USD Selling Extends for 7 Consecutive Days as President Trump Increases Pressure on Fed Chair【JULY2, 2025】

Fundamental Analysis

- President Trump sends a handwritten letter demanding a rate cut from the Fed Chair

- Markets question the Fed’s independence, leading to intensified USD selling

- US-Japan trade talks stall, reports suggest consideration of 30–35% tariffs

- Gold rises $80 over two days, suggesting asset flows out of USD

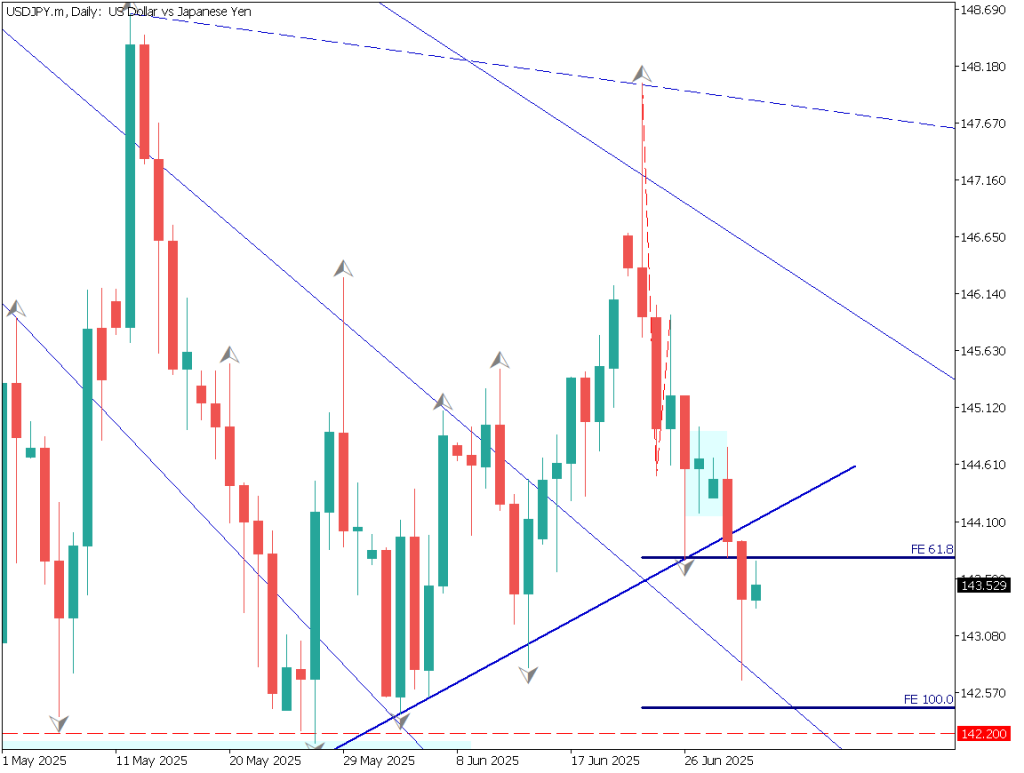

USDJPY Technical Analysis

Analyzing the USDJPY daily chart: USDJPY broke below the 61.8% retracement level, briefly dipping under 143. Although short covering occurred, the 61.8% level now serves as resistance, indicating persistent selling pressure.

President Trump’s handwritten demand for rate cuts sent to the Fed Chair came as a major shock. It clearly casts doubt on the Fed’s independence. The market reacted with USD selling, pushing USDJPY lower.

As long as the Trump administration remains in power, the rate-cutting stance will likely persist. Consequently, further USD selling and JPY buying seem likely.

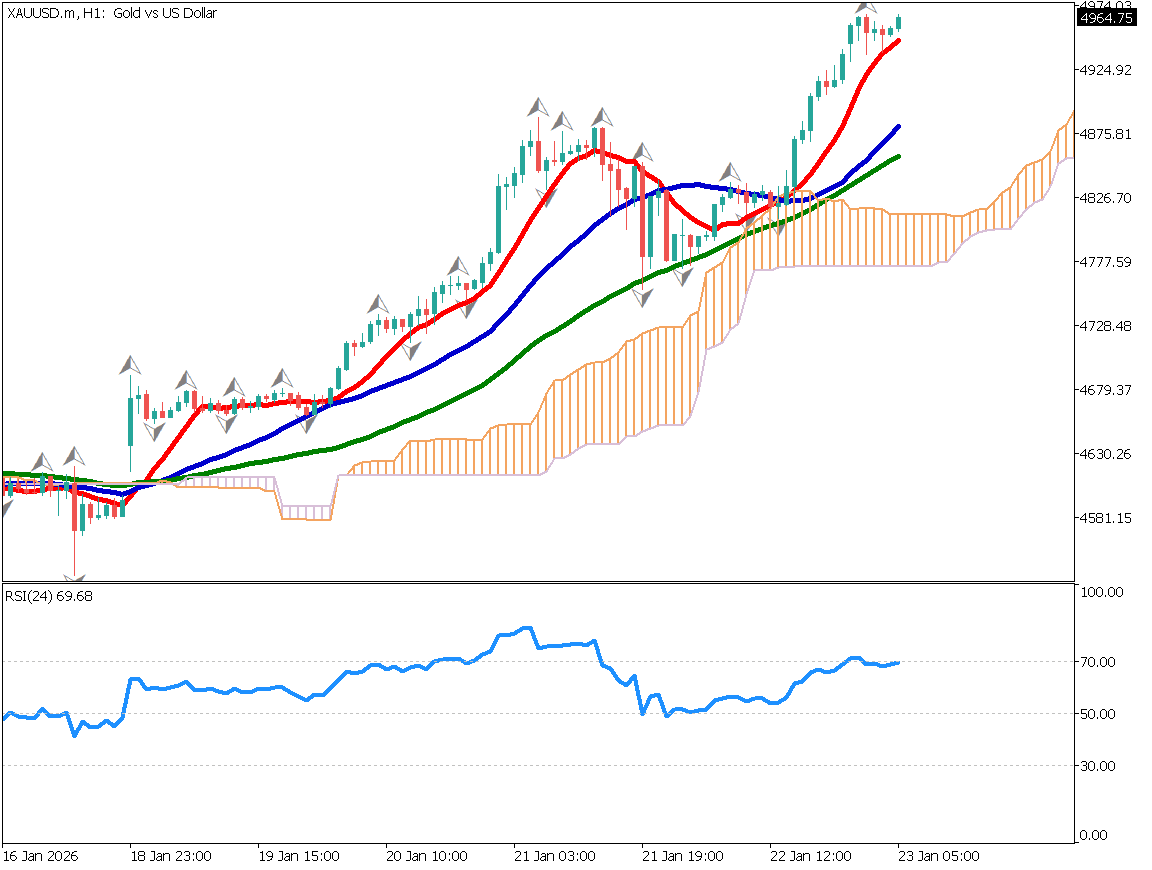

Day Trading Strategy (1-Hour Chart)

On the 1-hour chart, a clear rebound from the 61.8% level is observed. As long as this level isn’t breached to the upside, a bearish trading stance is preferred. Since the price is currently above the 24-period moving average, it would be prudent to wait for a drop below this line before considering entry.

The RSI hovers around the 50 mark, indicating a balance between buying and selling pressure.

Day trading strategy:

Consider short entry after a confirmed break below the 24-period moving average. Set take-profit near 142.85 yen and stop-loss if the price moves back above the 24-period MA. Note that market volatility may increase due to the upcoming ADP Employment Report.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 143.78 – 61.8% retracement level

- 142.68 – Yesterday’s low

Market Sentiment

USDJPY

- 39% short / 61% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| US ADP Employment Report | 21:15 |

| ECB President Lagarde Speech | 23:15 |

| US Crude Oil Inventories | 23:30 |