EUR/USD Weakens Amid Strong Dollar Buying Pressure【May 28, 2025】

Fundamental Analysis

- U.S. stock markets rebounded, which bolstered demand for the U.S. dollar.

- Japanese long-term yields declined, pushing USD/JPY into the 144 yen range.

EURUSD Technical Analysis

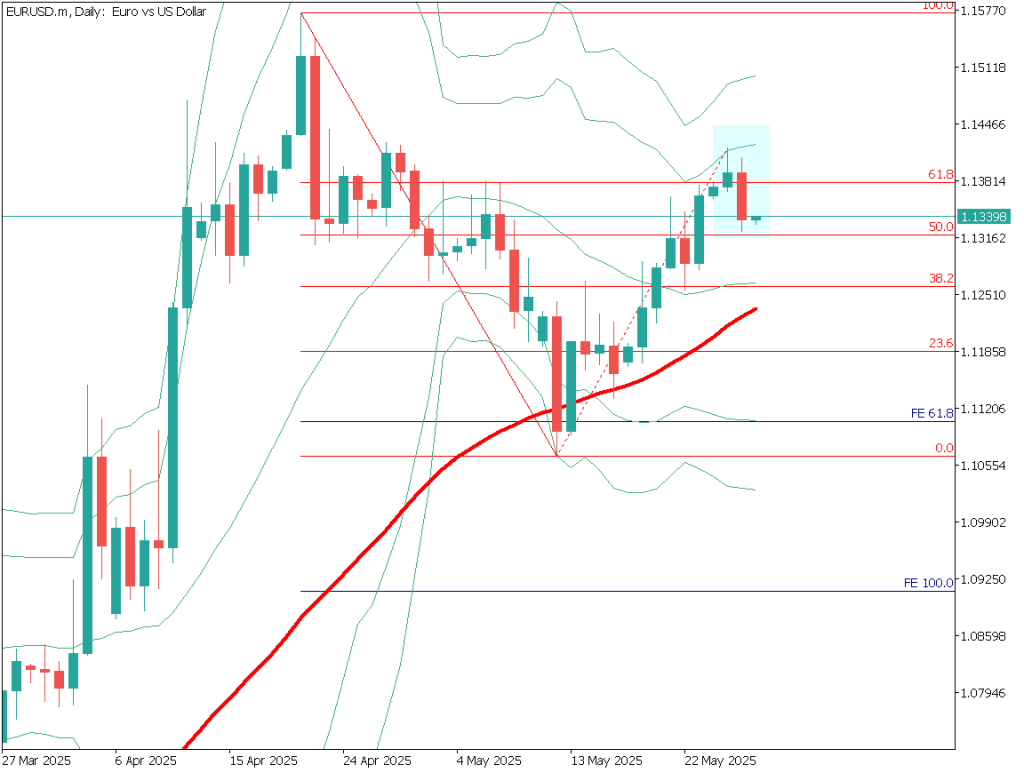

A Fibonacci retracement is applied to EUR/USD, showing a reversal near the 61.8% level, which also aligns with the upper Bollinger Band (+2σ). The pair is currently trading around 1.1340, where a daily engulfing pattern has emerged—indicating a potential trend reversal.

The next critical level is the 50% Fibonacci retracement near 1.1320. This level is further supported by the 52-day moving average, which has served as a strong technical base in recent sessions.

As U.S. equities recover, dollar buying has accelerated. Markets are closely watching NVIDIA’s earnings release and the publication of the FOMC meeting minutes later today during New York trading hours.

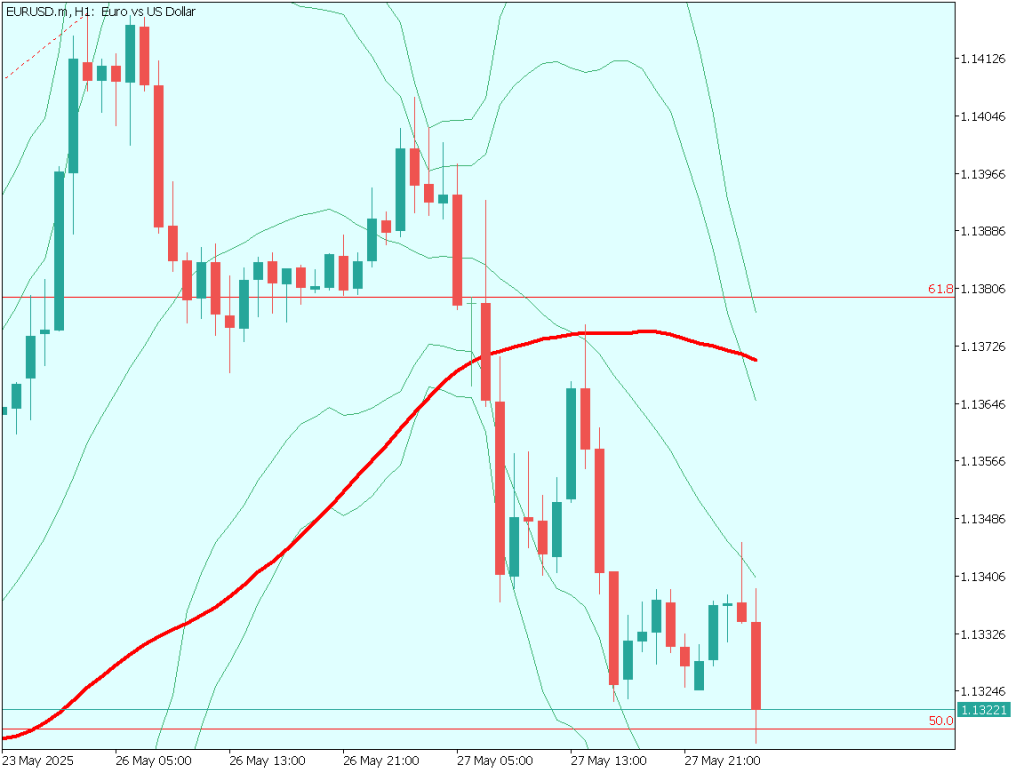

Day Trading Strategy (1-Hour Chart)

The 52-period moving average is a key focus on the 1-hour chart, which now shows a downtrend confirmed by Dow Theory. As of writing, EUR/USD has declined to around 1.1320, with strong dollar momentum continuing after yesterday’s equity rally.

The EU is reportedly seeking to accelerate trade negotiations with the U.S., a move that could reinforce dollar strength and pressure the euro. Price action remains range-bound, and the critical question is whether EUR/USD can break below 1.1320.

Trade Strategy: Short EUR/USD

A textbook “N-shaped” price pattern has emerged, and a move down toward 1.1300 is expected—approximately a 20-pip decline. A breakout to the downside from the current consolidation is anticipated.

Set a stop-loss above 1.1345.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 1.1320: Key Fibonacci level

- 1.1300: Psychological round number

Market Sentiment

EURUSD

- Short positions: 57% Long positions: 43%

Today’s Key Economic Events

| Event | Time (JST) |

| Australia CPI | 10:30 |

| Germany Unemployment Rate | 16:55 |

| U.S. FOMC Meeting Minutes | 03:00 (next day) |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.