UU.S. Government Notifies Japan of 25% Tariff, USDJPY Reacts with Yen Weakness【JULY8, 2025】

Fundamental Analysis

- U.S. Government Notifies Japan of 25% Tariff

- Tariff to be implemented on August 1, with a three-week grace period

- USDJPY reacts with yen weakness, Nikkei 225 rises

USDJPY Technical Analysis

We analyze the daily chart of USDJPY. The pair rose to the 146 yen level after the Trump administration announced a 25% tariff on Japanese exports to the U.S. This move deals a significant blow to Japanese companies.

Immediately after the announcement, the yen weakened, and USDJPY rose from the low 144 yen range to 146 yen. However, the daily chart still indicates a range-bound market, and it is unclear whether the upward trend will continue.

Looking at the Bollinger Bands, the +1σ line is acting as a support level, suggesting the possibility of a future band walk.

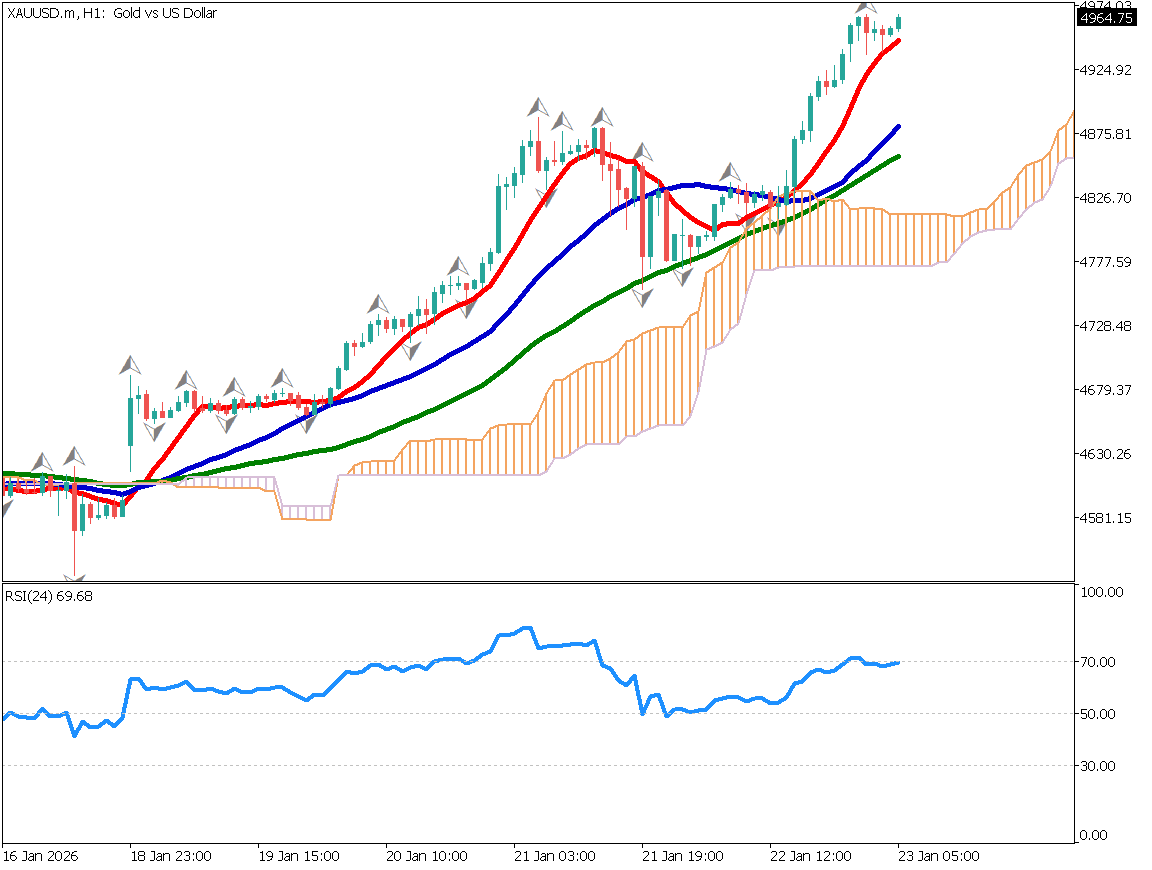

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart, yen selling accelerated following the tariff announcement, pushing USDJPY up to 146 yen. The rally appears to have paused around 146.35 yen. The RSI had surged to 87 at one point but has since declined to 66. With RSI dropping below 70, a corrective move may be gaining momentum.

There is a possibility that the price will temporarily fall to the mid-145 yen range. In particular, the RSI has shown a “failure swing,” also known as the “second top,” indicating a potential pullback. RSI may drop further to the 50 level.

With the tariff announcement now behind us, the major volatility may have passed. We would consider buying on a dip around 145.25 yen.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 145.50 yen – Lower Bollinger Band support

Market Sentiment

USDJPY

- 70% short / 30% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| Australia: RBA Interest Rate Decision | 13:00 |