Flash Announcement of Ceasefire Agreement Between Iran and Israel, Crude Oil Plunges【June 24, 2025】

Fundamental Analysis

- Crude oil prices plummeted from the $75 range to the $64 range.

- President Trump posted on social media that Iran and Israel had agreed to a ceasefire.

- The risk-off mood quickly reversed, leading to market turnarounds across various assets.

- Fed Governor Bowfman mentioned a potential rate cut, prompting further dollar selling.

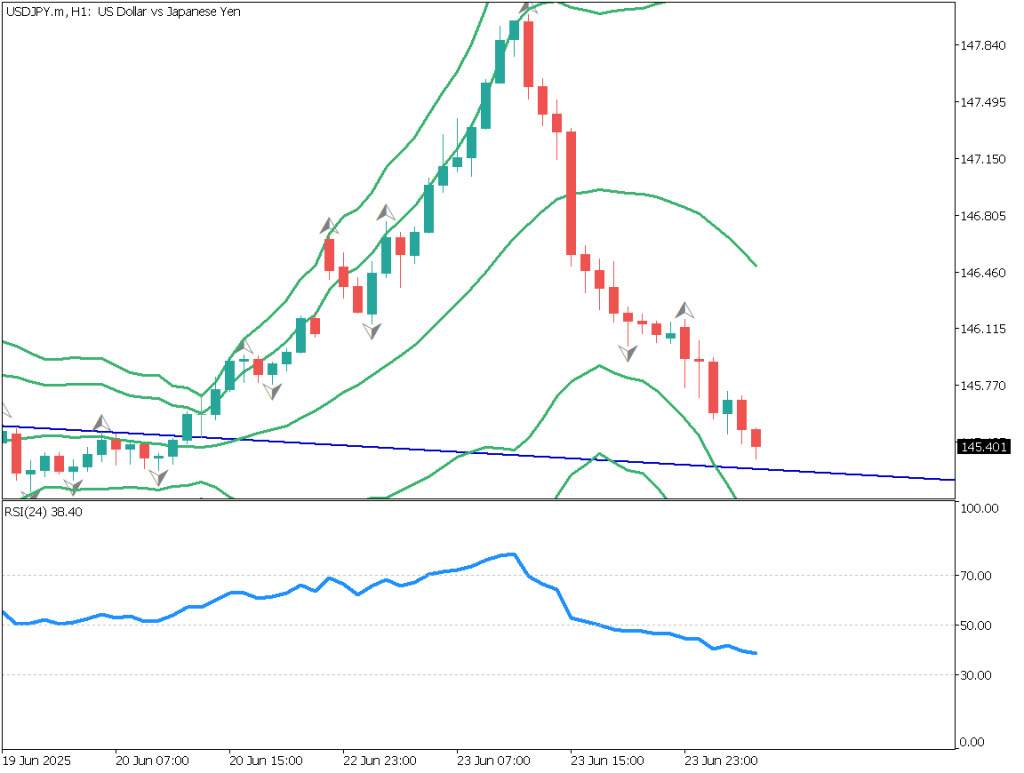

USDJPY Technical Analysis

USDJPY, which had temporarily risen to 148 yen due to higher oil prices, pulled back after President Trump’s morning social media post, with yen buying resuming and USDJPY falling back to around 145.50 yen.

The pair has broken above the downtrend line; going forward, it will be key to see if this trendline acts as a support level.

Even though Iran and Israel have agreed to a ceasefire, the possibility of conflict resuming should still be considered. Trading USDJPY remains highly challenging, but it may be reasonable to attempt a dip-buying strategy once the RSI reaches 50.

Day Trading Strategy (1-Hour Chart)

The 1-hour chart shows a large peak, with a sharp rise up to 148 yen followed by a swift decline.

As the market is being driven by fundamentals, technical analysis becomes challenging.

The 145 yen level is a strong support zone, so some dip-buying can be expected. The RSI has also dropped to 30, suggesting a rebound tendency.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 145 yen – Important support zone

Market Sentiment

USDJPY

- 27% short / 73% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| Canada Consumer Price Index (CPI) | 21:30 |

| Bank of England Governor Bailey Speech | 23:00 |

| Federal Reserve Chair Powell Speech | 23:00 |

| US Consumer Confidence Index | 23:00 |