USDJPY to its 52-day moving average.

- U.S.–China negotiations are scheduled for this weekend—watch for a possible gap when markets reopen on Monday.

USDJPY Technical Analysis

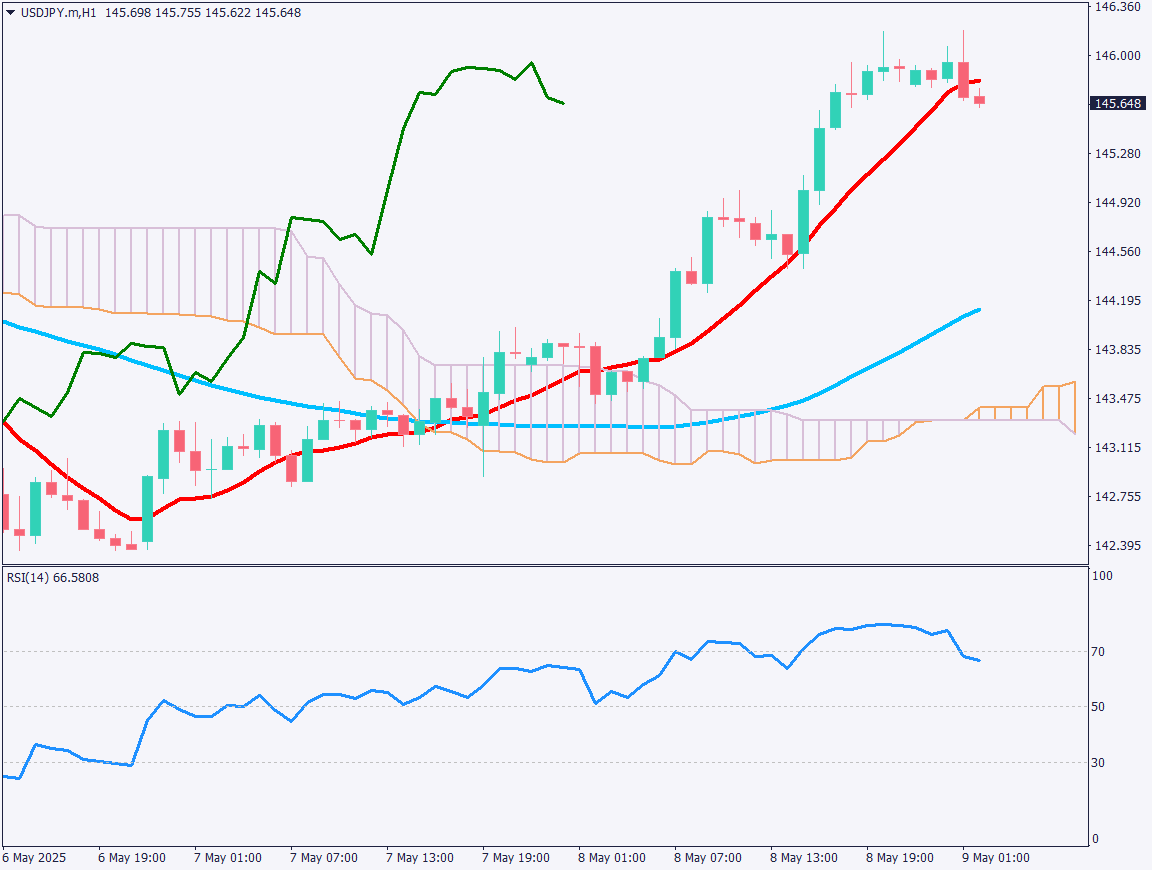

USDJPY surged from the 143 JPY area to 145.90 JPY on the trade-deal headlines, with the 52-day moving average capping gains for now.

RSI is at 55, underscoring the prevailing upward momentum. A clean break above the 52-day MA would push price into the Ichimoku cloud; if risk appetite persists, the next objective is likely around 148 JPY.

With U.S.–China talks imminent, traders should be cautious about holding positions over the weekend.

Day trading strategy

On the 1-hour chart, RSI has slipped below 70 and a small double-top is visible, confirmed by a recent bearish engulfing candle that sliced through the 10-period MA.

Given the strong resistance at the 52-day MA noted above, intraday bias is mildly bearish until the U.S.–China outcome is known.

- Trade idea: Short USDJPY with profit-taking in the high-143 JPY range.

- Stop-loss: Above the recent swing high at 146.20 JPY.

Support/Resistance lines

Key support and resistance lines to consider:

- 146.20 JPY – yesterday’s high

- 145.00 JPY – psychological round number

Market Sentiment

USDJPY – Sell: 54% / Buy: 46%

Today’s important economic indicators

| Economic Indicators and Events | Japan Time |

|---|---|

| Speech by the Bank of England Governor | 17:40 |

| Canada Employment Report | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.