USD/JPY Maintains Bearish Trend, Breaks Below 52-day Moving Average【June 27, 2025】

Fundamental Analysis

- Iran and the U.S. have resumed nuclear talks; the ceasefire agreement remains in place.

- Geopolitical risks have eased, prompting a rebound in USD/JPY.

EURUSD Technical Analysis

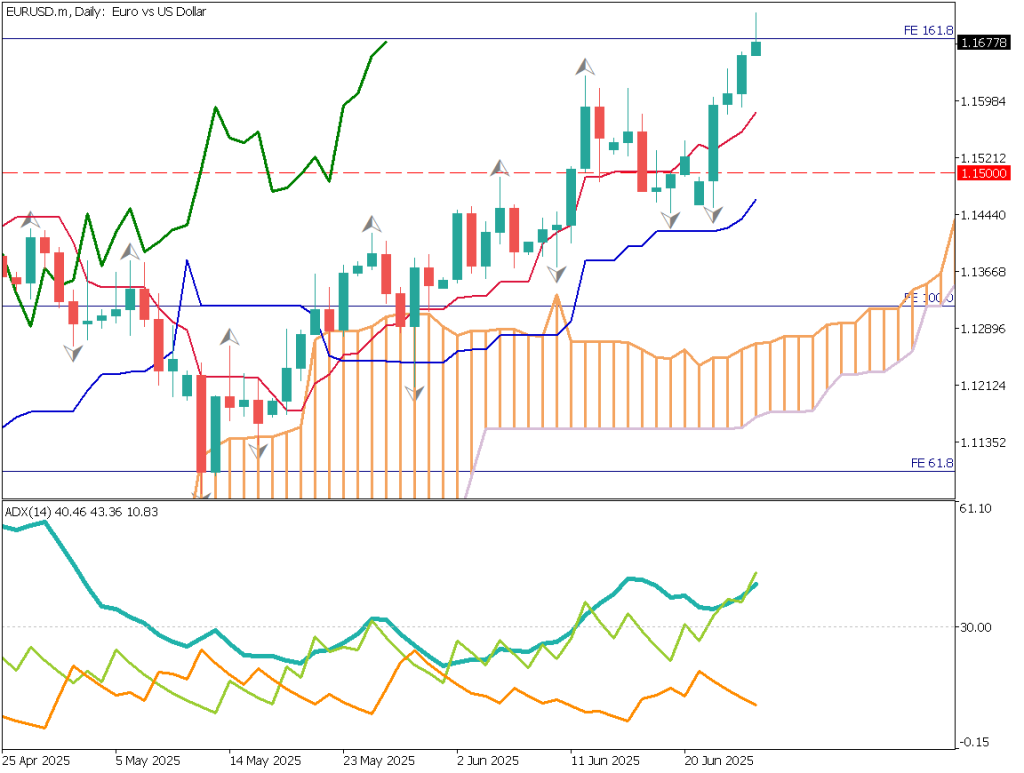

Analyzing the daily chart of EUR/USD:

The pair has broken above its recent high, rising into the 1.16 range and currently trading in the upper 1.16 area. The Fibonacci expansion level has drawn market attention, with the pair pulling back after hitting the 161.8% level.

Given the psychological significance of round numbers, the next resistance is expected around 1.17. If EUR/USD breaks above the 161.8% level at 1.1685, the price could aim for 1.1750. Since the ADX is hovering around 40, if the trend loses momentum, a pullback may occur. Special attention should be paid to reversal signals such as engulfing patterns.

Day Trading Strategy (1-Hour Chart)

Fractals have appeared on the 1-hour chart, indicating a potential market reversal. Currently, the pair is trading below the conversion line, suggesting a possible decline toward the base line around 1.165.

However, speculation that the U.S. Federal Reserve may cut rates is driving dollar selling.

Once the decline stabilizes, we anticipate dip-buying may emerge.

Day Trading Strategy: Buy on dips

- Set buy limit orders around 1.165 and 1.1635

- Take profit at 1.17

- Stop loss below 1.16

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 1.1700 – Psychological round number

- 1.1685 – Fibonacci level

- 1.1600 – Psychological round number

Market Sentiment

EURUSD

- 83% short / 17% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| BoE Governor Bailey Speech | 20:00 |

| U.S. GDP | 21:30 |

| U.S. Jobless Claims | 21:30 |