Watch for Sudden Moves in USDJPY Ahead of U.S. Jobs Report【June 6, 2025】

Fundamental Analysis

- The U.S. Non-Farm Payrolls report is scheduled for release during the New York session, with the market expecting an increase of 127,000 jobs.

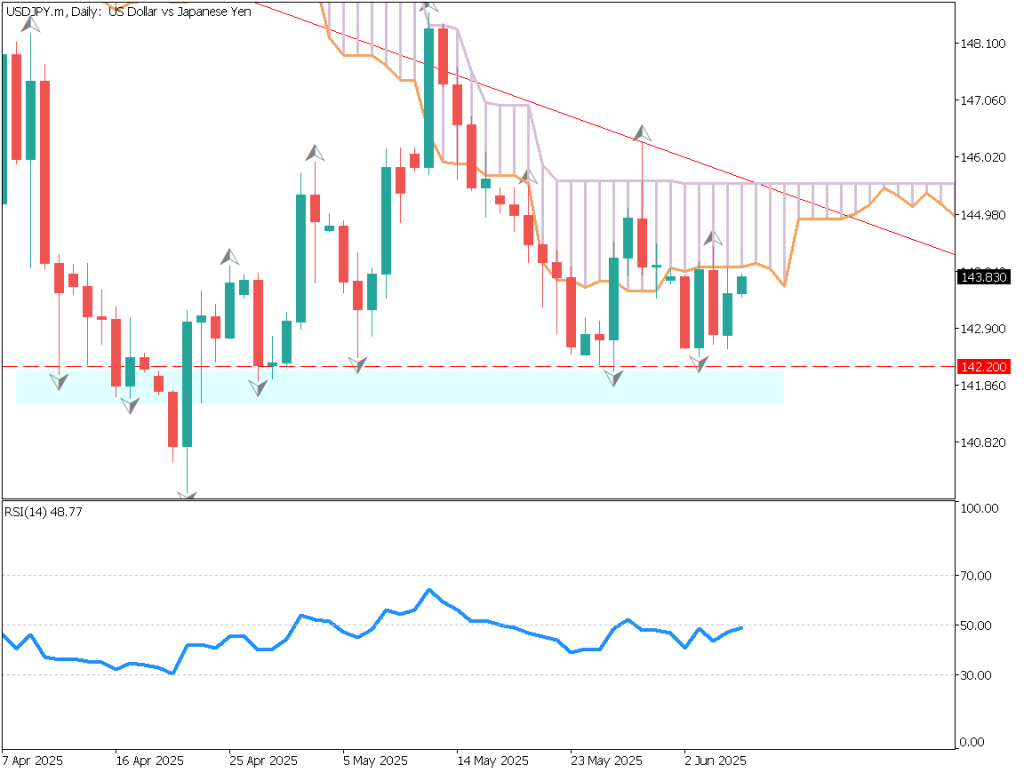

- USDJPY is currently finding firm support around the 142.20 level. However, the Ichimoku cloud is capping gains on the topside.

USDJPY Technical Analysis

USDJPY is forming a descending triangle, with price action converging toward a breakout. The key catalyst will likely be the U.S. Non-Farm Payrolls due at 21:30 JST today.

Fractal analysis shows that prices have reversed over six times in the 141.80–142.20 range, reinforcing the zone as a strong support area.

Should the jobs report disappoint, a break below 142.00 is possible. Given the significant number of long positions, a drop into the low 141s could trigger stop-loss orders and result in a sharp decline.

Day Trading Strategy (1-Hour Chart)

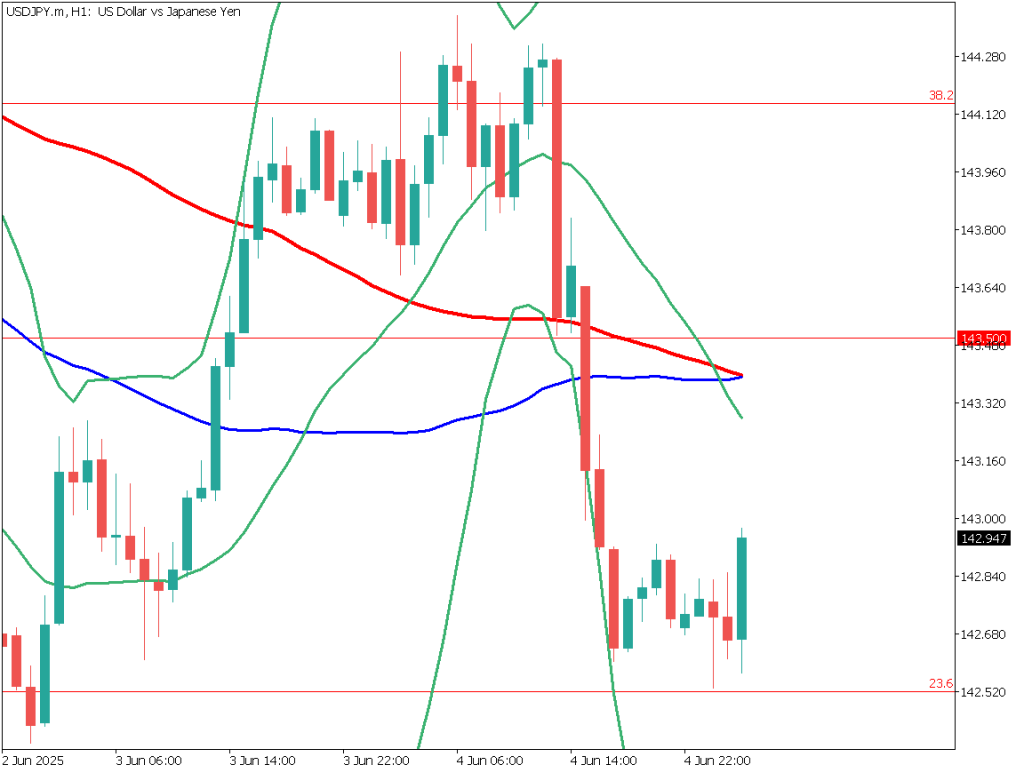

After the release of the ADP employment report, the market saw a pullback followed by short-covering. Ahead of today’s NFP, traders are likely to remain cautious, focusing on position adjustments rather than new entries.

If the jobs data is weaker than expected, selling pressure may increase. On the other hand, stronger-than-expected data could push USDJPY above 144.00, with 144.50 acting as the next resistance. A breakout above this level could trigger large-scale buying and stop-loss execution from short positions.

With today’s NFP report pending, we recommend staying on the sidelines and observing market movements to formulate a strategy for next week.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 144.50 – Notable resistance zone

- 142.50 – Price level with at least 6 reversal points in the past

Market Sentiment

USDJPY

- 41% short / 59% long

Key Economic Events Today

| Time (JST) | Event |

| 18:00 | Eurozone GDP |

| 21:30 | Canada Unemployment Rate |

| 21:30 | U.S. Non-Farm Payrolls |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.