U.S. Employment Data Exceeds Expectations; USDJPY Surges【JULY4, 2025】

Fundamental Analysis

- U.S. employment data comes in strong; non-farm payrolls increase and unemployment rate declines.

- USD bought in FX markets, U.S. stock indices also rise.

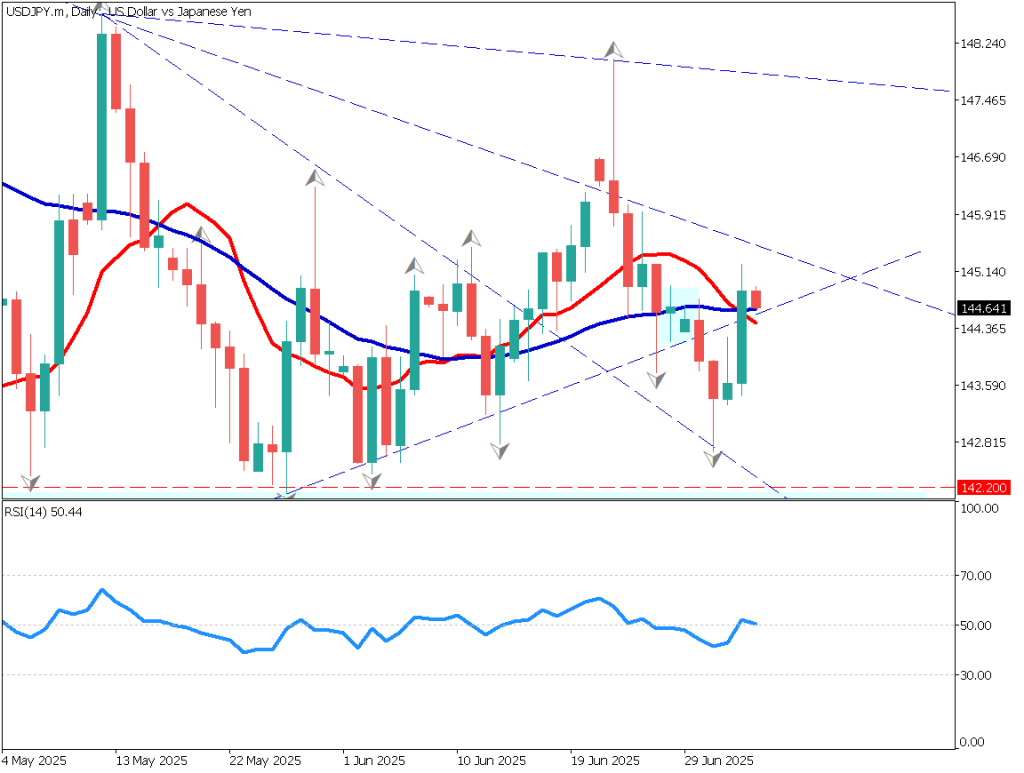

USDJPY Technical Analysis

Analyzing the USDJPY daily chart. USDJPY is trading within a narrow range between 142 and 146. Strong U.S. employment data has lowered expectations for a rate cut, leading to increased dollar buying and a sharp rise to the 145 range during the NY session.

Currently, the upward momentum has paused slightly, leading to a minor pullback. However, the 52-day moving average is functioning as a support level. The RSI is hovering around 50, indicating a lack of clear direction. As today is a U.S. holiday, trading opportunities are likely limited to the Tokyo and London sessions.

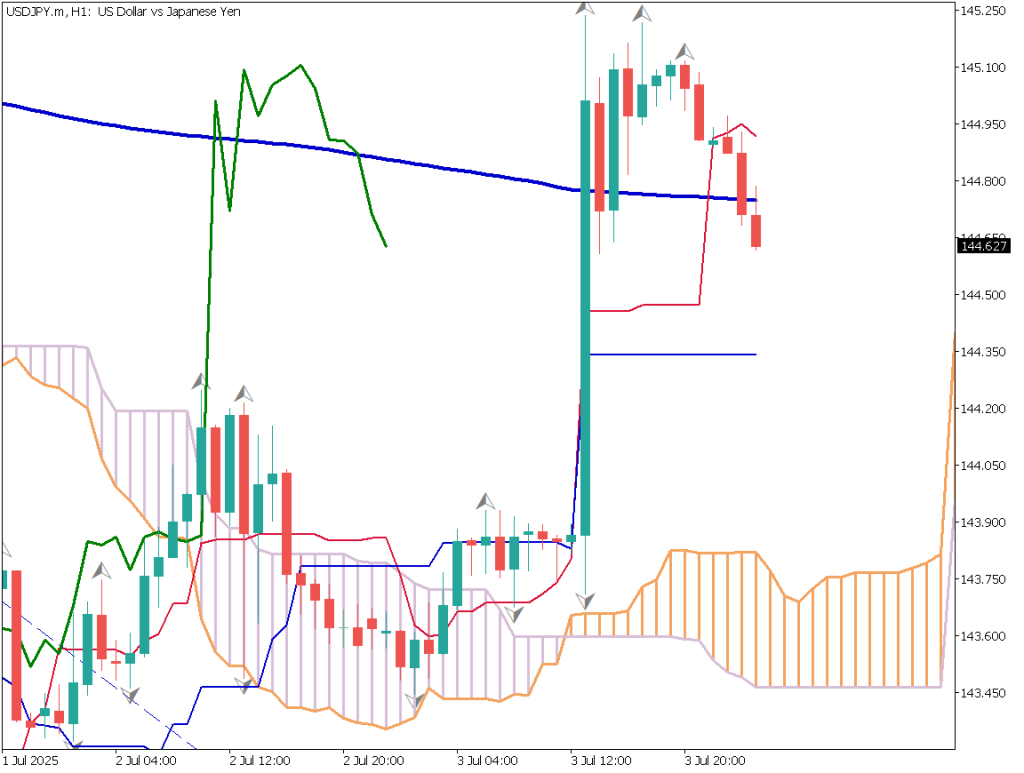

Day Trading Strategy (1-Hour Chart)

On the 1-hour chart, USDJPY faces strong resistance above 145. Although the pair surged after the employment data, the rally appears to have stalled. The price has broken below the conversion line of the Ichimoku Cloud and appears to be targeting the base line.

Caution is advised, especially going into the weekend, as President Trump has a tendency for unexpected comments or actions. Given that today is a U.S. holiday, any weekend developments could lead to a major opening gap on Monday.

From a technical perspective, the bias is still upward, but the preferred approach would be to buy on a deeper pullback. Additionally, positions should not be held over the weekend. Suggested strategy: place a buy limit order near 144.00, take profit near 145.00, and stop loss at 143.85.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 144.25 – Base Line

Market Sentiment

USDJPY

- 30% short / 70% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| U.S. Holiday | – |

| EU・PPI | 18:00 |