EUR/USD edges higher, markets await early-morning FOMC【June 18, 2025】

Fundamental Analysis

- The Bank of Japan has eased its reduction in JGB purchases, showing consideration for long-term yields.

- With the FOMC looming, the market is watching closely for any mention of forthcoming rate cuts.

EURUSD Technical Analysis

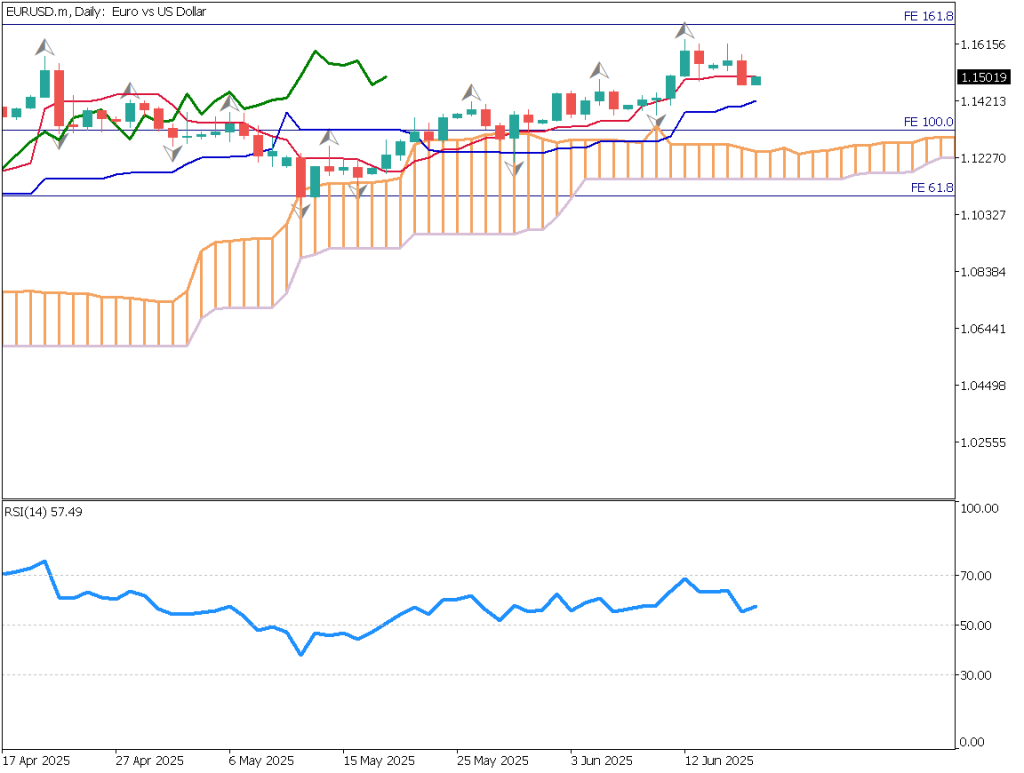

EUR/USD is hovering near the round number of 1.150USD. While price has slipped fractionally below the Tenkan-sen, the Kijun-sen is pointing upward, so the overall upward bias remains.

The Tenkan-sen sits at 1.1502USD, and traders are eyeing whether the pair can regain this level.

A look at Fibonacci expansion shows clear reactions at 61.8 % and 100 %, indicating these levels are closely watched.

The 161.8 % projection, around 1.1685USD, is likely to serve as the next upside target.

If the FOMC hints at rate cuts, dollar selling could lift EUR/USD. A hawkish stance with no cut guidance could see dollar buying drive the pair down toward 1.1350USD.

Day Trading Strategy (1-Hour Chart)

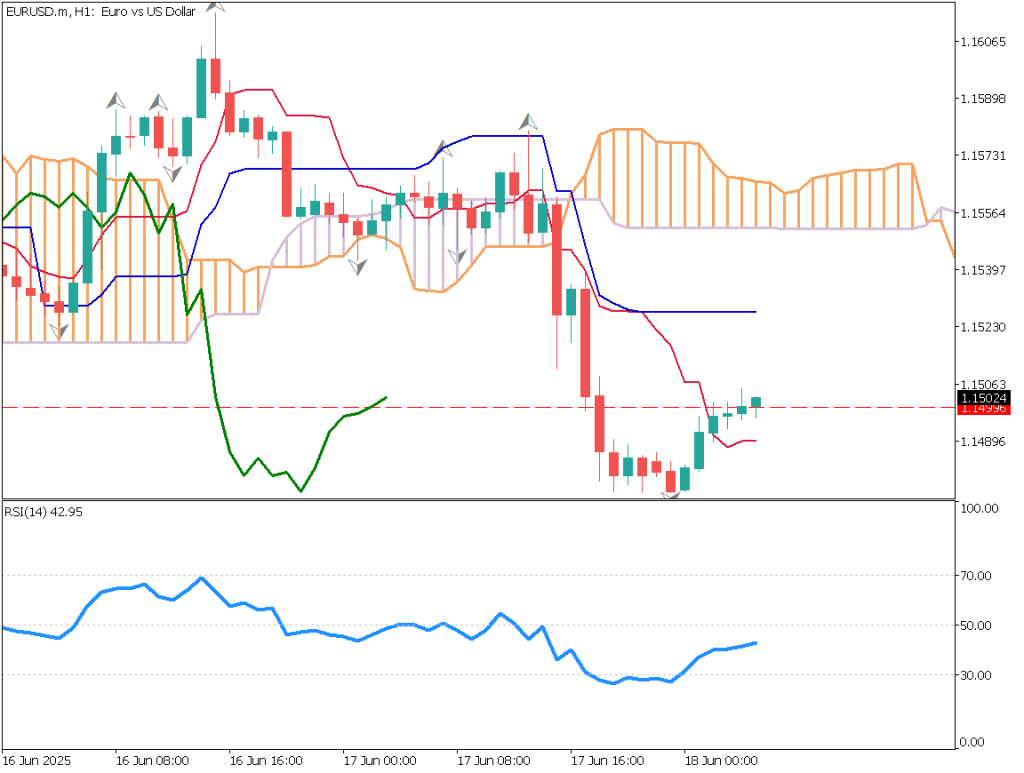

On the 1-hour chart, the 1.150USD round number is pivotal. After dipping to 1.1475USD, the pair staged a return-move and is slightly above 1.150USD. Should 1.150USD prove to be resistance, a slide toward 1.1350USD is possible.

Intraday bias: sell on rallies

- Entry : limit sell at 1.1535USD

- Take-profit : around 1.1385USD

- Stop : 1.1560USD

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 1.150USD – round number

Market Sentiment

EURUSD

- 62% short / 38% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| UK Consumer Price Index (CPI) | 15:00 |

| Eurozone Consumer Price Index (HICP) | 18:00 |

| US Initial Jobless Claims | 21:30 |

| US Federal Funds Rate (FOMC) | 03:00 (next day) |

| Fed Chair Powell press conference | 03:30 (next day) |