U.S. ADP Employment Data Plunges, USDJPY Tumbles【June 5, 2025】

Fundamental Analysis

- U.S. ADP employment data deteriorated significantly; result: 37,000 jobs

- Focus shifts to this week’s official U.S. employment report

- Geopolitical risks between Russia and Ukraine have sharply escalated

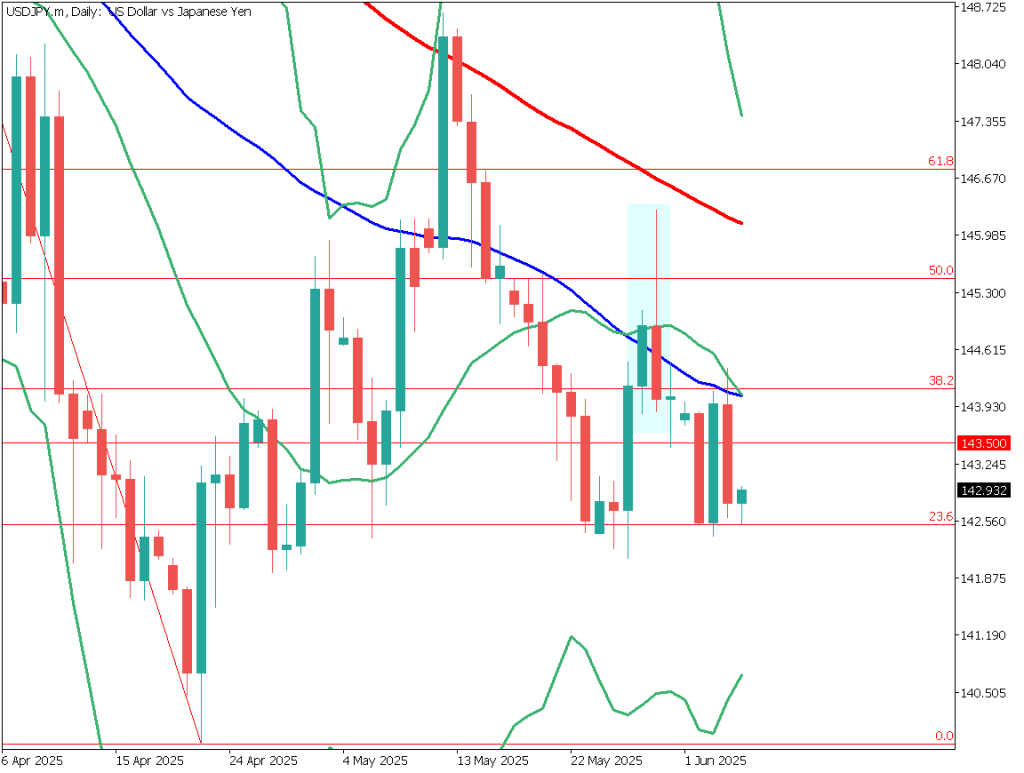

USDJPY Technical Analysis

The U.S. ADP employment report released yesterday was much worse than expected. The number of jobs came in at just 37,000, about one-third of forecasts, and 25,000 fewer than the previous figure. This triggered a surge in risk-off sentiment and accelerated dollar selling, causing USD/JPY to plunge from the 144 yen level to around 142.50 yen.

As a result, the pair rebounded downward from the 52-day moving average and is now trading in a range between Fibonacci 23.6% and 38.2% levels. The 23.6% support line is likely to remain in focus.

Going forward, attention will be on whether the pair breaks out of the 142.50 to 144 yen range.

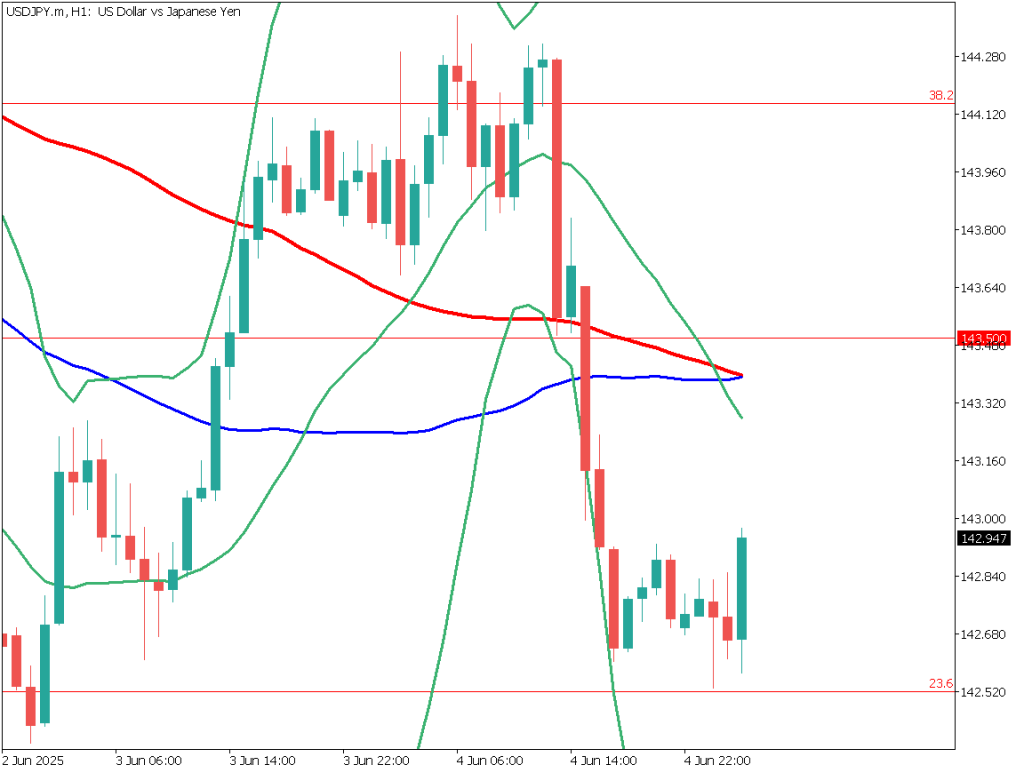

Day Trading Strategy (1-Hour Chart)

USD/JPY saw a sharp drop in response to the ADP data but has temporarily rebounded. As the moving averages are flattening out, there is a possibility of a rise toward the mid-143 yen level. However, the overall tone remains risk-off, making a sustained dollar rally unlikely.

We recommend a strategy targeting the rebound highs near the moving averages.

Day Trade Plan:

- Sell Limit: 143.30 yen

- Take Profit: 142.50 yen

- Stop Loss: 143.55 yen

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 143.30 yen – Key 1-hour moving average

- 142.50 yen – Fibonacci level

Market Sentiment

USDJPY

- 28% short / 72% long

Today’s Key Economic Events

| Event | Time (JST) |

| Eurozone – ECB Interest Rate | 21:15 |

| U.S. – Initial Jobless Claims | 21:30 |

| Eurozone – ECB Press Conference | 21:45 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.