U.S. Administration Notifies Tariff Rates to Various Countries; Gold Seeks Direction【JULY10, 2025】

Fundamental Analysis

- The U.S. administration announced a 50% tariff on Brazil.

- Prices of copper, silver, and other precious metals surged.

XAUUSD Technical Analysis

Analyzing the daily chart of gold shows a triangle pattern forming, with lower highs and higher lows indicating a lack of clear direction. Currently, the market is in a range around 3300USD.

Let’s explore possible movements ahead. The Alligator indicator, developed by Bill Williams, shows the long-term > medium-term > short-term moving averages aligned from top to bottom, signaling a bearish outlook.

The price is approaching the lower trendline of the triangle pattern, so we should watch for a potential breakout. The Parabolic SAR, often used for stop-and-reverse strategies, is positioned above the candlesticks, which also supports a bearish stance unless a buy signal is triggered.

Day Trading Strategy (1-Hour Chart)

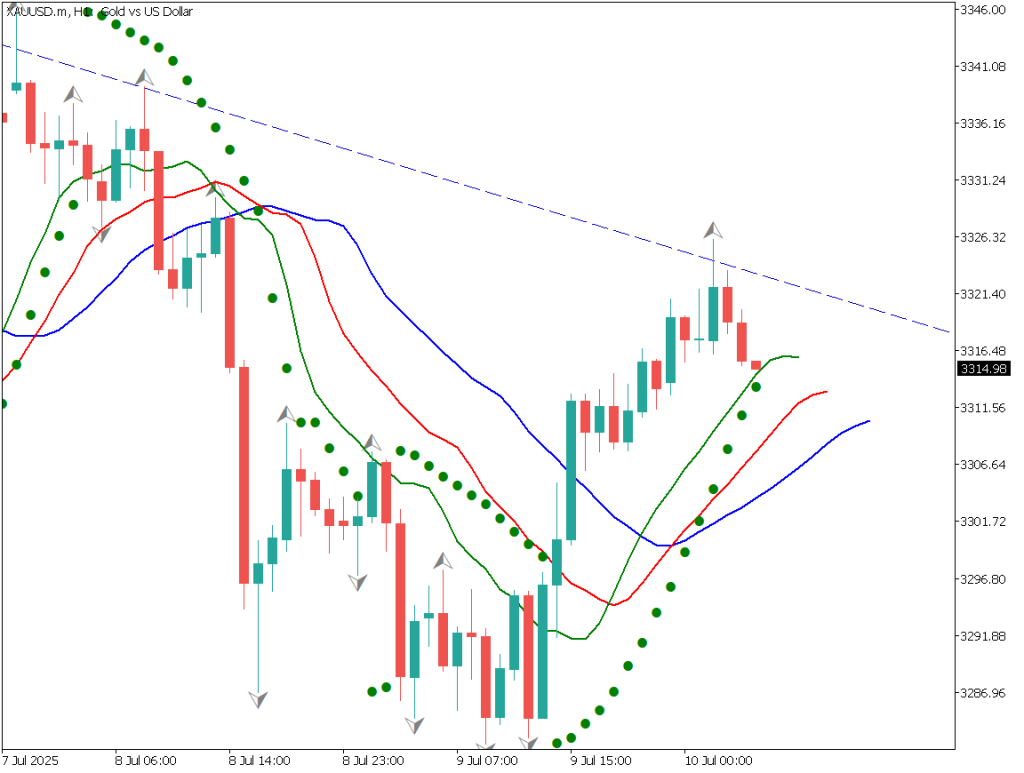

On the 1-hour chart, the price is reacting to a descending trendline and has rebounded. The Parabolic SAR is below the candlesticks on the 1-hour chart, making it difficult to justify a short entry.

Additionally, the Alligator lines are opening upward.

There’s a conflict between the daily and hourly charts. However, with many stop-loss orders likely below current levels, a downside breakout could lead to a measurable decline.

For short-term trades, consider a new short position when a Parabolic SAR sell signal appears. For medium- to long-term strategies, consider buying around the 3280USD level if the price drops.

Support and Resistance Levels

Support and resistance levels to watch going forward:

- 3320USD – Short-term Alligator

- 3282USD – Recent daily low

Market Sentiment

XAUUSD

- 47% short / 53% long

Key Economic Events Today

| Event/Indicator | Time(JPT) |

| Japan – Domestic Corporate Goods Price Index | 8:50 |

| U.S. – Initial Jobless Claims | 21:30 |