USD/JPY Remains Quiet as Geopolitical Risks Rise【June 20, 2025】

Fundamental Analysis

- President Trump announced he would decide on measures against Iran within two weeks.

- The focus remains on the geopolitical risks in the Middle East, where tensions continue.

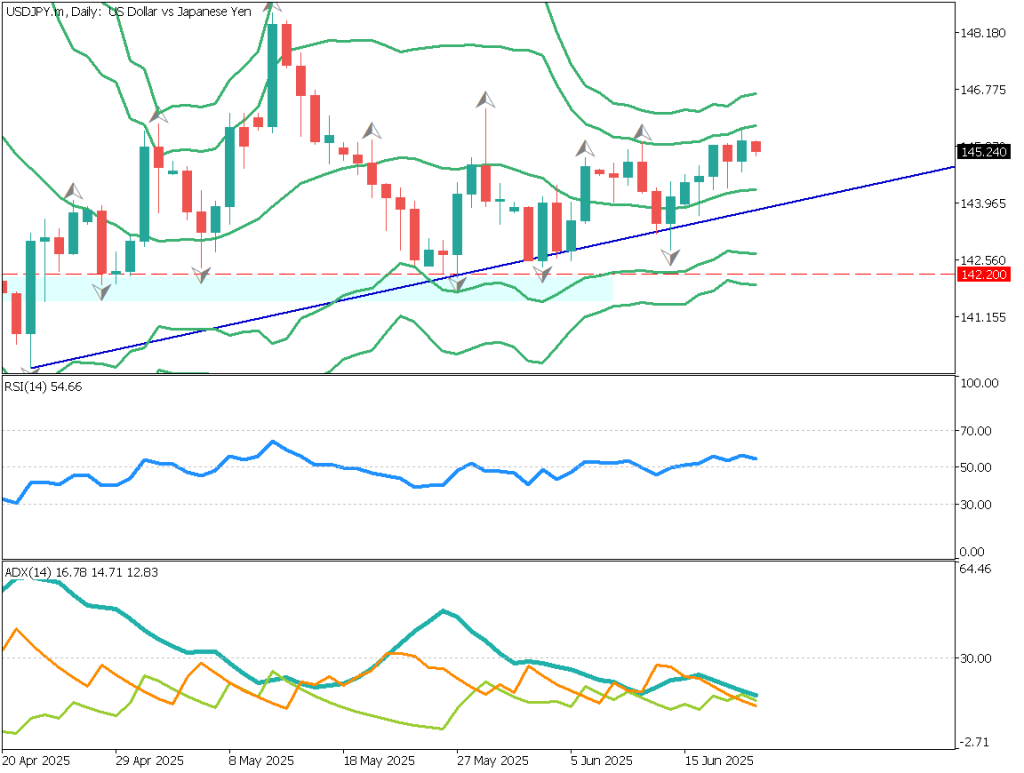

USDJPY Technical Analysis

The USD/JPY pair maintains a mild upward trend but remains in a quiet market. The biggest concern is whether the U.S. will intervene in the Middle East conflict, which remains unpredictable.

If intervention occurs, the market could react negatively, potentially leading to rapid yen appreciation. Accelerated dollar selling may impact many financial markets.

USD/JPY has been fluctuating up and down unpredictably. However, in the larger context following the Bank of Japan’s announcements, a slight yen depreciation bias seems apparent. The RSI is currently at 54.

All ADX indicators are pointing downward, suggesting a lack of clear direction.

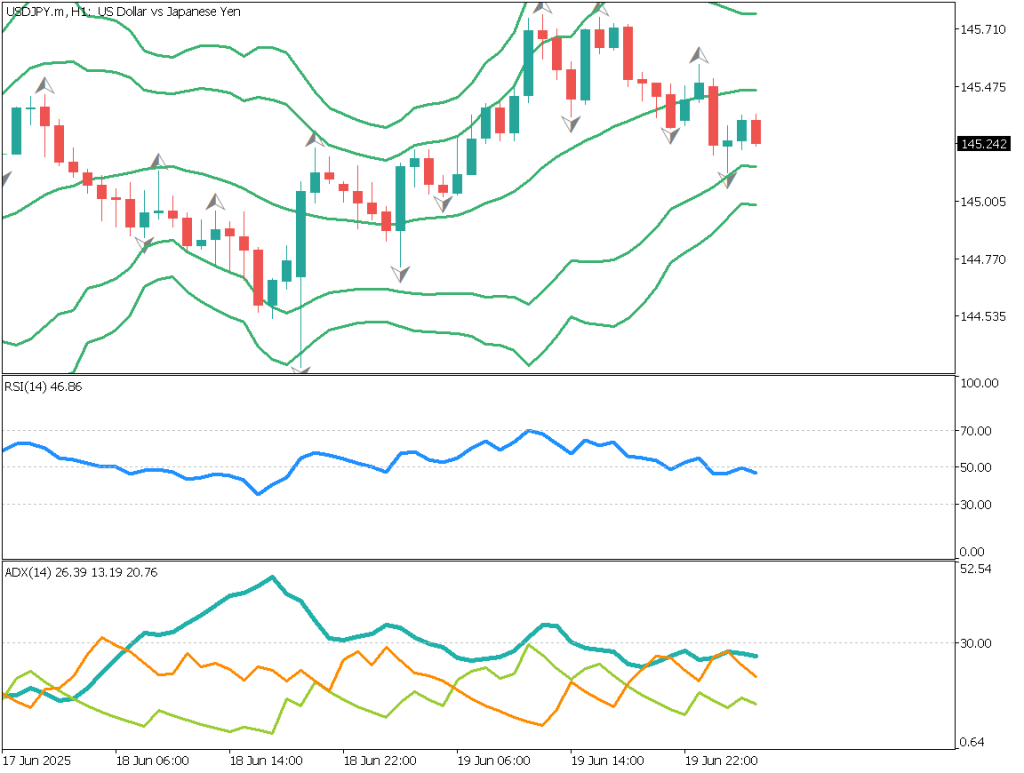

Day Trading Strategy (1-Hour Chart)

On the 1-hour chart, short-term selling pressure appears to be increasing. The RSI stands at 46, below the 50 mark, indicating a slight dominance of selling pressure. Although it rebounded at the -2σ line of the Bollinger Bands, if it falls below 145 yen, it could trigger stop-loss orders and drop to the lower 144 yen range.

Given the risk-off sentiment, the day trading strategy favors selling on rallies.

- Stop: 145.75 yen

- Take Profit: 144.50 yen

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 145.75 yen – Recent resistance level

- 144.50 yen – Major support level

Market Sentiment

USDJPY

- 31% short / 69% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| Japan National Consumer Price Index (CPI) | 8:30 |

| UK Retail Sales | 15:00 |

| US Philadelphia Fed Manufacturing Index | 21:30 |

| US Leading Economic Index | 23:00 |