Trump Administration Announces Tariff Hike – Yen May Strengthen Again on Risk-Off Sentiment【June2, 2025】

Fundamental Analysis

- President Trump announced an increase in tariffs on steel and aluminum to 50%.

- The President of the San Francisco Fed stated that two rate cuts this year would be appropriate.

USDJPY Technical Analysis

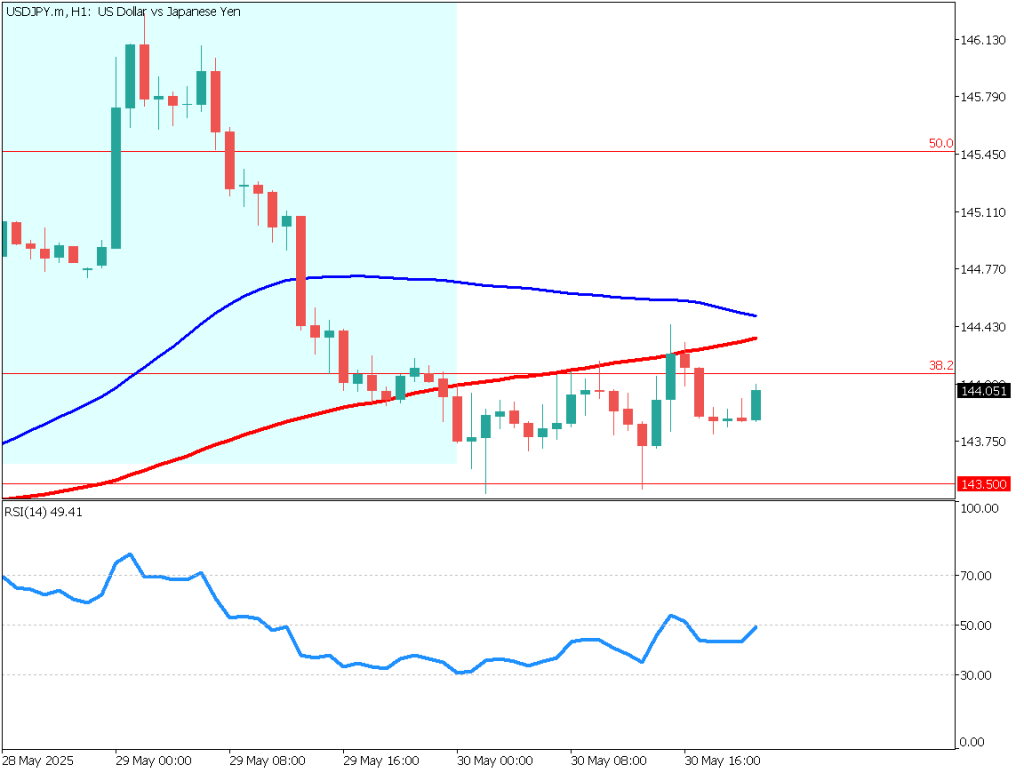

USDJPY is near the 52-day moving average and has formed a large bearish engulfing candle with a long upper shadow.

Although it fell to around 143.50 yen, it rebounded and ended the day with a doji candle.

On May 30, President Trump announced a 50% tariff on steel and aluminum, doubling the current 25% rate.

The new rate is expected to be applied starting June 4.

This policy seems to be aimed at China and could potentially escalate trade friction.

However, given Trump’s style, a last-minute withdrawal is also possible.

Looking at the Fibonacci retracement, the price has broken below the 38.2% level, indicating heavy resistance on the upside.

With the appearance of an engulfing candle, the technical bias leans slightly toward the downside.

Day Trading Strategy (1-Hour Chart)

The recent low at 143.50 yen is being closely watched.

In the short term, the focus will be on whether it breaks below 143.50 yen, and in the medium to long term, whether it breaks below 142.50 yen.

It is important to pay attention to how the market reacts to the tariff hikes on steel and aluminum.

If momentum builds to break below 143.50 yen, consider entering a short position targeting 142.50 yen.

For pullbacks, consider selling around 144.50 yen.

Ideally, a short trade should be made near the 52-day moving average on the daily chart.

If the price rises above 145 yen, place a stop.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 143.450 yen – Recent daily low

Market Sentiment

USDJPY

- Short positions: 39% Long positions: 61%

Today’s Key Economic Events

| Event | Time (JST) |

| US Manufacturing PMI | 22:45 |

| US ISM Manufacturing Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.