U.S. ADP Employment Report Posts Surprise Decline【JULY3, 2025】

Fundamental Analysis

- U.S. ADP Employment Report came in at -33,000, far below expectations of +95,000

- Attention turns to today’s U.S. Nonfarm Payrolls for further signs of labor market weakness

EURUSD Technical Analysis

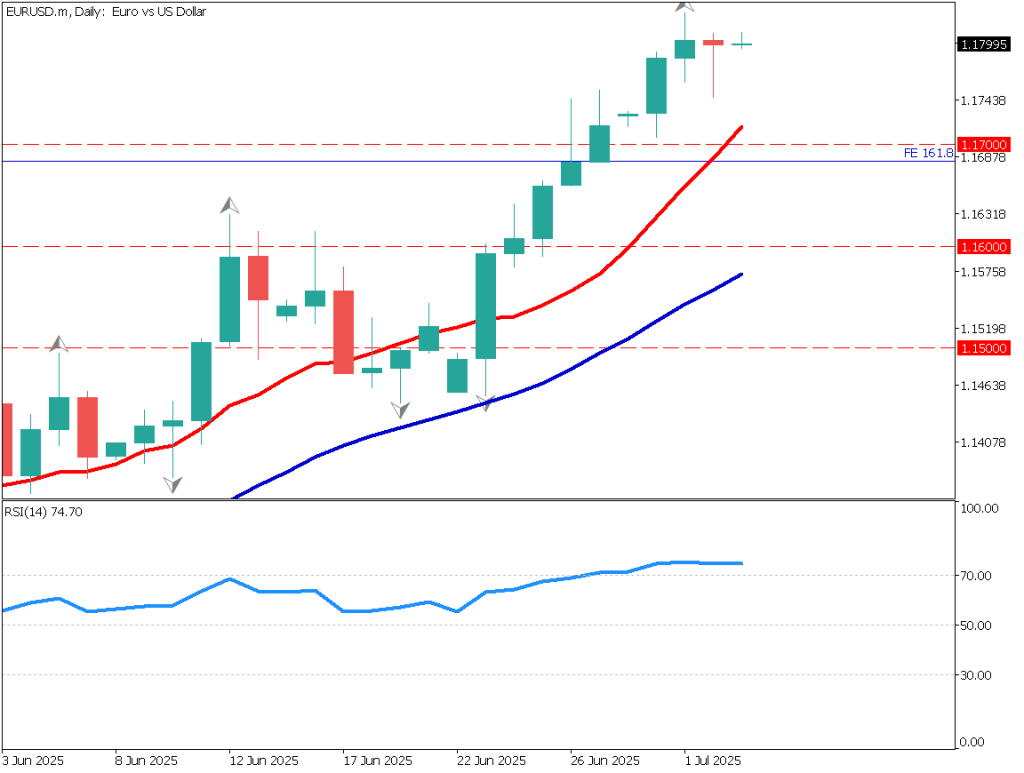

The daily chart of EUR/USD is analyzed. While the pair had been rising for eight consecutive days, signs of exhaustion are beginning to emerge. The 1.18 level appears to be a strong resistance zone. After rallying over 300 pips from the 1.15 area in late June, 86% of market sentiment is now tilted toward short positions. Caution over high price levels could lead to a pullback.

However, yesterday’s ADP report posted a surprising decline of -33,000 jobs, signaling potential economic deterioration in the U.S. If the economy continues to weaken, U.S. stock markets, which had risen on rate-cut expectations, may start to reverse lower.

A certain degree of correction is likely, but overall USD weakness may persist, allowing EUR/USD to rise further on a relative basis.

Day Trading Strategy (1-Hour Chart)

On the 1-hour chart, the 10-period moving average is acting as a support line. A slight downtrend is forming, and there’s potential for a drop to around 1.176. If the RSI approaches 50, a buying opportunity might emerge, but given the growing number of short positions, it may be better to wait until RSI nears 30.

Today’s U.S. Nonfarm Payrolls release is a high-impact event. As volatility is expected to increase, caution is advised. The day trading stance should remain on the sidelines.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 1.1800 – Round number resistance

Market Sentiment

USDJPY

- 84% short / 16% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| U.S. Nonfarm Payrolls | 21:30 |

| U.S. Purchasing Managers Index (PMI) | 22:45 |

| U.S. ISM Non-Manufacturing PMI | 23:00 |