The Fed Holds Rates Steady, Damps Rate Cut Expectations【June 19, 2025】

Fundamental Analysis

- Fed Chair Powell Denies Early Rate Cuts

- With inflation expected to rise due to Trump’s new tariffs, rate cuts within the year may be difficult.

USDJPY Technical Analysis

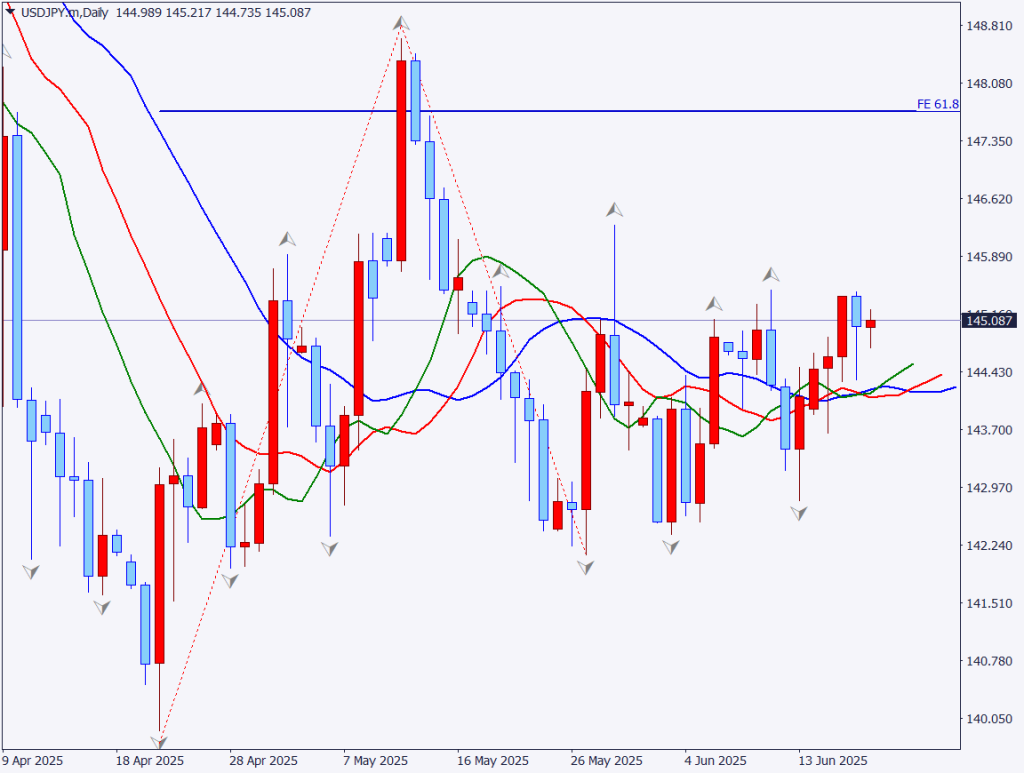

Analyzing the USDJPY daily chart shows that lows are gradually rising. According to the Alligator indicator developed by Bill Williams, the mouth is slightly opening, indicating a possible upcoming trend after a period of range-bound movement since late May.

The key point is whether it can break above the 145 yen level. The upside target seems to be around 148 yen. Powell’s hawkish remarks denying early rate cuts would typically lead to dollar buying.

However, with escalating geopolitical risks in the Middle East and reports suggesting possible U.S. involvement, the situation remains highly uncertain.

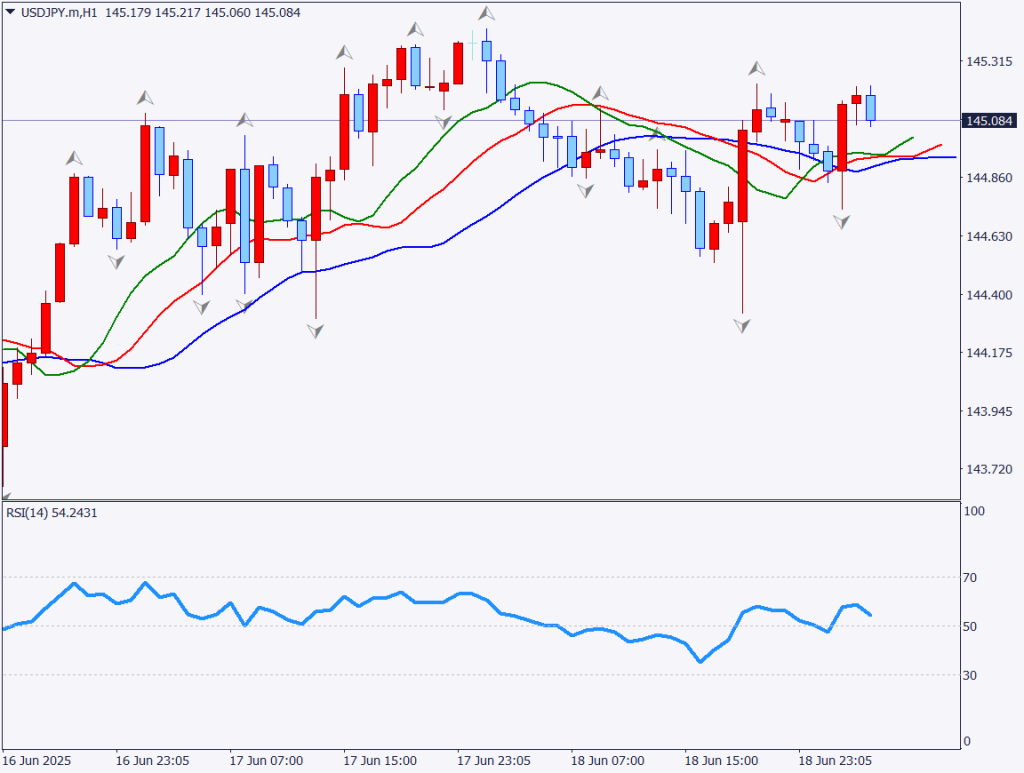

Day Trading Strategy (1-Hour Chart)

Although the Fed Chair’s press conference was hawkish, market focus has shifted to the Middle East situation. The conflict between Israel and Iran is intensifying, with reports suggesting potential U.S. military involvement. This has created a highly risky market environment.

If the U.S. actually intervenes, a rapid yen appreciation may occur. Caution is advised during the NY session announcements.

For now, sticking to short-term trades may be safer. Consider short positions around 145 yen, long positions around 144 yen, and immediately apply stop-loss orders upon any breakout.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 144.40 yen — Yesterday’s low

Market Sentiment

USDJPY

- 49% short / 51% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| U.S. Holiday (Public Holiday) | – |

| U.K. – Bank of England (BoE) Policy Rate | 20:00 |

| U.S. – Jobless Claims | 21:30 |