USD/JPY Focused on Breakout as Tariff Deadline Approaches【June 30, 2025】

Fundamental Analysis

- President Trump has expressed dissatisfaction with U.S.-Japan auto trade, indicating there is no need for further delay.

- The U.S. has cut off trade with Canada and warned of new tariffs.

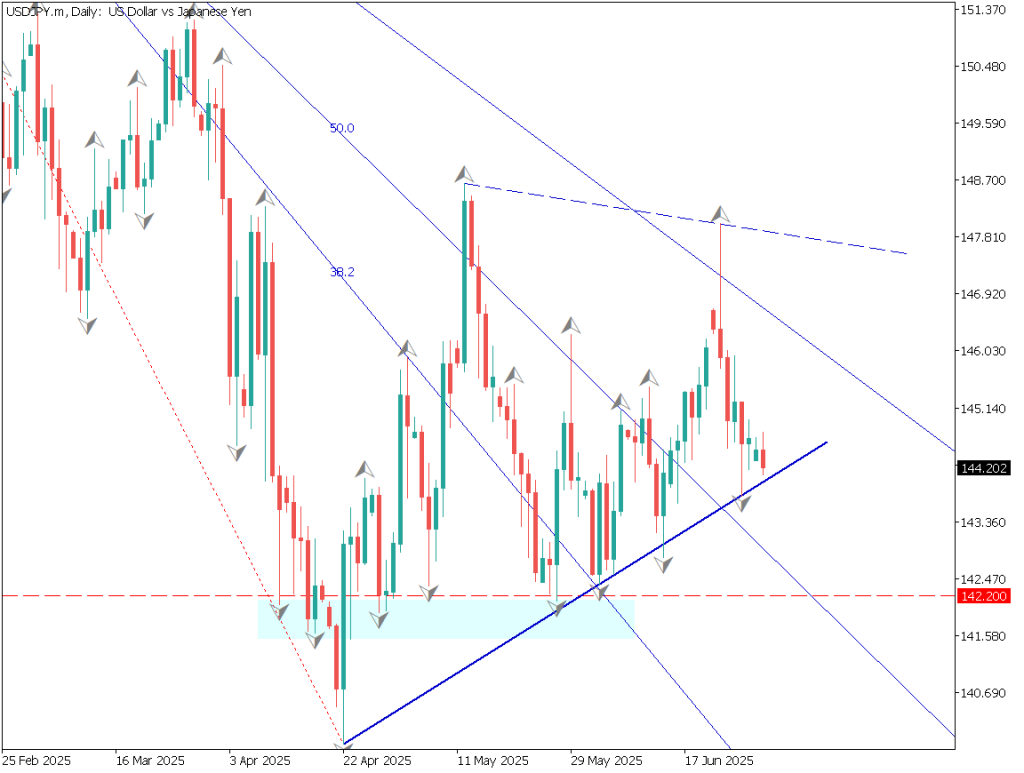

USDJPY Technical Analysis

On the USD/JPY daily chart, highs are slightly declining, and the price is approaching the rising trendline.

With geopolitical risks easing, market focus has shifted to the additional tariff deadline on July 9.

During the Gotobi fixing session, the pair rose to around 144.75, but eased back to around 144.15 in the early afternoon, indicating a slight appreciation of the yen.

Today’s key point is whether the pair will break below the rising trendline.

With the U.S. employment data scheduled for release this week, traders are advised to remain cautious.

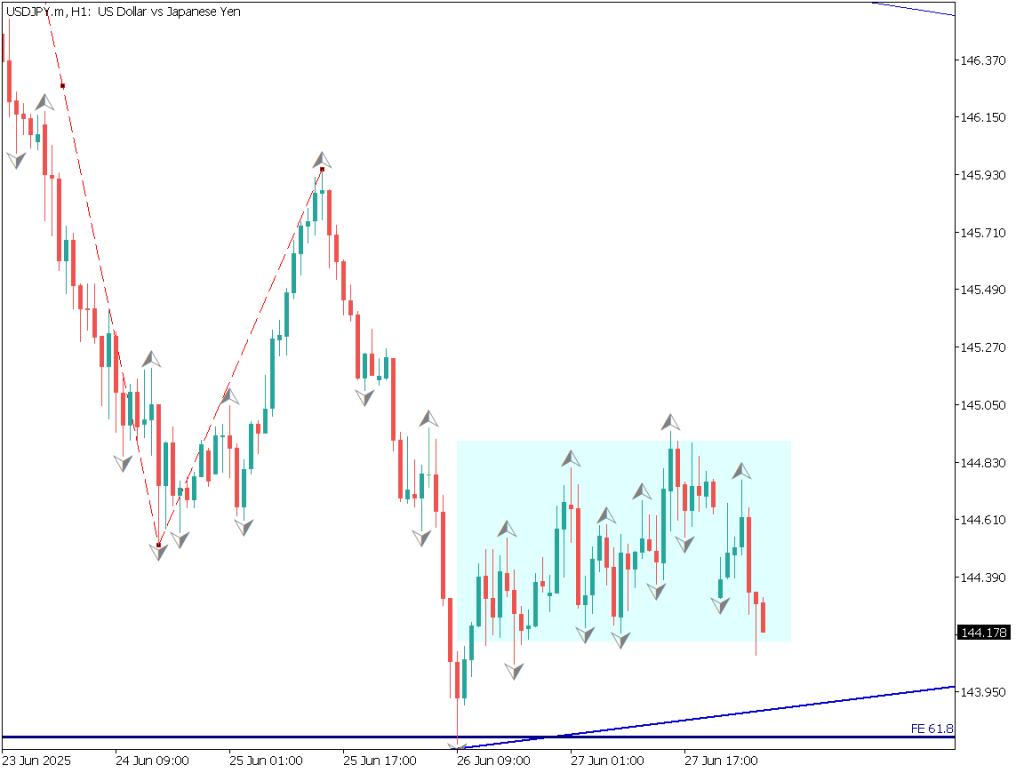

Day Trading Strategy (1-Hour Chart)

On the 1-hour chart, a box range has formed between 144.15 and 144.75. Attention should be paid to a potential breakout.

If the price breaks downward, the trendline around 143.95 and the 61.8% Fibonacci level at 143.79 are expected to serve as strong support.

The presence of multiple fractals in a price zone indicates strong market pressure in that area.

Day Trading Strategy (Reversal):

- Buy Limit: 143.80

- Take Profit: 144.15

- Stop Loss: 143.45

- Sell Limit: 144.85

- Take Profit: 144.15

- Stop Loss: 145.25

Set two pending orders and wait for the market movement.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 144.75 – Today’s Gotobi session high

- 143.77 – Fibonacci level

Market Sentiment

USDJPY

- 46% short / 54% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| UK GDP | 15:00 |

| Germany CPI | 21:00 |

| ECB President Lagarde Speaks | 4:00 (Next day) |