USD/JPY Surges into 147 Range! U.S. Strikes Iranian Nuclear Facility【June 23, 2025】

Fundamental Analysis

- The United States bombed Iran’s nuclear facilities; Iran threatens to block the Strait of Hormuz.

- A new war may have started; volatility ahead requires caution.

- Possible escalation into prolonged conflict with increasing U.S. involvement, heightening uncertainty.

- China’s economy may also be negatively impacted by the U.S. attack on Iran.

- Growing concerns over potential inflationary pressures worldwide.

USDJPY Technical Analysis

USD/JPY has surged into the 147 range. The pair is significantly exceeding the +2σ line of the Bollinger Bands, clearly showing a flight to the U.S. dollar during geopolitical crises. Iran’s threat to block the vital oil route through the Strait of Hormuz has caused crude oil prices to spike sharply. Similar to the early phase of the Ukraine conflict, this situation is pushing USD higher and JPY lower.

Moving forward, attention will focus on Iran’s response. With Iran hinting at full-scale retaliation, there is a risk of the conflict dragging on. The longer U.S. involvement continues, the greater the uncertainty.

With inflation risks mounting, the global market remains highly vigilant.

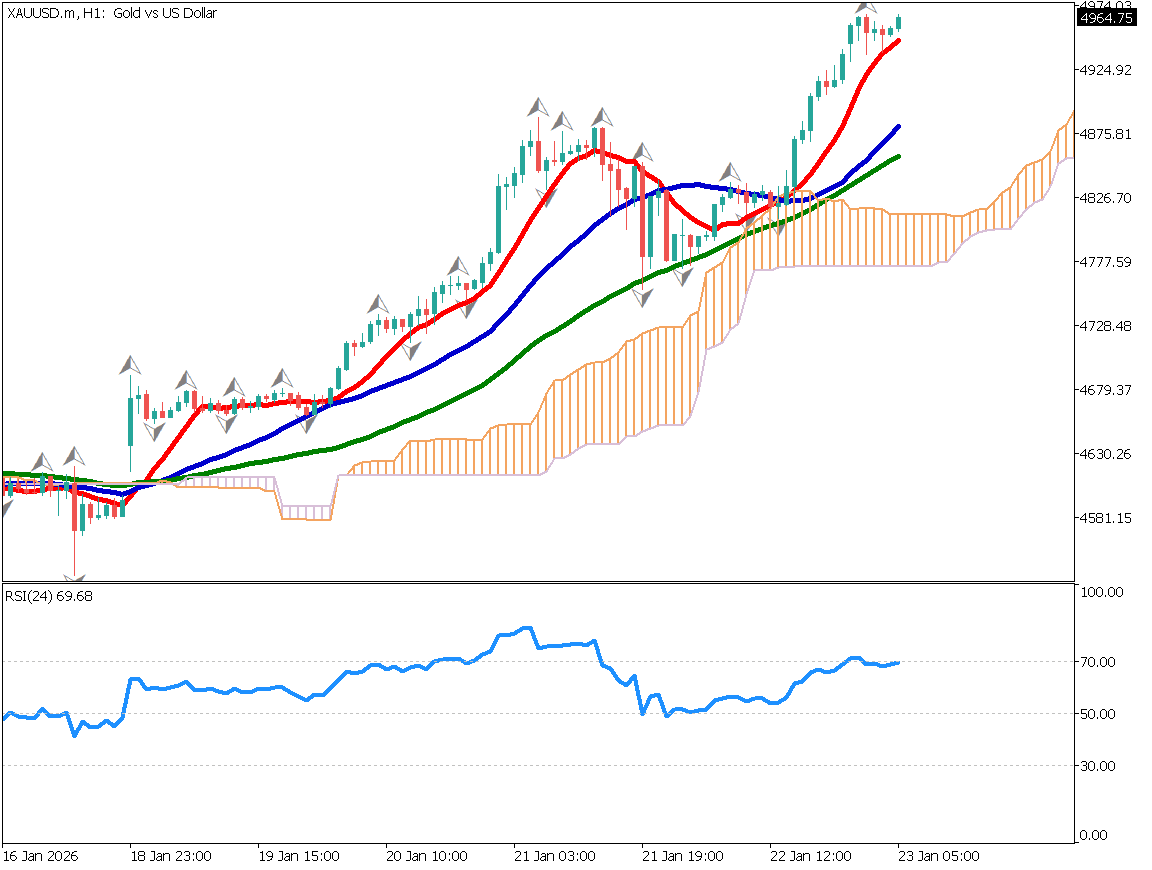

Day Trading Strategy (1-Hour Chart)

The pair is forming a band walk along the +2σ line of the Bollinger Bands, with the RSI rising to 80. This suggests an overbought condition, increasing the possibility of a pullback. However, if crude oil prices continue to rise, leading to heightened inflation, the yen may weaken further, and buying on dips is likely to strengthen.

At this stage, uncertainty remains extremely high, so monitoring the situation is crucial.

For medium- to long-term trading, buying on dips around the 145 yen level is preferable.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 148.65 yen – Key resistance level

Market Sentiment

USDJPY

- 70% short / 31% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| U.S. Purchasing Managers’ Index (PMI) | 22:45 |

| U.S. Existing Home Sales | 23:00 |